Dow Jones Industrial Average plummeted today, sparking concern among investors. This article delves into the reasons behind the sudden downturn, providing insights into market dynamics and potential long-term impacts.

What Happened?

The Dow Jones Industrial Average (DJIA), a widely followed index representing the performance of 30 major companies, experienced a significant drop today. The index closed lower by over 400 points, marking a substantial decline that raised questions among market observers.

Key Factors Contributing to the Decline

- Global Economic Concerns: One of the primary reasons for the Dow's downturn is the increasing global economic uncertainty. Geopolitical tensions, trade disputes, and slowing economic growth in key regions such as China and the Eurozone have created a volatile environment for investors.

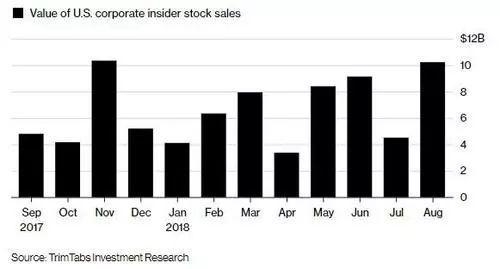

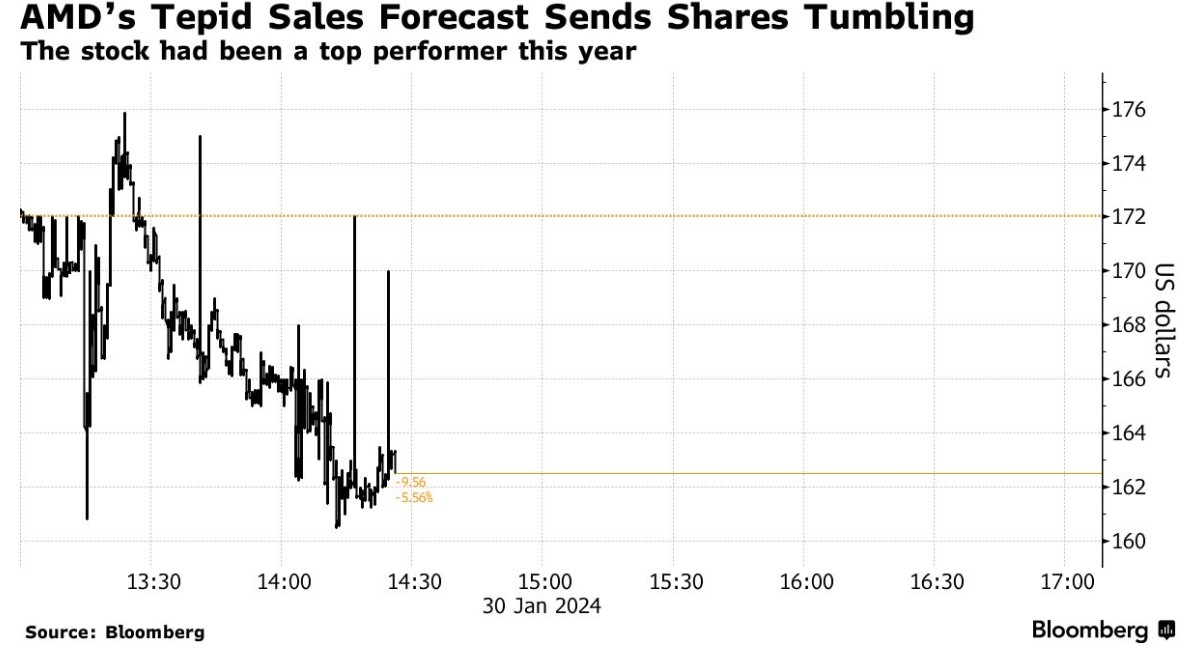

- Weak Corporate Earnings: Many companies within the DJIA have recently reported weaker-than-expected earnings. This has raised concerns about the overall health of the US economy and the potential for further downward pressure on stock prices.

- Market Sentiment: Investors have been cautious in recent weeks, reacting to news and events that have the potential to impact the market. The recent pullback in the DJIA reflects this cautious sentiment.

Analysis: The Impact on Key Sectors

The decline in the Dow Jones has had a significant impact on various sectors:

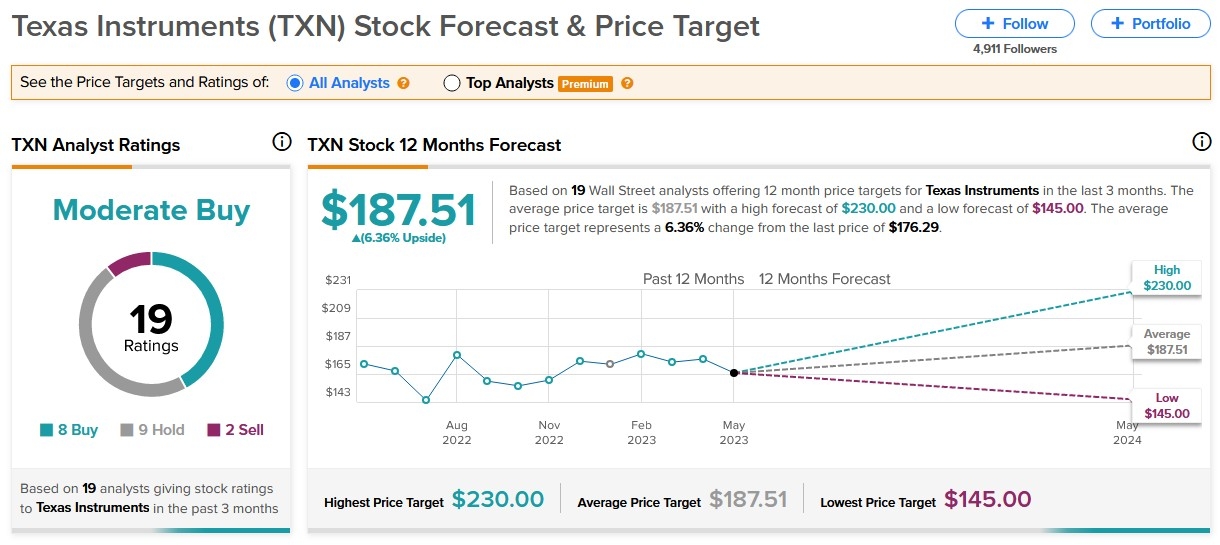

- Technology: The tech sector, which is heavily represented in the DJIA, has been particularly hard-hit. Companies like Apple and Microsoft, which contribute significantly to the index, have seen their share prices decline in recent weeks.

- Financials: The financial sector has also been affected, with banks and other financial institutions seeing their share prices decline in response to concerns about economic growth and the potential for rising interest rates.

- Energy: The energy sector has experienced a mixed response, with some companies seeing their share prices rise due to higher oil prices, while others have been negatively impacted by the overall downturn in the market.

Case Study: Apple's Decline

One notable case study is the decline in Apple's share price. Apple is a major component of the DJIA, and its recent performance has been a significant driver of the index's decline. The company's recent earnings report, which showed weaker-than-expected sales, has contributed to the downward pressure on the stock.

What Does This Mean for Investors?

The recent decline in the Dow Jones Industrial Average serves as a reminder of the volatility that can be found in the stock market. While the market may continue to face challenges in the near term, it is important for investors to remain focused on long-term strategies and to not be overly swayed by short-term market movements.

In conclusion, the recent decline in the Dow Jones Industrial Average can be attributed to a combination of global economic concerns, weak corporate earnings, and cautious market sentiment. While the market may continue to face challenges in the near term, it is important for investors to remain patient and focused on their long-term investment strategies.

Top Energy Storage Stocks to Watch in the U? new york stock exchange