The Federal Reserve's (Fed) monetary policy has a significant impact on the US stock market. Understanding how these policies can affect stocks is crucial for investors looking to make informed decisions. This article delves into the dynamics of Fed policy and its implications for US stocks.

The Role of the Federal Reserve

The Federal Reserve is responsible for managing the country's monetary policy. Its primary goals include maintaining price stability, maximizing employment, and moderating long-term interest rates. The Fed uses various tools to achieve these objectives, including adjusting the federal funds rate, conducting open market operations, and changing reserve requirements.

Adjusting the Federal Funds Rate

One of the most impactful tools at the Fed's disposal is adjusting the federal funds rate. This rate is the interest rate at which banks lend and borrow funds from each other overnight. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money, which can lead to higher interest rates across the economy. Conversely, when the Fed lowers the federal funds rate, borrowing becomes cheaper, which can stimulate economic growth.

Impact on Stock Market

The Fed's policy decisions have a direct impact on the stock market. Here's how:

- Interest Rates: Higher interest rates can make borrowing more expensive for companies, which can reduce their profitability. This can lead to a decline in stock prices. Conversely, lower interest rates can make borrowing cheaper and boost corporate earnings, potentially driving up stock prices.

- Valuation: Stock prices are often valued using discounted cash flow (DCF) models, which take into account the cost of capital. When interest rates are higher, the cost of capital increases, which can lead to lower stock valuations. Lower interest rates can have the opposite effect.

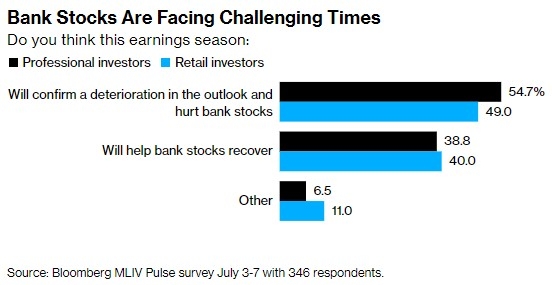

- Investor Sentiment: The Fed's policy decisions can also influence investor sentiment. For example, if the Fed signals that it plans to raise interest rates, investors may become more cautious and sell off stocks, leading to a market downturn.

Case Studies

To illustrate the impact of Fed policy on the stock market, let's look at two recent examples:

- 2015 Rate Hike: In December 2015, the Fed raised the federal funds rate for the first time in nearly a decade. This move was widely anticipated, and the stock market reacted positively, with the S&P 500 closing at a record high the following day.

- 2020 Rate Cut: In response to the COVID-19 pandemic, the Fed cut the federal funds rate to nearly zero in March 2020. This move helped to stabilize the stock market during a period of extreme volatility.

Conclusion

The Federal Reserve's monetary policy plays a crucial role in the US stock market. Understanding how these policies can affect stocks is essential for investors looking to navigate the market effectively. By paying attention to the Fed's policy decisions and their implications for interest rates, valuation, and investor sentiment, investors can better position themselves for success.

Kn95 US Stock: A Comprehensive Guide to Pur? new york stock exchange