Investing in US stocks from India can be a daunting task for many investors. With the global economy becoming increasingly interconnected, the allure of investing in the world's largest stock market is undeniable. However, the question remains: Is it safe to invest in US stocks from India? This article delves into the various factors you should consider before making this decision.

Understanding the Risks and Rewards

Risks Involved

Currency Fluctuations: One of the primary risks of investing in US stocks from India is the fluctuation of the currency. If the Indian rupee weakens against the US dollar, your investment may become less valuable when converted back to rupees.

Geopolitical Risks: The global political landscape can significantly impact the US stock market. Events such as trade wars, political instability, and international conflicts can lead to volatility in the market.

Regulatory Differences: The regulatory framework in the US may differ from that in India. Understanding these differences is crucial to avoid legal issues and ensure compliance.

Rewards of Investing in US Stocks

Diversification: Investing in US stocks allows you to diversify your portfolio and reduce exposure to local market risks.

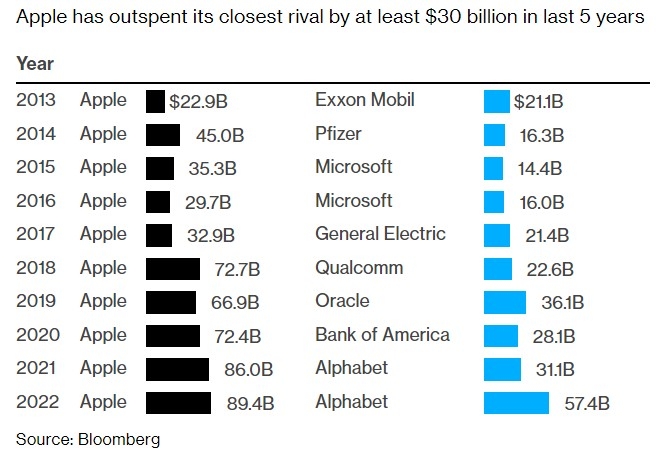

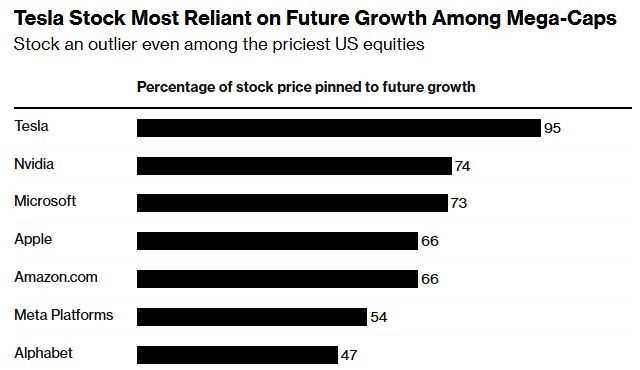

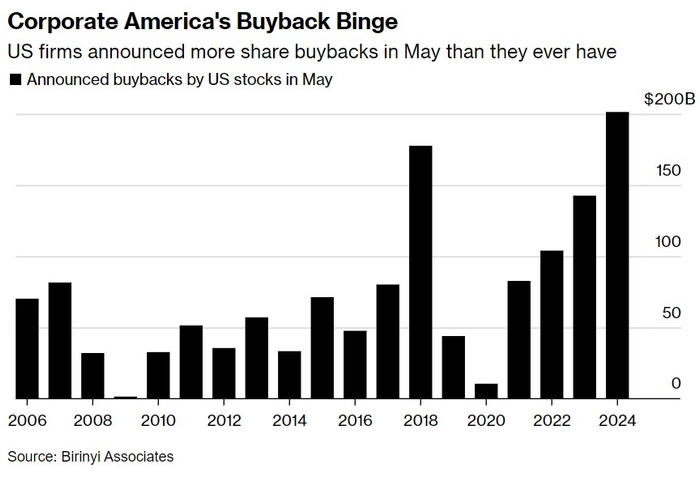

Strong Market Performance: The US stock market has historically offered higher returns compared to many other markets. This can be attributed to factors such as technological advancements, strong economic growth, and a robust regulatory framework.

Access to World-Class Companies: The US stock market is home to some of the world's most successful and innovative companies. Investing in these companies can provide you with exposure to cutting-edge technologies and industries.

Factors to Consider Before Investing

Financial Stability: Ensure that your financial situation is stable before investing in US stocks. This includes having a well-diversified portfolio and a sufficient emergency fund.

Risk Tolerance: Assess your risk tolerance level. Investing in US stocks can be volatile, so it's essential to be prepared for potential losses.

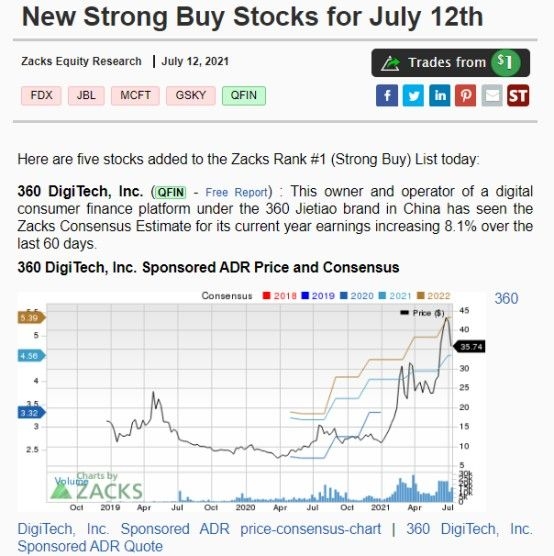

Knowledge and Research: Conduct thorough research on the companies you are interested in investing in. This includes analyzing their financial statements, understanding their business models, and keeping up with market trends.

Tax Implications: Be aware of the tax implications of investing in US stocks from India. Consult with a tax professional to ensure compliance with local tax laws.

Case Study: Investing in Apple Inc.

Consider the case of an Indian investor who invested in Apple Inc. in 2010. By 2020, the investment had grown by over 500%. This highlights the potential for significant returns when investing in US stocks.

Conclusion

Investing in US stocks from India can be a lucrative opportunity, but it's crucial to understand the risks and rewards involved. By conducting thorough research, assessing your financial situation, and considering the factors mentioned above, you can make an informed decision. Remember, investing always involves risks, and it's essential to invest responsibly.

Recent Analyst Upgrades: A Boost for US Tec? us steel stock dividend