In the fast-paced world we live in, managing personal finances can be a daunting task. Whether you're just starting out or looking to take your financial management to the next level, understanding the basics and strategies of final finance is crucial. This comprehensive guide will help you navigate through the complexities of personal finance, providing you with practical tips, expert advice, and actionable steps to ensure financial stability and security.

Understanding Final Finance

At its core, final finance is about making informed financial decisions that will shape your future. This includes budgeting, saving, investing, and planning for retirement. By taking control of your finances, you can reduce stress, achieve your goals, and create a more secure future for yourself and your loved ones.

Budgeting: The Foundation of Final Finance

Creating a budget is the first step towards financial success. It involves tracking your income and expenses, setting financial goals, and allocating funds to different categories. By understanding where your money goes, you can make adjustments and prioritize your spending, ensuring that you're not overspending and are saving for the future.

Pro Tip: Use budgeting apps or spreadsheets to help you track your income and expenses efficiently.

Saving: Building a Financial Safety Net

Saving is essential for financial stability. It provides a safety net in case of emergencies, helps you achieve your goals, and ensures a comfortable retirement. Here are some tips to help you build your savings:

- Set a Savings Goal: Determine how much you want to save and by when. This will give you a clear target to work towards.

- Automate Your Savings: Set up automatic transfers to your savings account to ensure you consistently save a portion of your income.

- Consider High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts, helping your money grow faster.

Investing: Growing Your Wealth

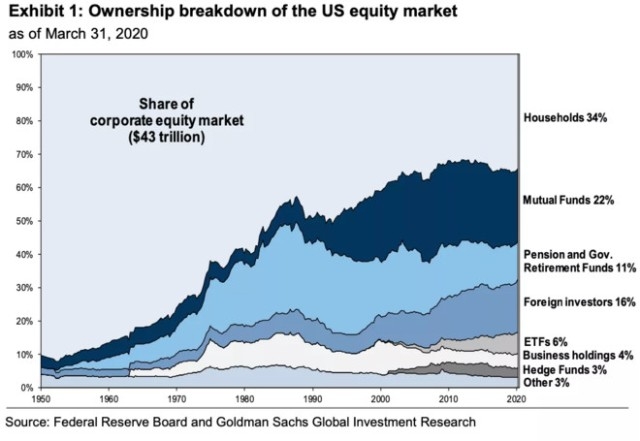

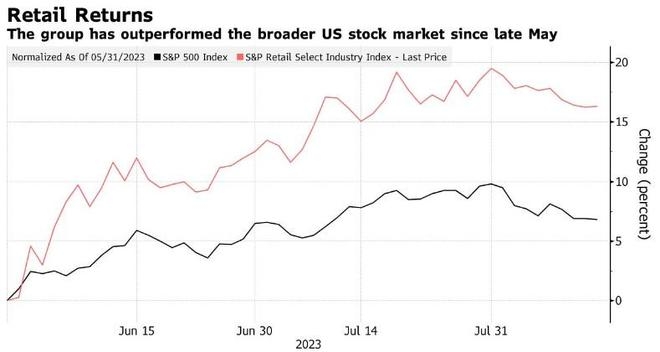

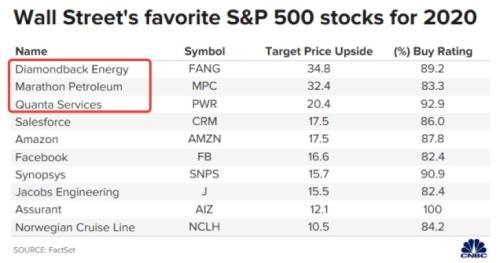

Investing is a powerful tool that can help you grow your wealth over time. By investing in stocks, bonds, mutual funds, or real estate, you can potentially earn higher returns than saving alone. However, it's important to understand the risks and invest in assets that align with your financial goals and risk tolerance.

Case Study: John, a 25-year-old software engineer, invested

Retirement Planning: Ensuring a Comfortable Future

Planning for retirement is a crucial aspect of final finance. By starting early and consistently contributing to your retirement accounts, you can ensure a comfortable and financially secure future. Here are some tips to help you plan for retirement:

- Understand Your Retirement Accounts: Research different retirement accounts, such as 401(k)s, IRAs, and annuities, and understand their benefits and limitations.

- Contribute Regularly: Aim to contribute at least the minimum required amount to your retirement accounts to take advantage of employer match programs and tax benefits.

- Review and Adjust Your Retirement Plan: As you get closer to retirement, regularly review your plan and make adjustments as needed to ensure you're on track to meet your financial goals.

Conclusion

Mastering final finance is a journey that requires dedication, discipline, and knowledge. By understanding the basics and implementing effective strategies, you can take control of your financial future and create a more secure and prosperous life. Start today by creating a budget, building your savings, investing wisely, and planning for retirement. Remember, the sooner you begin, the better off you'll be in the long run.

Stock Market Reacts to Foreign Following U.? new york stock exchange