The stock market has been a rollercoaster ride over the past few years, leaving investors wondering if the worst is over and whether the market has bottomed out. The term "have us stocks bottomed" essentially asks whether the current market conditions indicate the end of the downturn. In this article, we'll delve into various factors that could suggest a market bottom and analyze the potential for a rebound.

Historical Perspective

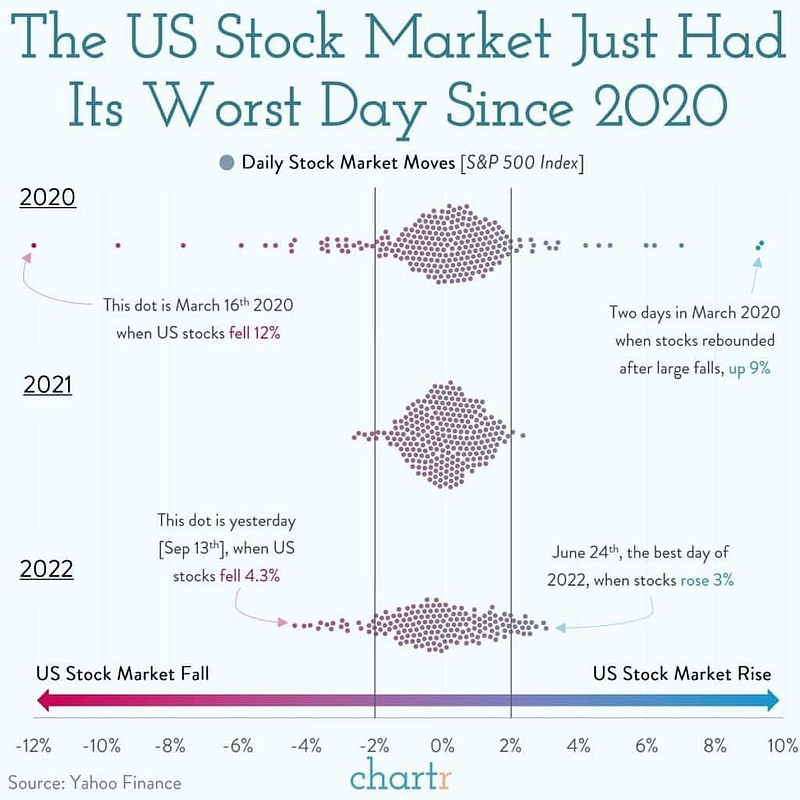

Historically, the stock market has experienced periods of volatility, with ups and downs that often seem unpredictable. However, there are several indicators that suggest when the market may have bottomed out. One such indicator is the relationship between stock prices and their historical averages. When stock prices fall below their historical averages, it may be a sign that the market has reached a bottom.

Valuation Metrics

Another critical factor to consider when determining if the market has bottomed is valuation metrics. One commonly used metric is the price-to-earnings (P/E) ratio. A low P/E ratio can indicate that stocks are undervalued and may be a good entry point for investors. Currently, the S&P 500 has a P/E ratio of around 20, which is below its long-term average of 25. This suggests that stocks may be undervalued and have room to rebound.

Economic Indicators

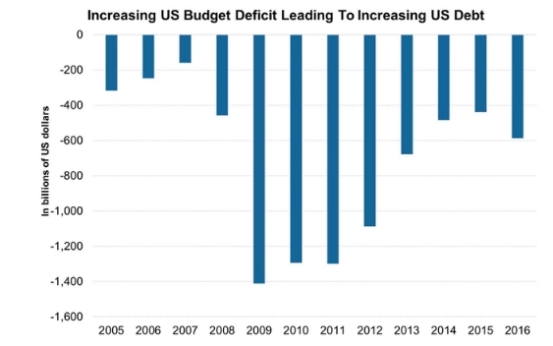

Economic indicators can also provide insights into the market's potential bottom. For example, low-interest rates can stimulate economic growth and boost stock prices. The Federal Reserve has been cutting interest rates in recent years, which could be a sign that the economy is improving and that the market has reached a bottom.

Sector Analysis

Analyzing different sectors of the stock market can also provide valuable information. For instance, defensive sectors like utilities and consumer staples tend to perform better during economic downturns. If these sectors are showing strength, it could indicate that the market has bottomed.

Case Study: The 2008 Financial Crisis

One of the most significant market downturns in recent history was the 2008 financial crisis. At the time, the S&P 500 fell from its peak of 1,565 in October 2007 to a low of 676 in March 2009. Despite the massive decline, many investors believed the market had bottomed out. They were correct, as the S&P 500 went on to more than double in value over the next few years.

Conclusion

While it's impossible to predict the exact bottom of the stock market, various indicators suggest that we may be nearing a market bottom. Valuation metrics, economic indicators, and sector analysis all point to the possibility of a rebound. As always, it's crucial for investors to do their due diligence and consider their risk tolerance before making any investment decisions. Whether or not the market has bottomed, it's essential to stay informed and stay diversified to navigate the ever-changing financial landscape.

Kuvera Invest in US Stocks: A Strategic App? us steel stock dividend