In the global financial landscape, the stock markets of the European Union (EU) and the United States (US) play pivotal roles. Both markets are major drivers of economic growth and are highly attractive to investors worldwide. This article provides a comprehensive comparison of the EU and US stock markets, highlighting key differences and similarities.

Market Size and Composition

The US stock market is the largest in the world, with a market capitalization of over

Regulation and Oversight

The US stock market is regulated by the Securities and Exchange Commission (SEC), which ensures fair and transparent trading practices. The SEC also plays a crucial role in protecting investors. In contrast, the EU has a more fragmented regulatory framework. Each member state has its own financial regulator, and there is a lack of a single authority overseeing the entire EU stock market.

Trading Hours

The US stock market operates during regular business hours, from 9:30 AM to 4:00 PM Eastern Time. However, many investors can trade after hours, which can provide additional opportunities. The EU stock market operates on a similar schedule, with trading hours varying slightly depending on the country.

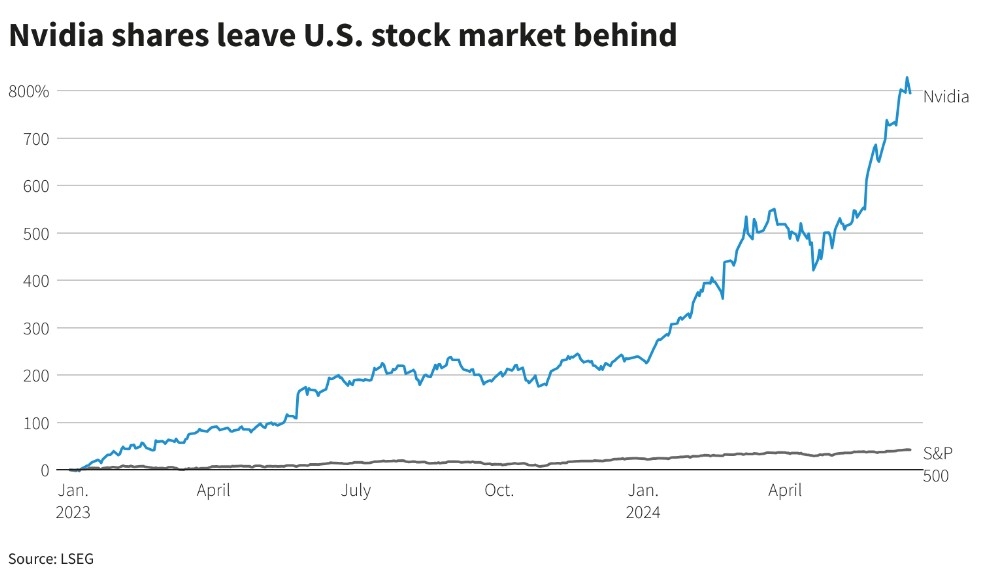

Market Performance

Over the past few years, the US stock market has outperformed the EU stock market. This can be attributed to several factors, including strong economic growth, technological advancements, and favorable tax policies. However, the EU stock market has shown resilience, and there are opportunities for growth in certain sectors.

Dividends and Payouts

The US stock market is known for its high dividend yields, with many companies offering regular dividend payments. This makes it an attractive option for income-seeking investors. The EU stock market also offers dividend-paying stocks, but the yields are generally lower compared to the US.

Sector Composition

The US stock market is heavily concentrated in technology, healthcare, and financial services. These sectors have been major drivers of growth, and many of the world's largest companies are based in the US. The EU stock market has a more diverse sector composition, with a strong presence in industries such as automotive, pharmaceuticals, and telecommunications.

Case Studies

A notable example of a company listed on both the EU and US stock markets is Airbus. Airbus is a global leader in aerospace and defense, with a significant presence in both markets. Its stock is listed on the Paris Stock Exchange in the EU and the New York Stock Exchange in the US.

Another example is SAP, a German software company. SAP's stock is listed on the Frankfurt Stock Exchange in the EU and the New York Stock Exchange in the US. This demonstrates the interconnectedness of the two markets.

Conclusion

The EU stock market and the US stock market offer unique opportunities for investors. While the US market is larger and more diversified, the EU market has potential for growth in certain sectors. Investors should carefully consider their investment goals and risk tolerance when choosing between the two markets.

Ukraine War's Impact on the US Stock M? us steel stock dividend