Over the past five years, the Dow Jones Industrial Average (DJIA) has experienced significant fluctuations, reflecting the dynamic nature of the global economy and the financial markets. This article provides a comprehensive analysis of the Dow Jones performance over the last five years, highlighting key trends, market dynamics, and the factors influencing its trajectory.

Historical Context and Performance

The Dow Jones, a widely followed stock market index, represents the average share price of 30 large, publicly-traded companies in the United States. Over the last five years, the index has seen both remarkable growth and periods of volatility. As of the latest data, the Dow Jones has experienced an impressive rise of over 40%, demonstrating the resilience of the U.S. economy and the stock market.

Key Trends and Factors Influencing the Dow Jones

Economic Growth and Corporate Profits: The robust economic growth in the United States has been a major driver of the Dow Jones' upward trajectory. Strong corporate earnings have contributed to the index's growth, with many companies reporting record profits.

Interest Rates: The Federal Reserve's monetary policy, particularly the adjustment of interest rates, has had a significant impact on the Dow Jones. Lower interest rates tend to boost stock prices, while higher rates can lead to volatility.

Global Economic Conditions: The performance of the Dow Jones has been influenced by global economic conditions, including trade tensions, geopolitical events, and emerging market fluctuations.

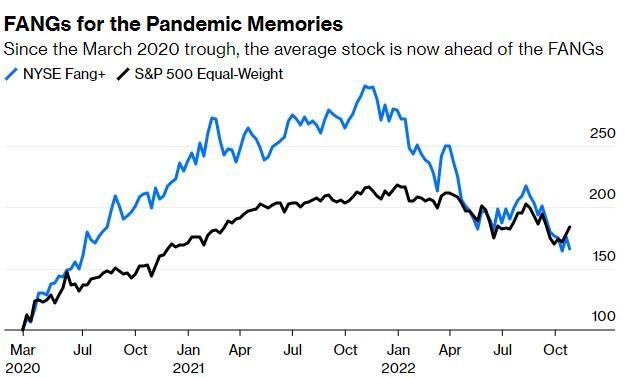

Technological Advancements: The rise of technology companies, such as Apple, Microsoft, and Amazon, has had a profound impact on the Dow Jones. These companies have contributed significantly to the index's growth, driven by their impressive financial performance and market capitalization.

Market Sentiment: Investor sentiment has played a crucial role in the Dow Jones' performance. Factors such as market optimism, fear of missing out (FOMO), and speculation have influenced stock prices and the index's overall trajectory.

Case Studies

COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in 2020 led to unprecedented market volatility. However, the Dow Jones recovered quickly, demonstrating the resilience of the U.S. economy and the stock market.

Trade Tensions: The ongoing trade tensions between the United States and China have had a mixed impact on the Dow Jones. While some companies have been negatively affected, others have thrived due to increased domestic demand.

Conclusion

In conclusion, the Dow Jones Industrial Average has experienced significant growth over the last five years, driven by a combination of economic factors, technological advancements, and market sentiment. While the index has faced challenges, its overall performance reflects the resilience of the U.S. economy and the stock market. As we look ahead, it will be interesting to see how the Dow Jones continues to evolve and respond to the ever-changing economic landscape.

Stock Creek Rd at Hall Rd Knoxville TN US: ? new york stock exchange