In the ever-evolving landscape of the stock market, identifying top value stocks is a crucial step for investors seeking long-term growth and stability. This article delves into the top US value stocks to watch in 2023, offering insights into their potential and why they stand out in the market.

Apple Inc. (AAPL)

Apple Inc. (AAPL) remains a top value stock in the US, thanks to its dominant position in the technology sector. The company's robust product portfolio, including the iPhone, iPad, and Mac, continues to drive strong revenue and profit growth. With a market capitalization of over $2 trillion, Apple is not just a tech giant but also a significant player in the global economy. Its strong financial health, innovative products, and diverse revenue streams make it a compelling investment opportunity.

Microsoft Corporation (MSFT)

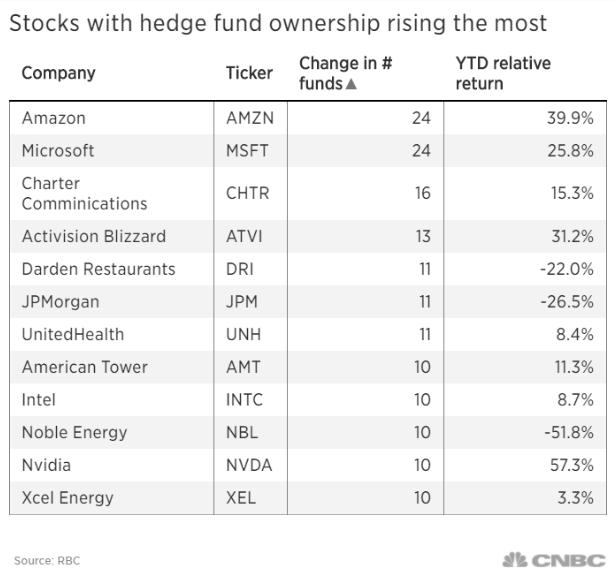

Microsoft Corporation (MSFT) is another top US value stock to consider. The tech giant has a diverse portfolio of products and services, including Windows, Office, Azure, and LinkedIn. Microsoft's cloud computing business, particularly Azure, has been a significant growth driver. The company's commitment to innovation and expansion into new markets makes it a solid investment choice for long-term investors.

Amazon.com, Inc. (AMZN)

Amazon.com, Inc. (AMZN) is a top US value stock that has transformed the retail industry. The company's e-commerce platform has become a household name, and its expansion into cloud computing with Amazon Web Services (AWS) has been a game-changer. With a strong market position and a commitment to innovation, Amazon remains a top pick for investors looking for long-term growth.

Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) is a top US value stock in the healthcare sector. The company has a diverse portfolio of products, including consumer healthcare, pharmaceuticals, and medical devices. Johnson & Johnson's strong brand reputation, innovative products, and commitment to research and development make it a solid investment choice. The company's consistent dividend payments and strong financial health further enhance its appeal to investors.

Visa Inc. (V)

Visa Inc. (V) is a top US value stock in the financial services sector. The company operates one of the world's largest payment networks, processing billions of transactions annually. Visa's strong market position, innovative payment solutions, and global reach make it a compelling investment opportunity. The company's commitment to growth and expansion into new markets continues to drive strong revenue and profit growth.

Case Study: Procter & Gamble (PG)

Procter & Gamble (PG) is a top US value stock that has been a staple in the consumer goods sector for decades. The company's diverse portfolio of brands, including Gillette, Pampers, and Tide, has helped it maintain a strong market position. Procter & Gamble's commitment to innovation and expansion into new markets has driven strong revenue and profit growth. The company's strong financial health and consistent dividend payments make it a solid investment choice for long-term investors.

In conclusion, the top US value stocks to watch in 2023 offer a mix of strong financial health, innovative products, and solid growth prospects. Investors looking for long-term growth and stability should consider adding these top value stocks to their portfolios.

US Arms Stocks: A Comprehensive Guide to th? new york stock exchange