In a volatile trading session, the US stock market closed on May 9, 2025, with a mix of gains and losses across major indices. Let's dive into the key highlights of the day.

Dow Jones Industrial Average (DJIA):

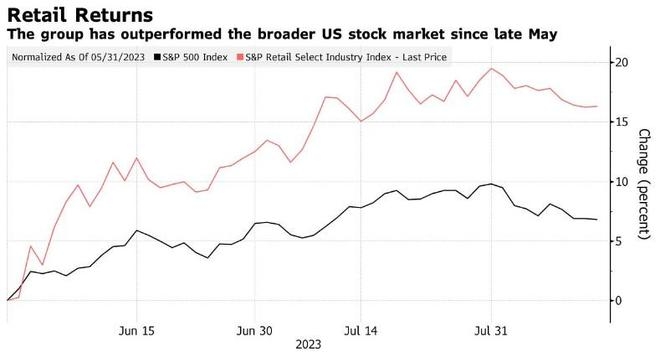

S&P 500 Index: The S&P 500 Index also ended the day in the red, as energy and consumer discretionary sectors underperformed. Healthcare and financials sectors, however, managed to post modest gains. Pharmaceutical company Pfizer Inc. (PFE) reported positive results from a key drug trial, driving its stock higher.

NASDAQ Composite: The NASDAQ Composite closed slightly higher, driven by strong performance from technology and biotech companies. Tesla Inc. (TSLA) reported record deliveries for the first quarter, sending its stock to new all-time highs. Facebook parent Meta Platforms Inc. (META) also saw its stock gain, despite a decline in user growth.

Market Volatility: The VIX Index, also known as the "fear gauge," rose slightly, reflecting increased uncertainty in the market. Market watchers believe that this volatility could persist in the near term, as investors grapple with a range of factors, including inflation, geopolitical tensions, and central bank policies.

Economic Data: The U.S. Labor Department reported that the unemployment rate fell to 3.6% in April, slightly below expectations. Average hourly earnings rose by 0.3%, while the consumer price index (CPI) increased by 0.4%. These data points suggest that the economy is continuing to strengthen, despite concerns about inflation.

Sector Performance: Energy stocks were among the worst performers, as oil prices fell on concerns about global supply and demand. Consumer discretionary stocks also underperformed, as retailers reported weaker-than-expected sales. Healthcare and financials sectors, on the other hand, managed to post gains, driven by strong earnings reports from major companies.

Conclusion: The US stock market closed on May 9, 2025, with a mix of gains and losses, reflecting the complex and dynamic nature of the global economy. Investors will likely remain cautious in the near term, as they navigate a range of uncertainties. As always, it's important for investors to stay informed and stay diversified to manage risk effectively.

The Evolution of Stock Speculation in US Hi? new york stock exchange