The stock market is a complex ecosystem that can be influenced by a multitude of factors. This morning, investors are grappling with a sudden downturn, prompting the question: why is the market down? In this article, we'll delve into the potential reasons behind this decline and what it could mean for the future of the market.

Economic Indicators and Data

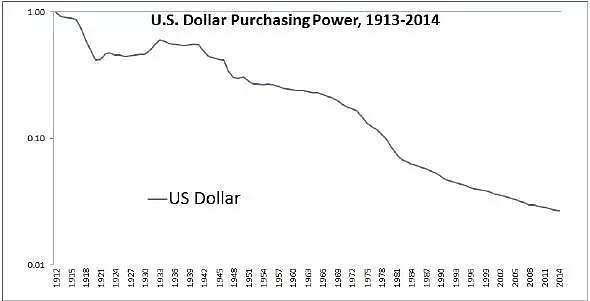

One of the primary reasons for the market's downturn could be the release of economic indicators and data that didn't meet market expectations. For instance, if the latest jobs report shows a lower-than-expected unemployment rate or if inflation figures come in higher than anticipated, it can lead to a sell-off as investors adjust their expectations.

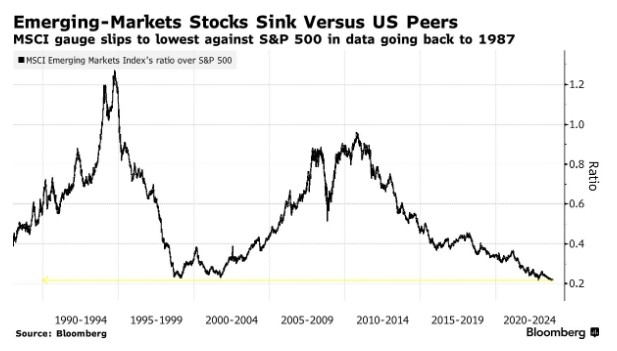

Global Events and Geopolitical Tensions

Global events and geopolitical tensions can also have a significant impact on the stock market. For example, if there's a geopolitical conflict or a major event in a key economic region, it can lead to uncertainty and a subsequent sell-off. This morning, if there's been a significant global event or geopolitical tension, it could be contributing to the market's downturn.

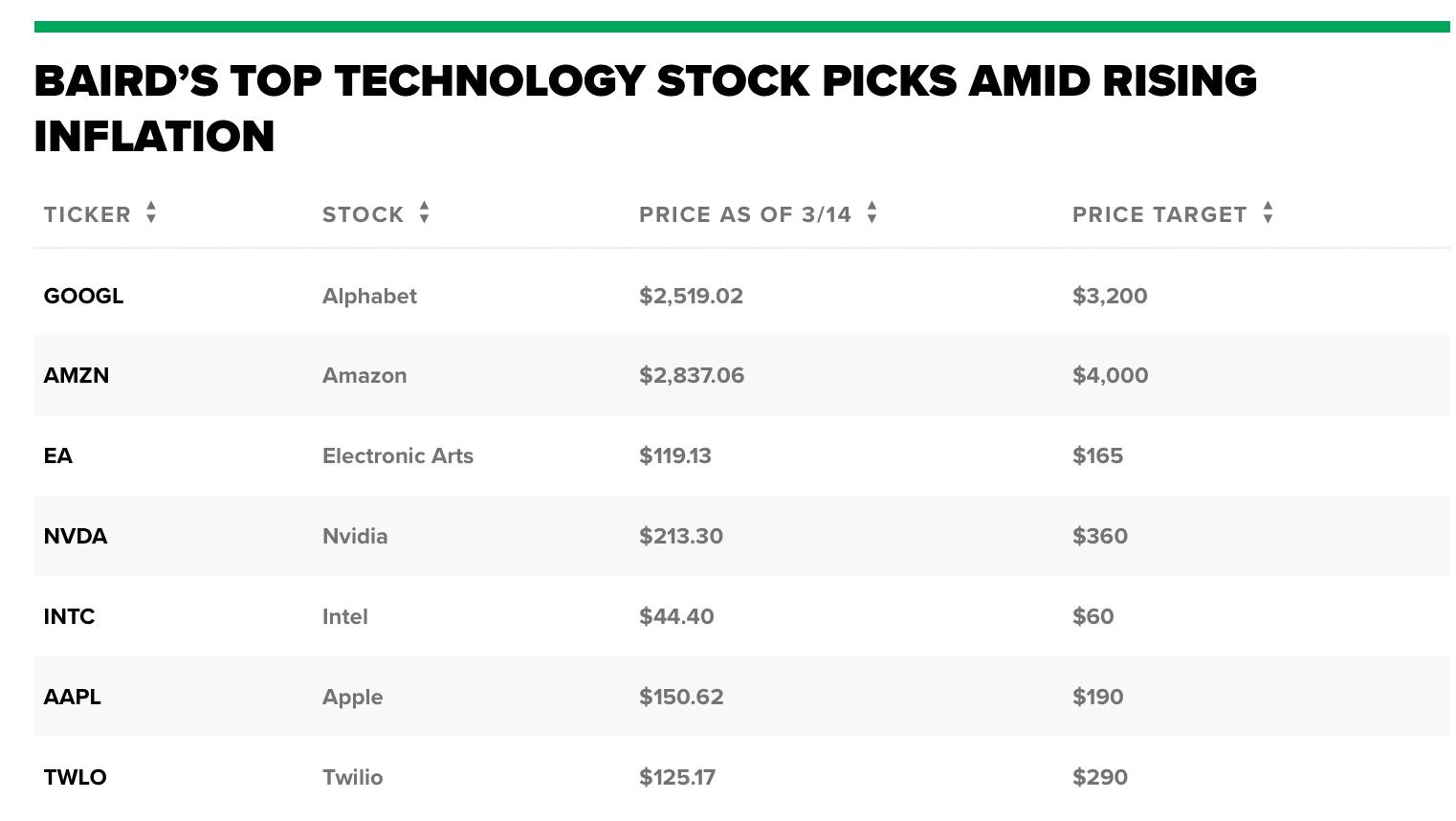

Company Earnings Reports

Another potential reason for the market's downturn could be the release of company earnings reports. If a major company's earnings miss market expectations or if there's a negative outlook from a key industry leader, it can lead to a sell-off as investors adjust their expectations.

Technological Factors and Market Sentiment

Technological factors and market sentiment can also play a significant role in the stock market's performance. For instance, if there's been a significant technological breakthrough or if there's been a shift in market sentiment, it can lead to a sudden downturn.

Impact on Investors and the Economy

The market's downturn can have a significant impact on investors and the broader economy. For investors, it can lead to a loss of confidence and a shift in investment strategies. For the broader economy, it can lead to a slowdown in economic growth and potentially a recession.

Case Study: The 2020 Stock Market Crash

A prime example of how market sentiment and external factors can impact the stock market is the 2020 stock market crash. The crash was triggered by the COVID-19 pandemic, which led to a sudden halt in economic activity and a surge in unemployment. The market's downturn was rapid and severe, but it also provided an opportunity for long-term investors to buy stocks at discounted prices.

Conclusion

In conclusion, the market's downturn this morning could be due to a variety of factors, including economic indicators, global events, company earnings reports, technological factors, and market sentiment. Understanding these factors can help investors make informed decisions and navigate the complexities of the stock market.

TFSA US Stocks: A Comprehensive Guide to In? new york stock exchange