In today's volatile financial market, investors are constantly seeking ways to diversify their portfolios and protect their wealth. One of the most popular investment options is gold, and the GLD US Stock is a prime example of how you can invest in this precious metal. This article will provide a comprehensive guide to understanding GLD US Stock, its benefits, and how to invest in it.

Understanding GLD US Stock

GLD US Stock, also known as the SPDR Gold Trust, is an exchange-traded fund (ETF) that tracks the price of gold. It is designed to provide investors with a simple and cost-effective way to invest in gold without the need to physically own the metal. The GLD ETF is backed by physical gold held in secure vaults, ensuring that the value of the ETF is directly tied to the price of gold.

Benefits of Investing in GLD US Stock

- Diversification: Gold is often considered a safe haven investment during times of economic uncertainty. By investing in GLD US Stock, you can diversify your portfolio and reduce your exposure to stock market volatility.

- Hedge Against Inflation: Gold has historically been a good hedge against inflation. As the value of the dollar decreases, the value of gold tends to increase, protecting your purchasing power.

- Low Correlation with Other Assets: Gold often has a low correlation with other financial assets, such as stocks and bonds. This means that its price may not move in tandem with these assets, providing a level of stability to your portfolio.

- Ease of Trading: GLD US Stock can be easily bought and sold on major stock exchanges, making it a convenient investment option for both beginners and experienced investors.

How to Invest in GLD US Stock

Investing in GLD US Stock is straightforward. Here's a step-by-step guide:

- Open a Brokerage Account: To invest in GLD US Stock, you'll need a brokerage account. You can open an account with a reputable online broker that offers access to ETFs.

- Fund Your Account: Once your account is set up, you'll need to fund it with cash or transfer funds from another account.

- Place an Order: Log in to your brokerage account and place an order to buy GLD US Stock. You can specify the number of shares you want to purchase or set a limit price.

- Monitor Your Investment: After purchasing GLD US Stock, it's important to monitor your investment and stay informed about market trends and economic news that may impact the price of gold.

Case Studies

To illustrate the benefits of investing in GLD US Stock, let's consider two case studies:

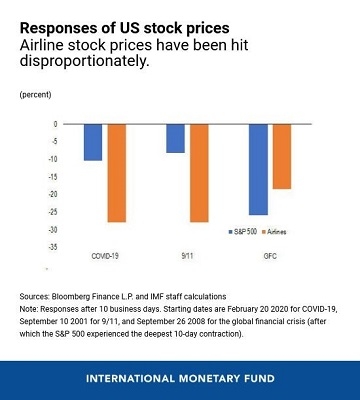

- During the 2008 Financial Crisis: During the 2008 financial crisis, the stock market plummeted, causing panic among investors. However, the price of gold remained relatively stable, and investors who held GLD US Stock saw their investments increase in value.

- Inflation Concerns: In recent years, there has been growing concern about inflation. Investors who invested in GLD US Stock during this period saw their investments appreciate as the value of the dollar decreased.

Conclusion

Investing in GLD US Stock can be a valuable addition to your investment portfolio. By understanding the benefits and how to invest, you can take advantage of the stability and potential growth offered by gold. Remember to do your research and consult with a financial advisor before making any investment decisions.

Is the US Stock Market Open on July 3rd?? new york stock exchange