Introduction: In the global financial market, the stock exchange US dollar rate plays a pivotal role in determining the value of stocks, currencies, and economic stability. This article delves into the significance of the stock exchange US dollar rate, its impact on investors, and how it shapes the financial landscape.

The Significance of Stock Exchange US Dollar Rate:

What is the Stock Exchange US Dollar Rate? The stock exchange US dollar rate refers to the value of the US dollar in relation to other currencies in the stock market. This rate is crucial as it affects the cost of importing and exporting goods, investment returns, and the purchasing power of investors.

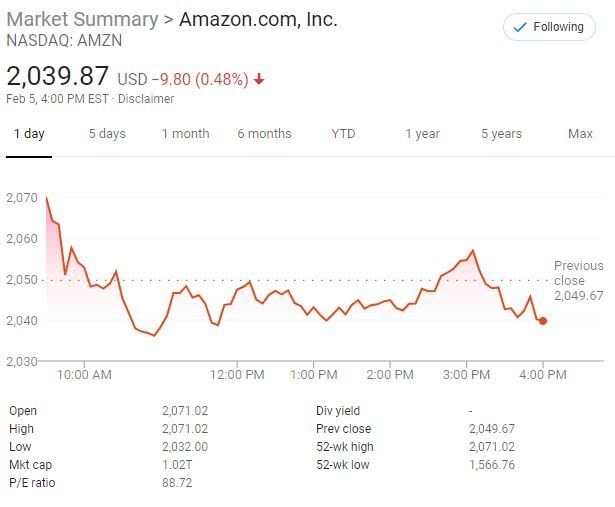

Impact on Stock Prices: When the stock exchange US dollar rate strengthens, the value of the US dollar increases in comparison to other currencies. This leads to a decrease in the cost of foreign goods, which can positively impact the profits of companies with significant international operations. Conversely, a weaker US dollar can lead to higher import costs and may negatively affect these companies' profits.

Investor Returns: The stock exchange US dollar rate significantly influences investor returns. A stronger dollar can result in higher returns for investors who have exposure to foreign markets, as they can convert their earnings into more US dollars. Conversely, a weaker dollar can lead to lower returns for these investors.

Global Economic Stability: The stock exchange US dollar rate also impacts global economic stability. A strong dollar can make US exports more expensive, potentially leading to a decrease in demand for American goods. On the other hand, a weaker dollar can make US exports more competitive, potentially boosting economic growth.

Understanding Currency Fluctuations:

Factors Influencing the Stock Exchange US Dollar Rate: Several factors influence the stock exchange US dollar rate, including:

- Interest rate differentials: When the US Federal Reserve raises interest rates, the value of the US dollar often increases.

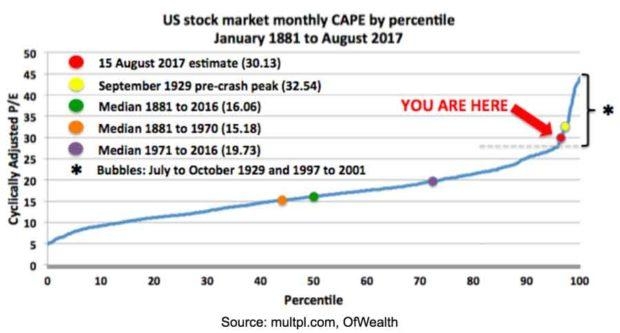

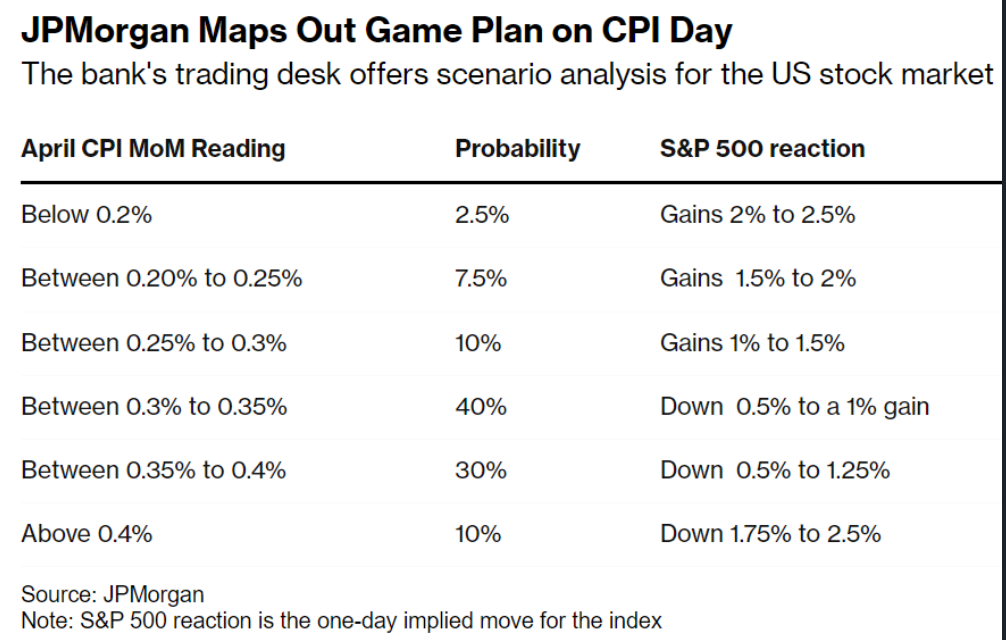

- Economic data: Strong economic indicators can strengthen the dollar, while weak data can weaken it.

- Geopolitical events: Political instability, trade disputes, and other geopolitical events can cause significant fluctuations in the stock exchange US dollar rate.

Case Studies:

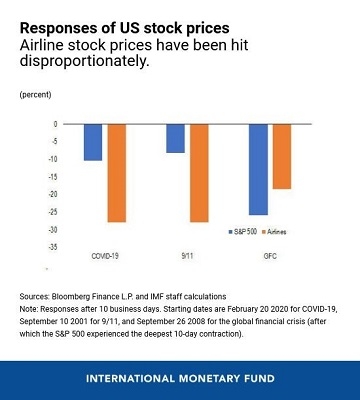

The 2008 Financial Crisis: During the 2008 financial crisis, the stock exchange US dollar rate weakened significantly. This led to increased investment in foreign markets and a surge in emerging market stocks.

The 2020 COVID-19 Pandemic: In response to the COVID-19 pandemic, the US Federal Reserve implemented an aggressive monetary policy, which weakened the stock exchange US dollar rate. This resulted in higher returns for investors with exposure to foreign markets.

Conclusion:

Understanding the stock exchange US dollar rate is essential for investors and financial professionals alike. By keeping a close eye on currency fluctuations and their impact on the stock market, investors can make informed decisions and maximize their returns. As the global financial landscape continues to evolve, the stock exchange US dollar rate will remain a crucial factor in shaping economic stability and investment opportunities.

Trade War: How the US Stock Market is React? new york stock exchange