In the fast-paced world of technology, the latest reports have brought a wave of optimism for US tech stocks. A recent surge in analyst upgrades has sent these shares soaring, signaling a strong outlook for the tech industry. This article delves into the reasons behind these upgrades and examines the potential impact on the market.

Analyst Upgrades: A Sign of Confidence

Analyst upgrades are a clear sign that experts have a positive outlook on a particular stock. In the case of US tech stocks, these upgrades have been driven by several factors:

- Strong Earnings Reports: Many tech companies have reported impressive earnings in recent quarters, leading to higher revenue and profit forecasts.

- Innovative Product Launches: Tech companies have been launching innovative products and services, generating excitement and driving growth.

- Robust Demand for Tech Products and Services: The demand for tech products and services has remained strong, even amidst the global economic uncertainty.

Key Tech Stocks Benefiting from Upgrades

Several key tech stocks have been the recipients of recent analyst upgrades. Here are a few notable examples:

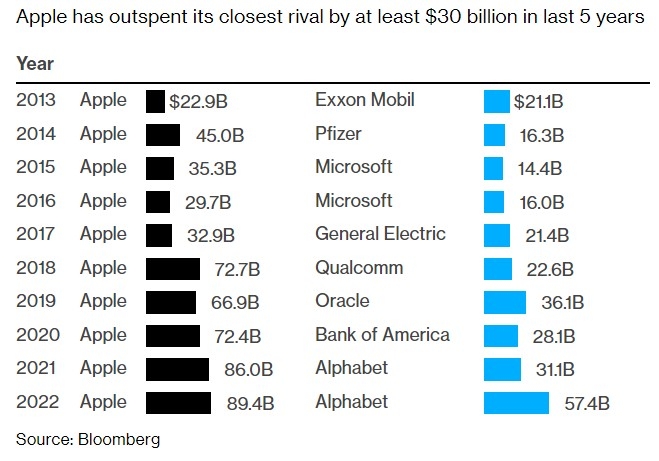

- Apple Inc. (AAPL): Analysts have upgraded Apple's stock on the back of strong iPhone sales and robust services revenue growth.

- Microsoft Corporation (MSFT): Microsoft has been praised for its cloud computing business and growing subscription revenue.

- Amazon.com, Inc. (AMZN): Amazon's continued expansion into new markets and strong e-commerce growth have impressed analysts.

- Tesla, Inc. (TSLA): Tesla's strong electric vehicle sales and growing energy storage business have driven analyst upgrades.

Impact on the Market

The recent analyst upgrades have had a significant impact on the market. Here are a few key takeaways:

- Increased Market Confidence: The upgrades have boosted investor confidence in the tech sector, leading to higher stock prices.

- Sector Rotation: Some investors may be rotating their portfolios to allocate more capital to tech stocks, driven by the positive outlook.

- Potential for Future Growth: The upgrades suggest that tech stocks have strong potential for future growth, making them attractive investment opportunities.

Case Study: NVIDIA Corporation (NVDA)

NVIDIA Corporation, a leading provider of graphics processing units (GPUs), is a prime example of how analyst upgrades can drive stock prices. In February 2021, NVIDIA reported strong fourth-quarter earnings, leading to a wave of analyst upgrades. The stock price soared by nearly 20% in the following weeks, reflecting the market's optimism about the company's future growth prospects.

Conclusion

The recent analyst upgrades for US tech stocks have provided a strong signal of confidence in the industry. With strong earnings, innovative products, and robust demand, these stocks have the potential for significant growth in the coming years. Investors looking to capitalize on this trend should keep a close eye on the key tech stocks mentioned in this article.

Title: "http stocks.us.reuters.com? new york stock exchange