In the fast-paced world of finance, staying updated with the US stock futures market is crucial for investors. As the trading day begins, futures contracts provide a glimpse into the potential movements of the stock market. This article offers a comprehensive overview of the US stock futures market today, highlighting key trends, factors influencing the market, and potential opportunities for investors.

Understanding US Stock Futures

Before diving into today's market trends, it's essential to understand what US stock futures are. Stock futures are financial contracts that allow investors to buy or sell a specific number of shares of a stock at a predetermined price on a future date. These contracts are often used as a speculative tool to gain exposure to the stock market without owning the actual shares.

Key Trends in the US Stock Futures Market Today

As of today, several key trends are shaping the US stock futures market:

Tech Stocks Leading the Charge: Technology stocks have been a major driver of the market, with companies like Apple, Microsoft, and Amazon leading the charge. These companies' strong earnings reports and positive outlooks have contributed to their surge in futures trading.

Energy Sector on the Rise: The energy sector has also seen significant movement, driven by rising oil prices and increased demand for energy resources. Companies like ExxonMobil and Chevron have seen their futures contracts rise as a result.

Volatility Remains a Concern: Despite the overall upward trend, volatility remains a significant concern in the market. Market uncertainty and geopolitical tensions have contributed to fluctuations in futures prices.

Factors Influencing the US Stock Futures Market

Several factors are influencing the US stock futures market today:

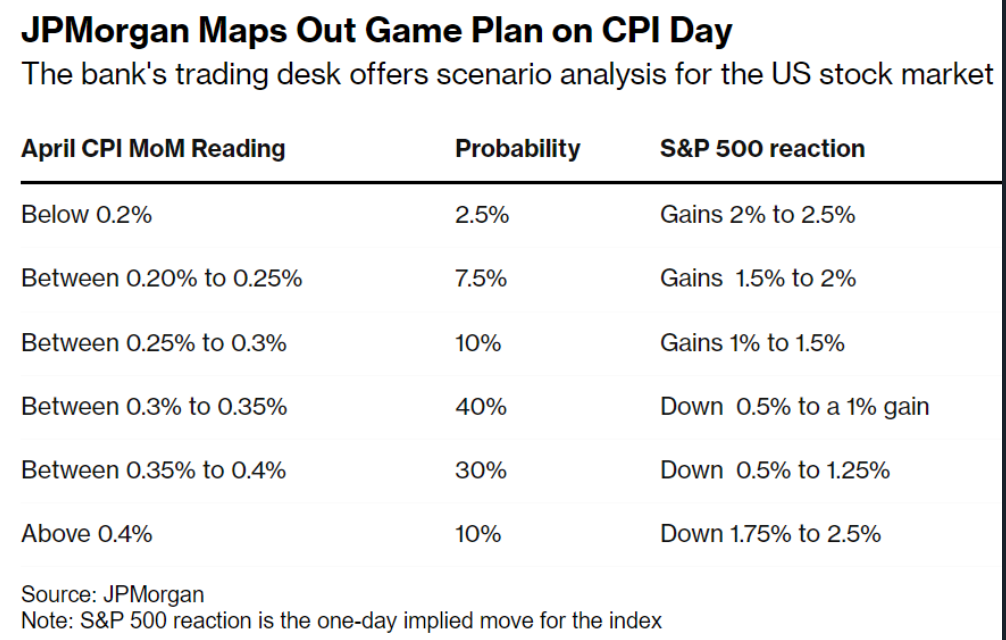

Economic Data: Economic indicators, such as GDP growth, unemployment rates, and inflation, play a crucial role in shaping the market. Positive economic data can boost investor confidence and drive futures prices higher, while negative data can have the opposite effect.

Central Bank Policies: Central bank policies, particularly those of the Federal Reserve, have a significant impact on the market. Interest rate decisions and monetary policy announcements can cause volatility in futures prices.

Geopolitical Tensions: Geopolitical tensions, such as trade disputes and political instability, can also influence the market. Investors often react to these events by moving their investments to safer assets, which can drive futures prices lower.

Case Study: Tesla's Stock Futures

A prime example of how futures contracts can reflect market sentiment is the case of Tesla. After CEO Elon Musk announced plans to increase production capacity, Tesla's stock futures surged. This demonstrates how company-specific news can have a significant impact on the market.

Conclusion

The US stock futures market today is shaped by a combination of factors, including economic data, central bank policies, and geopolitical tensions. By understanding these factors and staying informed about market trends, investors can make more informed decisions. Whether you're a seasoned investor or just starting out, keeping an eye on the US stock futures market is essential for success in the financial world.

Iran Flash Crash: How a Single Country'? new york stock exchange