Are you interested in investing in US stocks but unsure where to start? Investing in the US stock market can be a lucrative venture, but it requires knowledge, research, and a well-thought-out strategy. This guide will provide you with a comprehensive overview of how to invest in US stocks, from opening an account to diversifying your portfolio.

1. Choose a Brokerage Account

The first step in investing in US stocks is to open a brokerage account. There are several types of brokerage accounts to choose from, including:

- Retail Brokerage Accounts: These accounts are suitable for individual investors who want to trade stocks, bonds, and other securities.

- IRA Accounts: Individual Retirement Accounts are tax-advantaged accounts designed for retirement savings.

- Joint Brokerage Accounts: These accounts are for two or more individuals who want to share investment responsibilities.

When choosing a brokerage firm, consider factors such as fees, commissions, customer service, and available investment options. Some popular brokerage firms include:

- Charles Schwab

- Fidelity

- E*TRADE

- TD Ameritrade

2. Research and Analyze Stocks

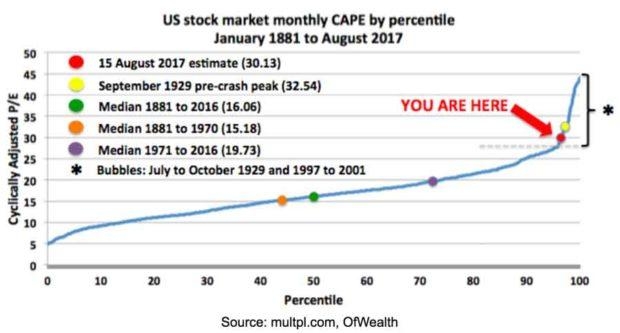

Once you have opened a brokerage account, it's time to research and analyze stocks. Here are some key factors to consider:

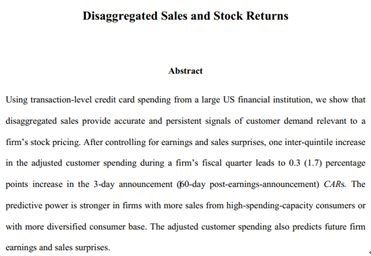

- Company Financials: Look at the company's income statement, balance sheet, and cash flow statement to assess its financial health.

- Market Capitalization: Determine the company's size and stability by considering its market capitalization.

- Sector and Industry: Research the company's sector and industry to understand its growth potential.

- Dividend Yield: If you're looking for income, consider the company's dividend yield.

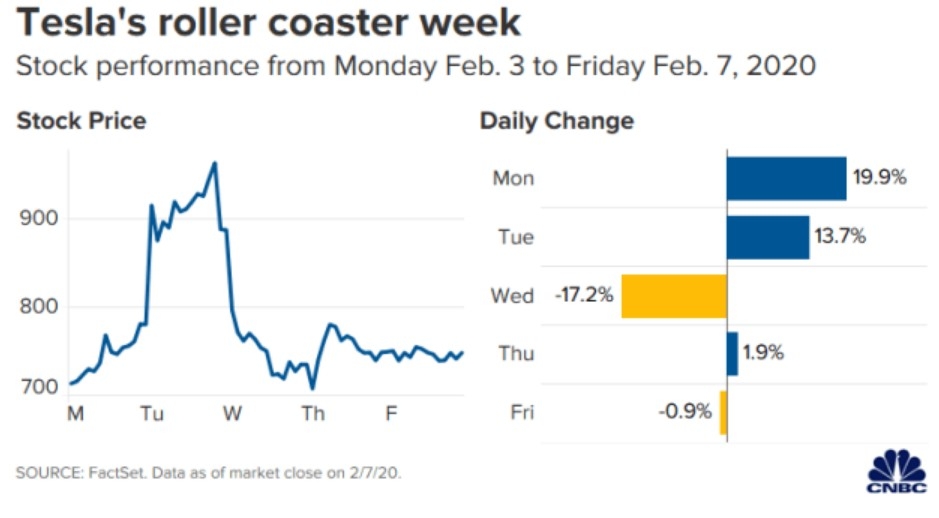

- News and Events: Stay updated on the latest news and events that may impact the company's stock price.

3. Diversify Your Portfolio

Diversification is crucial to mitigating risk and maximizing returns. Here are some strategies to diversify your portfolio:

- Asset Allocation: Allocate your investments across different asset classes, such as stocks, bonds, and real estate.

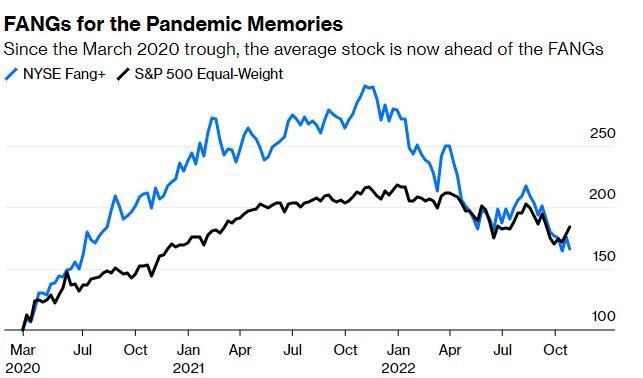

- Sector Rotation: Invest in different sectors based on economic conditions and market trends.

- International Exposure: Consider adding international stocks to your portfolio for global diversification.

4. Monitor and Review Your Investments

Once you've invested in US stocks, it's essential to monitor and review your portfolio regularly. Here are some tips:

- Set Regular Review Times: Review your portfolio at least once a quarter to assess your investments' performance.

- Stay Informed: Keep up with the latest news and events that may impact your investments.

- Adjust Your Portfolio: If necessary, adjust your portfolio to align with your investment goals and risk tolerance.

5. Case Studies

To illustrate the importance of research and diversification, let's consider two hypothetical scenarios:

- Scenario 1: An investor who bought shares of a single tech company and held onto them for five years saw significant gains. However, when the tech bubble burst, the investor lost a substantial portion of their investment.

- Scenario 2: An investor who diversified their portfolio across various sectors and asset classes saw less dramatic gains but also less significant losses during market downturns.

By diversifying your investments, you can protect yourself from the volatility of individual stocks and potentially achieve more stable returns.

Conclusion

Investing in US stocks can be a rewarding venture when approached with knowledge, research, and a well-thought-out strategy. By following these steps, you can open a brokerage account, research and analyze stocks, diversify your portfolio, and monitor your investments for optimal performance.

Title: Understanding the PE Ratio: A Key In? us steel stock dividend