In the dynamic world of aviation, mergers and acquisitions are a common occurrence. One such merger that caught the attention of investors and industry experts alike was the union between US Airways and American Airlines. This landmark deal, finalized in 2013, brought together two of the largest airlines in the United States. But what impact did this merger have on the stock price of US Airways? In this article, we delve into the aftermath of the merger, analyzing the stock price trajectory of US Airways and the factors that influenced it.

The Merger Agreement

The merger between US Airways and American Airlines was a strategic move aimed at increasing market share and enhancing the competitive position of the combined entity. The agreement, which was valued at approximately $11 billion, allowed US Airways to become part of a larger, more robust airline network. The merger brought together the strengths of both airlines, including a broader route network, increased fleet size, and enhanced customer service offerings.

Stock Price Trajectory Before the Merger

Prior to the merger, US Airways' stock price had been on an upward trend. This was primarily due to the airline's strong financial performance and increasing revenue. However, the stock price also faced some challenges, such as rising fuel costs and increased competition from low-cost airlines. Despite these challenges, the stock price of US Airways showed resilience, reaching an all-time high in the months leading up to the merger.

Stock Price Trajectory After the Merger

Following the merger, the stock price of US Airways experienced a rollercoaster ride. In the immediate aftermath of the merger announcement, the stock price surged significantly, driven by optimism about the combined entity's potential. However, as the integration process got underway, the stock price faced downward pressure. This was primarily due to the costs associated with integrating the two airlines, including workforce reductions, rebranding, and IT system consolidation.

Factors Influencing the Stock Price

Several factors influenced the stock price of US Airways after the merger. These included:

- Integration Costs: The costs associated with integrating the two airlines had a significant impact on the stock price. As these costs increased, the stock price faced downward pressure.

- Revenue Growth: The combined entity's ability to grow revenue played a crucial role in determining the stock price. As the new airline network started to generate more revenue, the stock price began to stabilize.

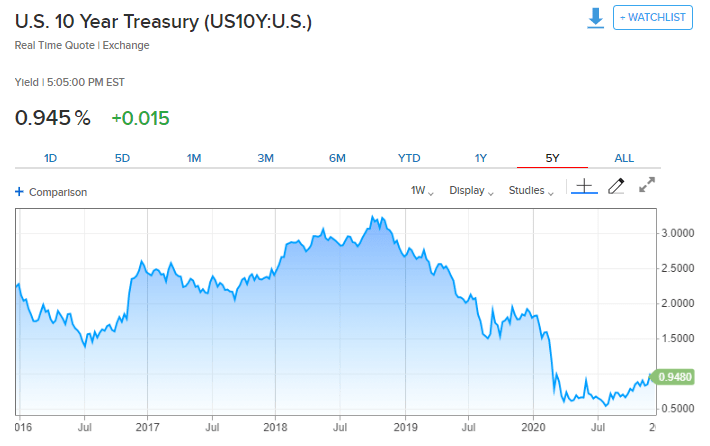

- Market Conditions: The overall market conditions, including interest rates and economic indicators, also influenced the stock price. In periods of economic growth and low interest rates, the stock price tended to rise.

Case Study: United Airlines and Continental Airlines

To understand the potential impact of a merger on stock prices, it is worth looking at a similar case study. In 2010, United Airlines merged with Continental Airlines, creating the world's largest airline by revenue. Similar to the US Airways-American Airlines merger, the stock price of United Airlines experienced a surge in the immediate aftermath of the merger. However, as integration costs increased and the market adjusted to the new reality, the stock price faced downward pressure.

Conclusion

The merger between US Airways and American Airlines had a significant impact on the stock price of US Airways. While the stock price initially surged, it later faced downward pressure due to integration costs and market conditions. However, as the combined entity started to generate more revenue and stabilize, the stock price began to stabilize as well. The case of US Airways serves as a reminder of the complexities and challenges associated with mergers and acquisitions in the aviation industry.

Most Liquid US Stocks: A Comprehensive Guid? new york stock exchange