In the ever-evolving landscape of the US stock market, construction stocks have emerged as a promising investment opportunity. As the country's infrastructure continues to age and urbanization expands, the construction industry is poised for significant growth. This article delves into the factors contributing to the rise of construction stocks and provides insights into how investors can capitalize on this trend.

The Construction Industry's Growth Trajectory

The construction industry in the US has seen a steady increase in demand over the past few years. This growth can be attributed to several factors:

- Infrastructure Upgrades: The American Society of Civil Engineers (ASCE) has given the US infrastructure a D+ grade, highlighting the need for significant upgrades. Projects such as the replacement of aging bridges, roads, and water systems are expected to drive demand for construction services.

- Urbanization: As cities continue to grow, the need for new residential, commercial, and industrial developments increases. This urbanization trend is expected to fuel the construction industry's growth in the coming years.

- Residential Construction: The housing market has seen a steady recovery, leading to increased demand for new homes and renovations. This surge in residential construction is expected to benefit construction stocks.

Key Construction Stocks to Watch

Several construction stocks have shown strong potential for growth in the US market. Here are some notable examples:

- PulteGroup, Inc. (PHM): As one of the largest homebuilders in the US, PulteGroup has a strong presence in the residential construction sector. The company has a diverse portfolio of new homes and has seen a significant increase in sales over the past few years.

- Beazer Homes USA, Inc. (BZH): Beazer Homes is another leading homebuilder with a focus on new home construction. The company has a strong track record of delivering quality homes and has seen increased demand in several key markets.

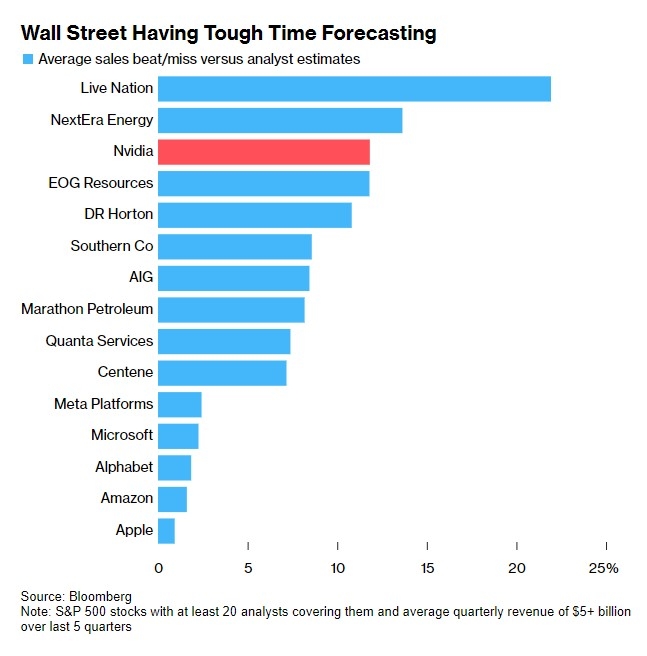

- D.R. Horton, Inc. (DHI): D.R. Horton is the largest homebuilder in the US, with a presence in 27 states. The company has a diverse portfolio of new homes and has seen strong growth in its home sales and earnings.

Case Study: Lennar Corporation (LEN)

Lennar Corporation is a well-known homebuilder with a strong presence in the US market. The company has successfully capitalized on the growing demand for residential construction. Here's a brief overview of Lennar's recent performance:

- Revenue Growth: Lennar's revenue has seen a steady increase over the past few years, driven by strong demand for new homes.

- Earnings Growth: The company's earnings have also grown significantly, with a focus on improving profitability.

- Dividend Yield: Lennar offers a dividend yield of 1.3%, providing investors with a steady stream of income.

Conclusion

Construction stocks have emerged as a lucrative investment opportunity in the US market. With the growing demand for infrastructure upgrades, urbanization, and residential construction, investors can benefit from the strong growth potential of the construction industry. By focusing on leading construction stocks such as PulteGroup, Beazer Homes, and D.R. Horton, investors can capitalize on this trend and potentially achieve significant returns.

Revolut Offers 4,000 US Stocks in 2025: Rev? new york stock exchange