The stock market is a dynamic entity that can experience significant fluctuations in a single day. Yesterday, investors were left reeling as the market took a dramatic downturn. In this article, we delve into the details of the market's decline, exploring the factors that contributed to the drop and the potential implications for investors.

Market Overview

Yesterday's market drop was one of the most significant in recent memory. The S&P 500, a widely followed benchmark index, fell by a staggering 3.5%. This represents a loss of over $1 trillion in market value. The Dow Jones Industrial Average and the NASDAQ Composite also suffered significant declines, with the Dow falling by more than 1,100 points and the NASDAQ dropping by over 3%.

Factors Contributing to the Drop

Several factors contributed to the market's decline. One of the primary reasons was concerns about the global economic outlook. As the COVID-19 pandemic continues to impact various regions around the world, investors are worried about the potential for a global recession.

Inflation Concerns

Another factor was rising inflation rates. The Consumer Price Index (CPI) in the United States has been on the rise, and investors are concerned that the Federal Reserve may need to raise interest rates to combat inflation. Higher interest rates can lead to increased borrowing costs and a slowdown in economic growth.

Geopolitical Tensions

Geopolitical tensions also played a role in the market's decline. The situation in Eastern Europe has been a source of concern, with investors worried about the potential for a wider conflict that could disrupt global supply chains and economic stability.

Sector-Specific Impacts

The decline in the market was not uniform across all sectors. Some sectors, such as technology and consumer discretionary, experienced particularly significant losses. This can be attributed to concerns about rising inflation and the potential for a slowdown in consumer spending.

Investor Sentiment

Investor sentiment also played a role in the market's decline. As the market fell, investors became increasingly cautious, leading to further selling pressure. This negative sentiment was exacerbated by a lack of confidence in the ability of policymakers to address the various challenges facing the global economy.

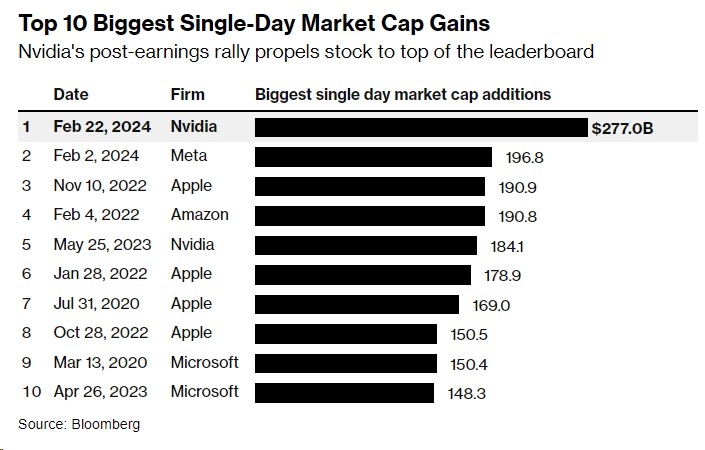

Case Study: Tech Stocks

One of the sectors that experienced the most significant losses was technology. Companies like Apple, Microsoft, and Amazon saw their stock prices fall by double digits. This can be attributed to concerns about rising inflation and the potential for a slowdown in consumer spending on technology products.

Conclusion

Yesterday's market drop was a stark reminder of the volatility that can be found in the stock market. While the market's decline was driven by a combination of factors, including concerns about the global economic outlook, rising inflation, and geopolitical tensions, it also highlighted the importance of diversifying one's investment portfolio. As investors navigate these uncertain times, it is crucial to remain vigilant and stay informed about the latest market developments.

2008 US Stock Market: A Comprehensive Analy? new york stock exchange