In the wake of the US government shutdown, the stock market is bracing for potential disruptions. This article delves into the anticipated impact of a government shutdown in October 2025 on the stock market, offering insights and analysis based on historical data and expert opinions.

A government shutdown can have significant repercussions on various sectors of the economy, and the stock market is no exception. As we approach the critical period in October 2025, investors and financial experts are closely monitoring the situation to gauge the potential impact on their investments.

Understanding the Implications of a Government Shutdown

A government shutdown occurs when the federal government temporarily closes its operations due to a lack of funding. This typically happens when Congress fails to pass a budget or when there is a dispute over funding priorities. The most recent government shutdown occurred in December 2018 and lasted 35 days.

During a government shutdown, federal employees are either furloughed or placed on unpaid leave, leading to a halt in government services and operations. This can have a cascading effect on the economy, impacting everything from federal contracts to government programs.

The Stock Market's Vulnerability

The stock market is highly sensitive to economic and political events, and a government shutdown is no exception. The following factors highlight the potential impact of a government shutdown on the stock market:

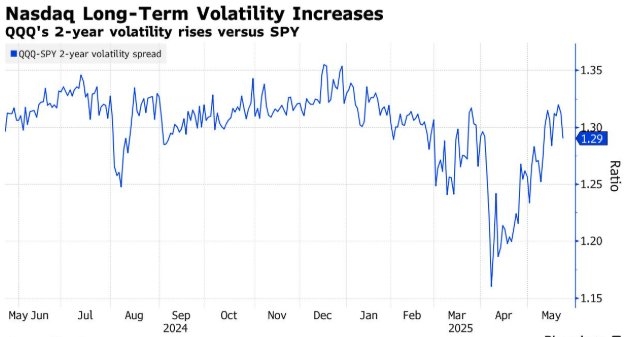

1. Market Confidence: A government shutdown can erode investor confidence, leading to volatility in the stock market. Investors may become uncertain about the future of the economy and the stability of their investments.

2. Government Contracts: The federal government is a major client for many companies, particularly in defense, technology, and healthcare sectors. A shutdown can disrupt these contracts, leading to potential revenue losses for affected companies.

3. Economic Data: A government shutdown can delay the release of important economic data, making it difficult for investors to make informed decisions. This can lead to increased uncertainty and volatility in the stock market.

4. Consumer Spending: A shutdown can affect government employees and contractors, leading to reduced consumer spending. This can impact companies that rely on consumer demand, potentially leading to lower earnings and stock prices.

Historical Perspectives and Case Studies

To better understand the potential impact of a government shutdown on the stock market, let's examine some historical perspectives and case studies:

2018 Government Shutdown: The 2018 government shutdown had a temporary impact on the stock market, with the S&P 500 falling by about 6% during the 35-day shutdown. However, the market quickly recovered as the shutdown ended and the economy stabilized.

2009 Economic Crisis: During the 2009 economic crisis, the stock market experienced significant volatility, with the S&P 500 falling by about 50% from its peak. While the government shutdown was not the primary cause of the crisis, it did exacerbate the situation.

Conclusion

The potential impact of a government shutdown in October 2025 on the stock market is a concern for investors and financial experts alike. While historical data and case studies offer some insights, the actual outcome will depend on various factors, including the duration of the shutdown and the economic conditions at the time. As investors, it is crucial to stay informed and prepared for potential market disruptions.

Positive Correlation Between US Stocks and ? new york stock exchange