In the volatile world of stock markets, identifying stocks with short-term momentum can be a game-changer for investors. These stocks, often referred to as "momentum stocks," have seen a significant rise in value over a short period, presenting an opportunity for quick gains. This article delves into the key factors to consider when looking for short-term momentum in US stocks, along with some notable examples.

Understanding Short-Term Momentum Stocks

What Makes a Stock a Momentum Stock?

A momentum stock is typically characterized by a rapid increase in its price over a short period. This upward trend is often driven by strong fundamentals, such as high revenue growth, positive earnings surprises, or a groundbreaking product launch. Additionally, investor sentiment plays a crucial role, as buyers flock to these stocks, driving their prices even higher.

Key Factors to Consider

When searching for short-term momentum stocks, several factors should be taken into account:

- Technical Analysis: This involves analyzing the stock's price and volume movements using charts and technical indicators. Look for patterns such as a rising trendline, a bullish divergence on the RSI (Relative Strength Index), or an upward sloping moving average.

- Fundamental Analysis: Evaluate the company's financial health, growth prospects, and competitive position. Look for strong revenue growth, positive earnings surprises, and a low debt-to-equity ratio.

- Market Sentiment: Monitor the news and investor sentiment surrounding the stock. Positive news, such as a successful product launch or a major partnership, can drive momentum.

Notable Short-Term Momentum Stocks

- Tesla (TSLA): Known for its electric vehicles and renewable energy solutions, Tesla has seen a significant rise in its stock price over the past few years. The company's recent successes, such as the launch of the Cybertruck and the expansion of its global footprint, have further fueled investor optimism.

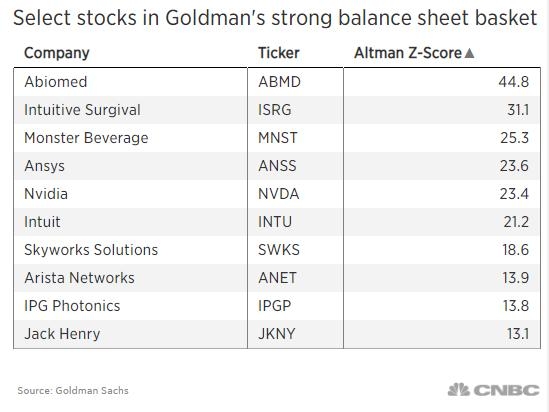

- NVIDIA (NVDA): A leader in the graphics processing unit (GPU) market, NVIDIA has seen a surge in demand for its products, particularly in the gaming and data center sectors. The company's strong financial performance and innovative technology have made it a top pick for momentum investors.

- Amazon (AMZN): As the world's largest online retailer, Amazon has continued to dominate the e-commerce space. The company's recent expansion into new markets, such as healthcare and cloud computing, has further solidified its position as a market leader.

Conclusion

Investing in short-term momentum stocks can be a lucrative strategy, but it's important to conduct thorough research and analyze various factors before making a decision. By focusing on technical, fundamental, and market sentiment indicators, investors can identify promising opportunities in the dynamic US stock market. Remember to always do your due diligence and consider your risk tolerance before investing in any stock.

T-Mobile US Stock Analysis: Key Insights an? us steel stock dividend