In today's fast-paced financial world, stock trading has become a popular way for individuals to invest and potentially earn significant profits. However, navigating the stock market can be overwhelming, especially for beginners. This comprehensive guide will help you understand the basics of stock trading, the essential tools you need, and strategies for success.

Understanding Stock Trading

Stock trading involves buying and selling shares of publicly-traded companies. The goal is to buy stocks at a low price and sell them at a higher price, thereby making a profit. It's important to note that stock trading carries risks, and it's crucial to do thorough research and understand the market before investing.

Essential Tools for Stock Trading

To succeed in stock trading, you'll need the right tools. Here are some essential tools to consider:

- Brokerage Account: A brokerage account allows you to buy and sell stocks. Choose a reputable brokerage firm that offers low fees and a user-friendly platform.

- Stock Market Data: Access to real-time stock market data is crucial for making informed decisions. Many brokerage firms provide this data, or you can use third-party services.

- Financial News and Analysis: Stay informed about market trends and company news by reading financial news websites and following market analysts.

Strategies for Stock Trading Success

Now that you have the tools, it's time to develop a winning strategy. Here are some key strategies to consider:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio by investing in different sectors and asset classes.

- Risk Management: Understand your risk tolerance and never invest more than you can afford to lose. Use stop-loss orders to limit potential losses.

- Long-Term Investing: Focus on long-term growth rather than short-term gains. Stocks can be volatile, but they often provide steady growth over time.

- Technical Analysis: Use technical analysis tools to identify trends and patterns in stock prices. This can help you make informed trading decisions.

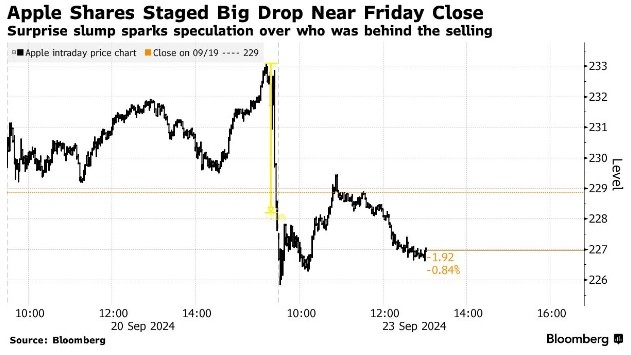

Case Study: Apple Inc.

Let's take a look at a real-world example. Apple Inc. (AAPL) is a leading technology company known for its innovative products. In 2012, the stock was trading around

This example illustrates the potential for long-term growth in the stock market. However, it's important to note that past performance is not indicative of future results.

Conclusion

Stock trading can be a lucrative way to invest your money, but it requires knowledge, discipline, and a well-thought-out strategy. By understanding the basics, using the right tools, and implementing proven strategies, you can increase your chances of success in the stock market. Remember to do your research, stay informed, and never invest more than you can afford to lose.

Pharmaceutical Companies Stocks: US Market ? new york stock exchange