Are you curious about whether you can purchase U.S. stocks within a Tax-Free Savings Account (TFSA)? If so, you've come to the right place. In this comprehensive guide, we'll delve into the ins and outs of owning U.S. stocks in a TFSA, including the benefits, potential risks, and how to get started.

Understanding TFSA and U.S. Stocks

A TFSA is a tax-advantaged savings account available to Canadian residents. Contributions to a TFSA are not tax-deductible, but any earnings, including interest, dividends, and capital gains, grow tax-free. This makes it an excellent tool for long-term savings and investment growth.

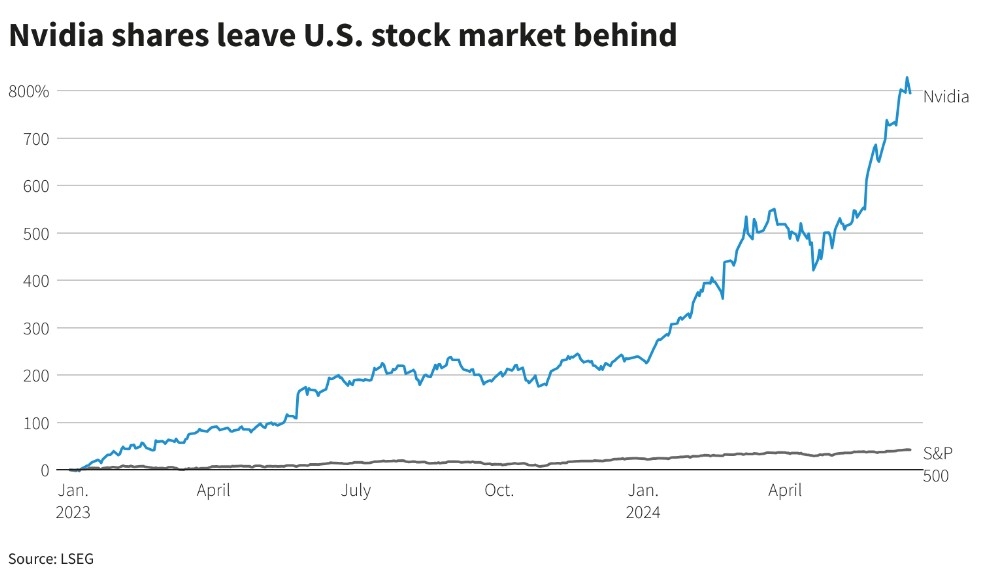

U.S. stocks, on the other hand, are shares of ownership in a U.S. company. Investing in U.S. stocks can offer exposure to a diverse range of industries and markets, potentially leading to higher returns.

Can You Own U.S. Stocks in a TFSA?

The short answer is yes, you can own U.S. stocks in a TFSA. However, there are a few important factors to consider:

1. Currency Conversion Fees:

When purchasing U.S. stocks, you'll need to convert Canadian dollars to U.S. dollars. This process can incur currency conversion fees, which may eat into your investment returns. It's essential to research and compare the fees charged by different brokerage firms to find the most cost-effective option.

2. U.S. Tax Implications:

While TFSA earnings grow tax-free, you may still be subject to U.S. taxes on dividends received from U.S. stocks. To avoid double taxation, you'll need to file a U.S. tax return and claim the Foreign Tax Credit on your Canadian tax return.

3. Brokerage Fees:

Brokers may charge additional fees for purchasing U.S. stocks within a TFSA. Be sure to read the fine print and understand any potential hidden costs.

How to Invest in U.S. Stocks in a TFSA

Now that you know you can own U.S. stocks in a TFSA, let's explore how to get started:

Choose a Brokerage Firm: Select a brokerage firm that offers access to U.S. stocks and provides a user-friendly platform. Popular options include TD Ameritrade, E*TRADE, and Questrade.

Open a TFSA Account: If you don't already have a TFSA, you'll need to open one. You can do this through your chosen brokerage firm or a financial institution.

Fund Your TFSA: Transfer funds from your RRSP or another source to your TFSA. Remember, the contribution limit for 2021 is $6,000, and you can carry forward any unused contribution room.

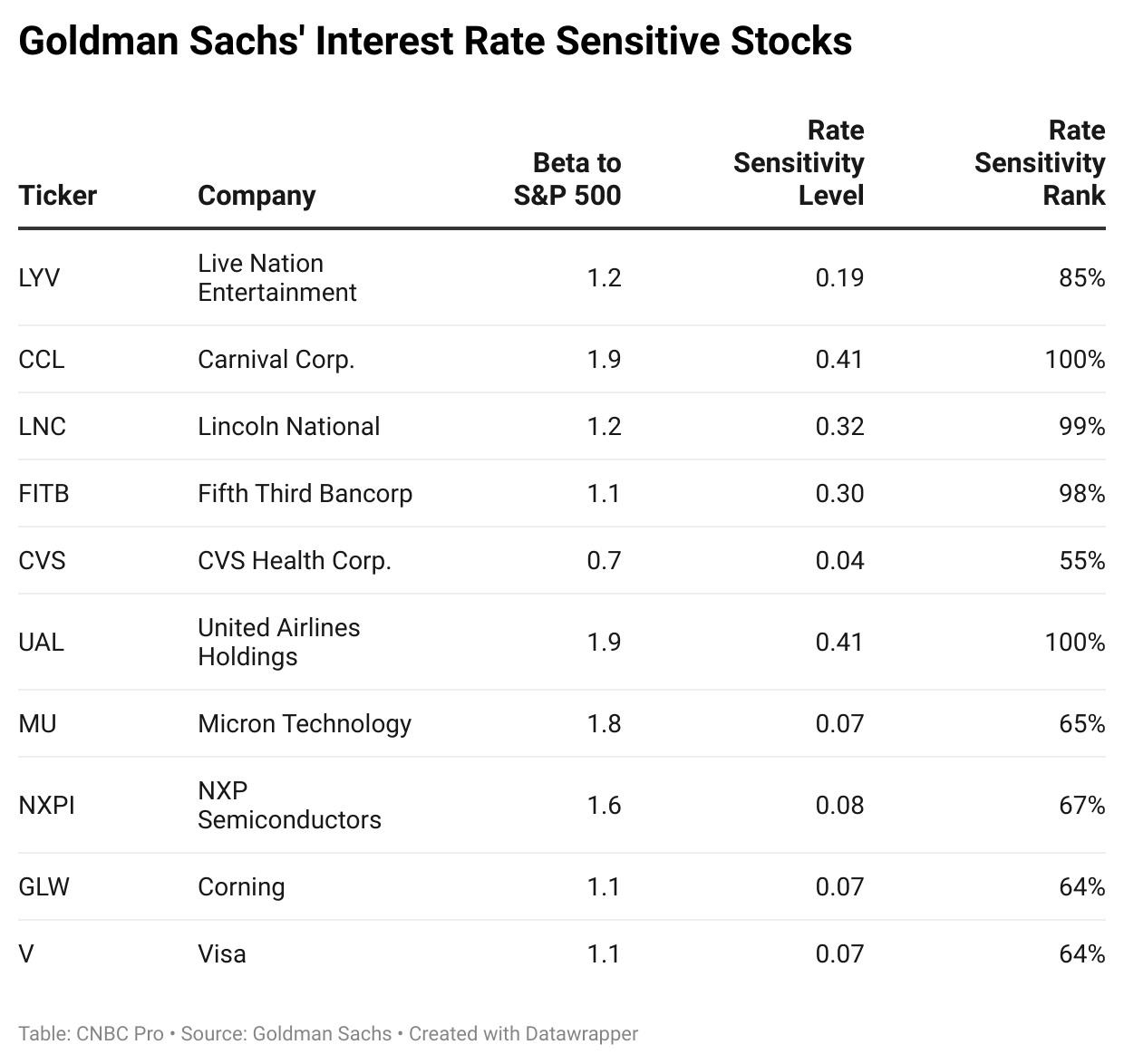

Research and Invest: Conduct thorough research on U.S. stocks that align with your investment goals and risk tolerance. Consider diversifying your portfolio to mitigate risk.

Monitor Your Investments: Regularly review your investments and make adjustments as needed to align with your financial goals.

Benefits of Owning U.S. Stocks in a TFSA

Investing in U.S. stocks within a TFSA offers several benefits:

- Tax-Free Growth: Any earnings, including dividends and capital gains, grow tax-free within your TFSA.

- Diversification: U.S. stocks can provide exposure to a diverse range of industries and markets, potentially leading to higher returns.

- Long-Term Growth: TFSA investments can be left to grow over the long term, potentially leading to significant wealth accumulation.

Conclusion

In conclusion, you can own U.S. stocks in a TFSA, but it's essential to consider the potential risks and fees associated with currency conversion and U.S. taxes. By carefully researching and selecting a reputable brokerage firm, you can invest in U.S. stocks within your TFSA and potentially benefit from tax-free growth and diversification.

Is the US Stock Market Due for a Correction? us steel stock dividend