The past two decades have witnessed significant shifts in the US stock market. This article delves into a 20-year chart of the US stock market, offering a comprehensive analysis of its performance, key trends, and major events. By examining this time frame, we gain valuable insights into the market's resilience and potential future directions.

Understanding the 20-Year Chart

The 20-year chart of the US stock market showcases a period of remarkable growth and volatility. To better understand this period, let's break it down into key segments:

2003-2007: The Bull Market

- Explanation: The early 2000s saw a robust bull market, driven by factors such as low interest rates and strong corporate earnings.

- Major Events: The dot-com bubble burst in 2000, but the market quickly recovered and continued its upward trajectory.

2007-2009: The Financial Crisis

- Explanation: The global financial crisis of 2007-2009 was a pivotal moment for the US stock market. The crisis was triggered by the subprime mortgage crisis, leading to a sharp decline in stock prices.

- Major Events: The Dow Jones Industrial Average (DJIA) fell by nearly 50% from its peak in 2007 to its trough in 2009.

2009-2019: The Post-Crisis Recovery

- Explanation: After the financial crisis, the US stock market experienced a remarkable recovery, driven by various factors such as quantitative easing, low-interest rates, and a strong economic recovery.

- Major Events: The S&P 500 and DJIA reached new all-time highs multiple times during this period.

2020-2023: The Pandemic Era

- Explanation: The COVID-19 pandemic caused significant volatility in the stock market. While the market initially plummeted, it quickly recovered and reached new highs.

- Major Events: The S&P 500 hit an all-time high in early 2021, only to experience a pullback later in the year.

Key Trends and Insights

Several key trends have emerged from the 20-year chart of the US stock market:

- Volatility: The market has experienced significant volatility over the past two decades, with periods of both sharp declines and rapid recoveries.

- Long-Term Growth: Despite the volatility, the US stock market has demonstrated strong long-term growth, with the S&P 500 and DJIA reaching new all-time highs multiple times.

- Economic Factors: Economic factors such as interest rates, inflation, and corporate earnings have played a crucial role in shaping the market's performance.

- Technological Advancements: The rise of technology stocks, particularly in the NASDAQ, has significantly influenced the market's performance over the past decade.

Case Studies

To further illustrate the market's performance, let's examine a few notable case studies:

- Apple (AAPL): Apple has been one of the best-performing stocks over the past two decades. Its stock price has increased by over 10,000% since 2003, driven by its innovative products and strong market positioning.

- Tesla (TSLA): Tesla's stock has experienced significant volatility, but it has also demonstrated strong growth potential. Its stock price has surged by over 1,000% since 2010, making it one of the most influential companies in the technology sector.

Conclusion

The 20-year chart of the US stock market reveals a period of remarkable growth, volatility, and resilience. By understanding this time frame, investors can gain valuable insights into the market's performance and potential future directions. As we continue to navigate an increasingly complex and dynamic market environment, it's essential to stay informed and adapt to changing conditions.

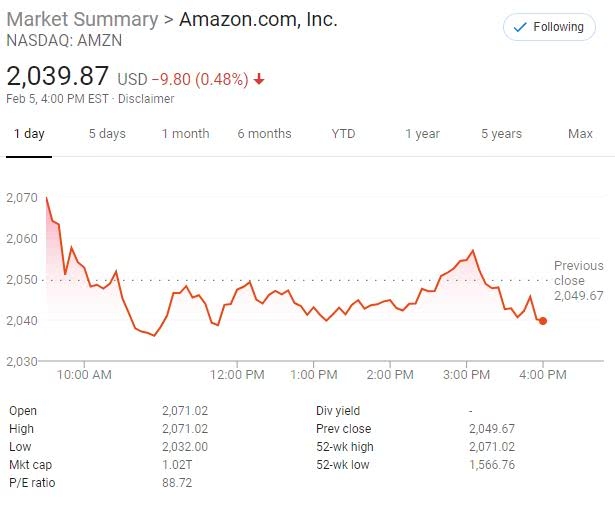

Title: Understanding the PE Ratio: A Key In? us steel stock dividend