Are you considering investing in the United States stock market but unsure if it's the right move for your portfolio? The allure of the US stock market is undeniable, given its history of robust growth and innovation. However, it's crucial to weigh the pros and cons before deciding to put all your investments in US stocks. In this article, we'll explore the factors you should consider to make an informed decision.

Understanding the US Stock Market

The US stock market is one of the most significant and influential markets in the world. It's home to numerous multinational corporations, tech giants, and established industries. The S&P 500, a widely followed index, includes the top 500 companies in the US, offering a snapshot of the market's performance.

Pros of Investing in US Stocks

- Historical Performance: The US stock market has historically provided strong returns over the long term. This is due to the country's economic stability, innovation, and the presence of numerous successful companies.

- Diversification: Investing in US stocks can offer diversification, as the market includes various sectors and industries. This can help reduce your portfolio's risk.

- Access to Innovation: The US is a hub for technological innovation, with numerous tech companies like Apple, Google, and Microsoft leading the way. Investing in these companies can provide exposure to the latest trends and technologies.

- Market Liquidity: The US stock market is one of the most liquid markets in the world, making it easy to buy and sell stocks without significant price impact.

Cons of Investing in US Stocks

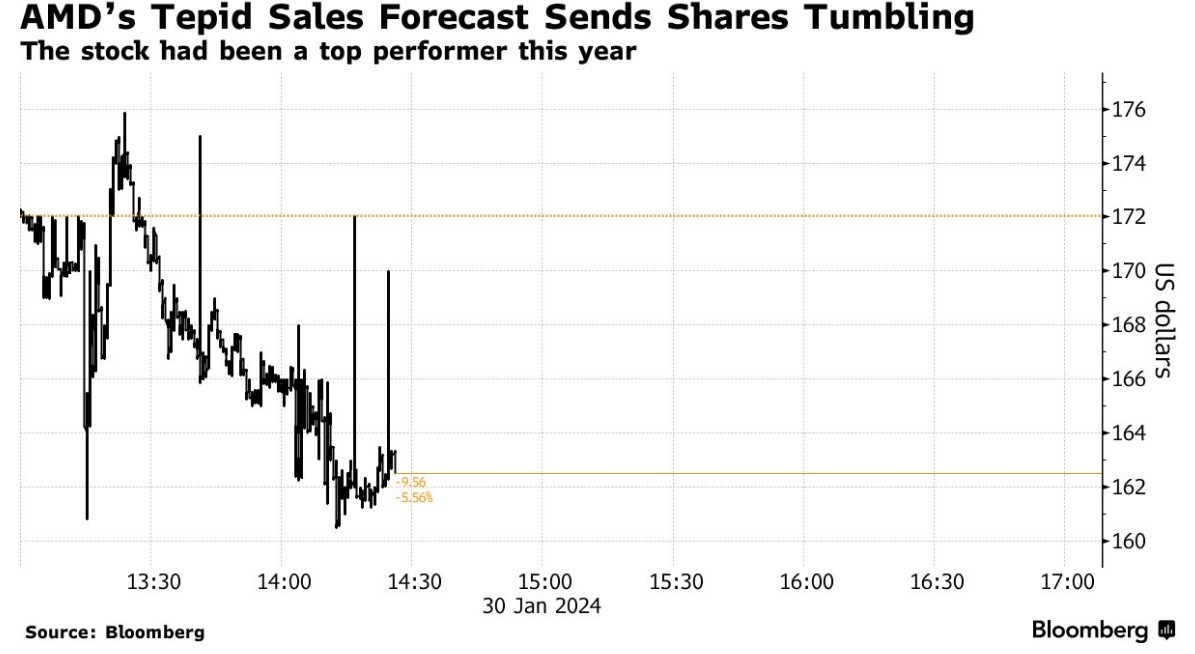

- Volatility: The US stock market can be volatile, with significant price fluctuations over short periods. This can be unsettling for investors with a low risk tolerance.

- Geopolitical Risks: The US is not immune to geopolitical events, such as trade wars and political tensions, which can impact the market.

- Overvaluation: The US stock market has experienced periods of overvaluation, which can lead to potential corrections in the future.

- Currency Risk: If you're investing in US stocks from outside the US, currency fluctuations can impact your returns.

Factors to Consider Before Investing in US Stocks

- Risk Tolerance: Assess your risk tolerance and ensure that investing in US stocks aligns with your comfort level. If you're risk-averse, consider diversifying your portfolio with other asset classes.

- Investment Goals: Define your investment goals, whether it's capital preservation, income generation, or long-term growth. This will help you determine the appropriate allocation to US stocks.

- Market Conditions: Monitor market conditions and economic indicators to gauge the overall health of the US stock market. This can help you make informed decisions about your investments.

- Diversification: Consider diversifying your portfolio with stocks from other countries and sectors to reduce risk and exposure to market-specific risks.

Case Study: International Investors

International investors often face the question of whether to invest in US stocks. For example, a Chinese investor might consider investing in US tech stocks like Apple and Google. While these companies offer exposure to innovative industries and strong growth potential, the investor should also consider the potential risks, such as currency fluctuations and geopolitical tensions.

Conclusion

Investing in US stocks can be a valuable component of your portfolio, but it's crucial to consider the risks and benefits before making a decision. Assess your risk tolerance, investment goals, and market conditions to determine the appropriate allocation to US stocks. Diversifying your portfolio can help reduce risk and maximize returns.

Is the US Stock Market Open? Understanding ? new york stock exchange