The stock market is a complex and interconnected global system, where the movements of one country's market can often have a ripple effect on others. In this article, we delve into the question: if US stocks were to crash, would Canadian stocks be affected in the same way?

Understanding the Relationship Between US and Canadian Stocks

To answer this question, it's crucial to understand the relationship between the US and Canadian stock markets. Both markets are significant in their own right, with the US market being the largest in the world and the Canadian market being the 10th largest. Despite their size, the two markets are highly correlated.

1. Economic Interdependence

One of the primary reasons for the correlation between US and Canadian stocks is economic interdependence. The two countries have a strong trading relationship, with Canada being the largest export market for the US. This economic tie means that any significant event affecting the US economy can have a direct impact on Canada.

2. Cross-listing

Another factor contributing to the correlation is cross-listing. Many Canadian companies have their stocks listed on US exchanges, and vice versa. This means that when a Canadian company's stock is listed on a US exchange, its performance is directly tied to the US market.

3. Globalization

Globalization has also played a role in the correlation between the two markets. As companies expand their operations globally, their stock performance is increasingly influenced by global economic events, rather than just domestic ones.

The Potential Impact of a US Stock Market Crash on Canadian Stocks

Now, let's consider the potential impact of a US stock market crash on Canadian stocks. While it's difficult to predict the exact outcome, there are several scenarios to consider:

1. Immediate Sell-Off

In the immediate aftermath of a US stock market crash, Canadian stocks may experience a sell-off. This is because investors often take a conservative approach and sell off stocks across the board during times of uncertainty.

2. Sector-Specific Impact

Some Canadian stocks may be more affected than others, depending on their exposure to the US market. For example, companies with significant operations in the US or those heavily reliant on US consumers may experience a more pronounced decline.

3. Long-Term Impact

While the immediate impact of a US stock market crash on Canadian stocks may be negative, the long-term impact may not be as severe. If the US economy recovers, Canadian stocks may also bounce back.

Case Studies

To illustrate the potential impact of a US stock market crash on Canadian stocks, let's look at a couple of case studies:

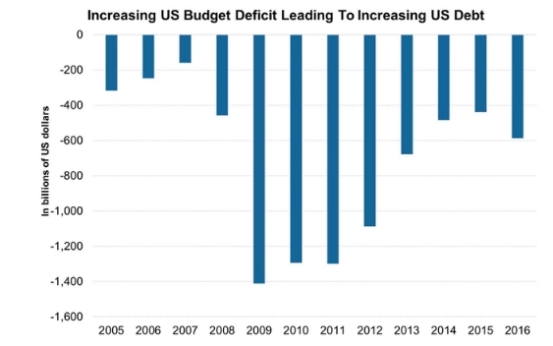

1. 2008 Financial Crisis

During the 2008 financial crisis, the US stock market crashed, leading to a significant sell-off in Canadian stocks. However, as the US economy began to recover, Canadian stocks also started to rebound.

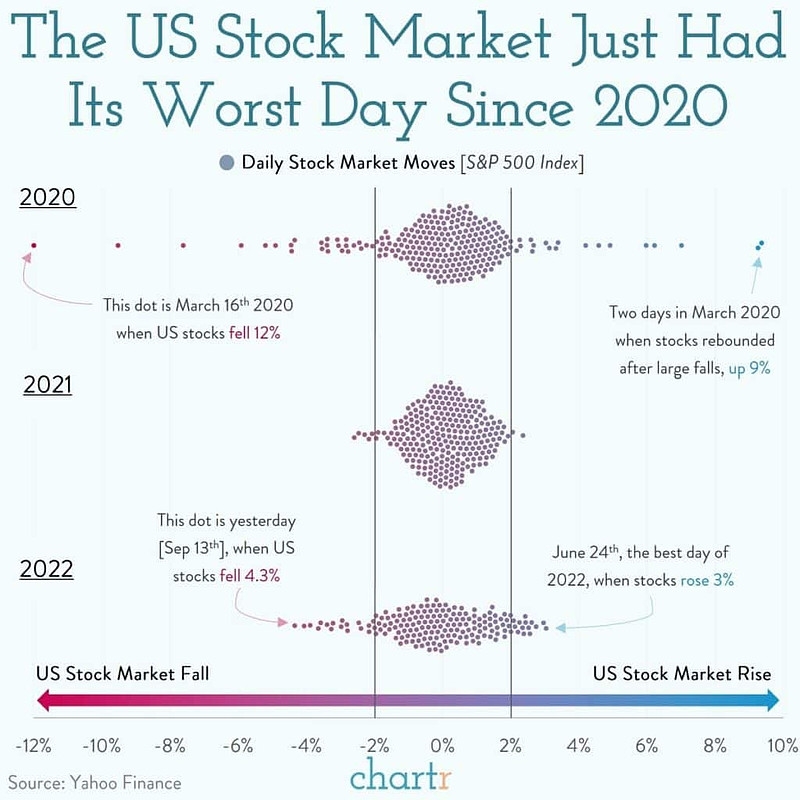

2. 2020 COVID-19 Pandemic

In 2020, the COVID-19 pandemic caused a global stock market crash, including the US and Canadian markets. While Canadian stocks were affected, they recovered faster than their US counterparts, largely due to the success of their vaccination rollout.

Conclusion

In conclusion, if the US stock market were to crash, Canadian stocks would likely be affected. However, the extent of the impact would depend on various factors, including the duration and severity of the crash, sector-specific exposure, and the overall economic conditions. While it's impossible to predict the future with certainty, understanding the relationship between the US and Canadian stock markets can help investors navigate potential market disruptions.

Exro Technologies Stock: A Promising Invest? us steel stock dividend