The year 2020 was a tumultuous year for the global economy, and the US stock market was no exception. The COVID-19 pandemic brought unprecedented challenges, leading to significant volatility in the market. This article provides a comprehensive analysis of the US stock market in 2020, using the graph to highlight key trends and insights.

Understanding the 2020 US Stock Market Graph

The graph of the US stock market in 2020 shows a mix of upward and downward trends, reflecting the market's reaction to various events and economic indicators. The graph starts in January 2020, with the S&P 500 Index at around 3,200 points. It then drops sharply in February and March, reaching a low of around 2,200 points in late March, as the pandemic began to take hold in the US.

The COVID-19 Pandemic and the Stock Market

The COVID-19 pandemic had a profound impact on the US stock market in 2020. As the virus spread, businesses closed, and unemployment soared, investors became increasingly cautious. This led to a sharp decline in stock prices, as seen in the graph.

However, as the pandemic progressed, companies and governments implemented measures to mitigate the economic impact. This, coupled with hopes for a vaccine, led to a gradual recovery in the stock market. By the end of the year, the S&P 500 Index had recovered to around 3,700 points, a significant gain from its March low.

Key Events and Trends in the Stock Market

Several key events and trends influenced the US stock market in 2020. Here are some of the most notable:

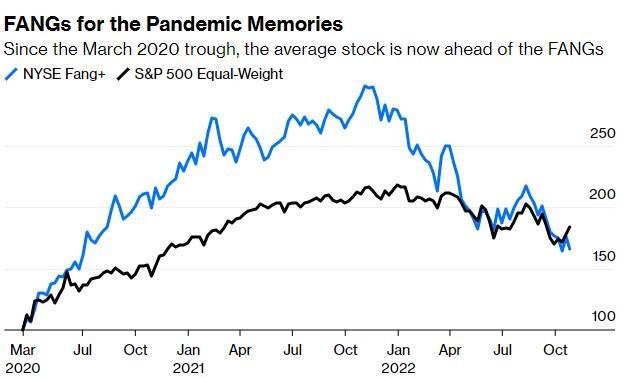

- The March 2020 Stock Market Crash: This was one of the most significant market crashes in history, driven by the COVID-19 pandemic. The S&P 500 Index dropped by nearly 35% in just two months.

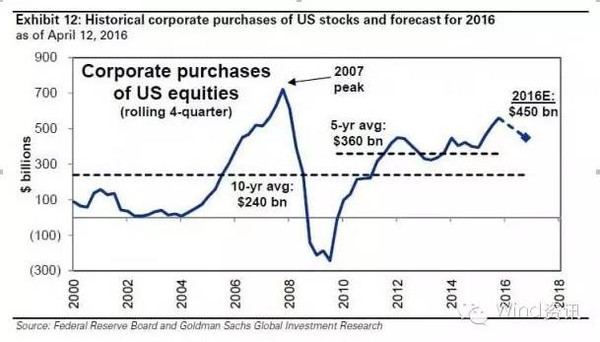

- The Federal Reserve's Response: The Federal Reserve took aggressive measures to stabilize the market, including lowering interest rates to near-zero and implementing various stimulus programs.

- The Technology Sector: The technology sector, particularly companies like Apple, Amazon, and Microsoft, performed exceptionally well in 2020. This was driven by increased demand for technology products and services during the pandemic.

- The November 2020 Election: The outcome of the US presidential election also had a significant impact on the stock market. Investors were cautious leading up to the election, but the market quickly recovered after the results were announced.

Case Studies: Companies that Thrived in 2020

Several companies managed to thrive in the challenging environment of 2020. Here are a few examples:

- Tesla: Tesla's stock price soared in 2020, reaching an all-time high of over $800 per share. This was driven by strong sales and the company's expansion into new markets.

- Netflix: Netflix also performed well in 2020, as the pandemic led to increased demand for streaming services. The company's stock price doubled during the year.

- Amazon: Amazon's stock price also surged in 2020, driven by strong sales and the company's expansion into new areas, such as healthcare and cloud computing.

Conclusion

The US stock market in 2020 was characterized by significant volatility, driven by the COVID-19 pandemic and various other factors. The graph provides a clear picture of the market's performance during the year, highlighting key trends and insights. While the market faced numerous challenges, it also demonstrated its resilience and adaptability.

US Stock Exchange Definition: Understanding? new york stock exchange