The stock market's opening bell for the week rang with a cautious tone as US stock futures dipped, signaling a potentially weaker market performance. This article delves into the reasons behind the downward trend and the potential implications for investors.

Market Dynamics and Factors Influencing Futures

Several factors have contributed to the downward trend in US stock futures. The primary concern revolves around the global economic outlook, particularly in the wake of the COVID-19 pandemic. Economic uncertainties and geopolitical tensions have created a volatile environment that has spooked investors.

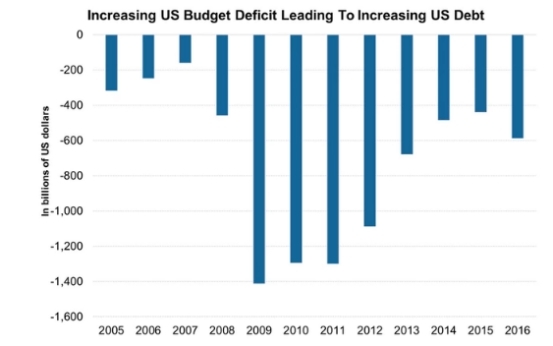

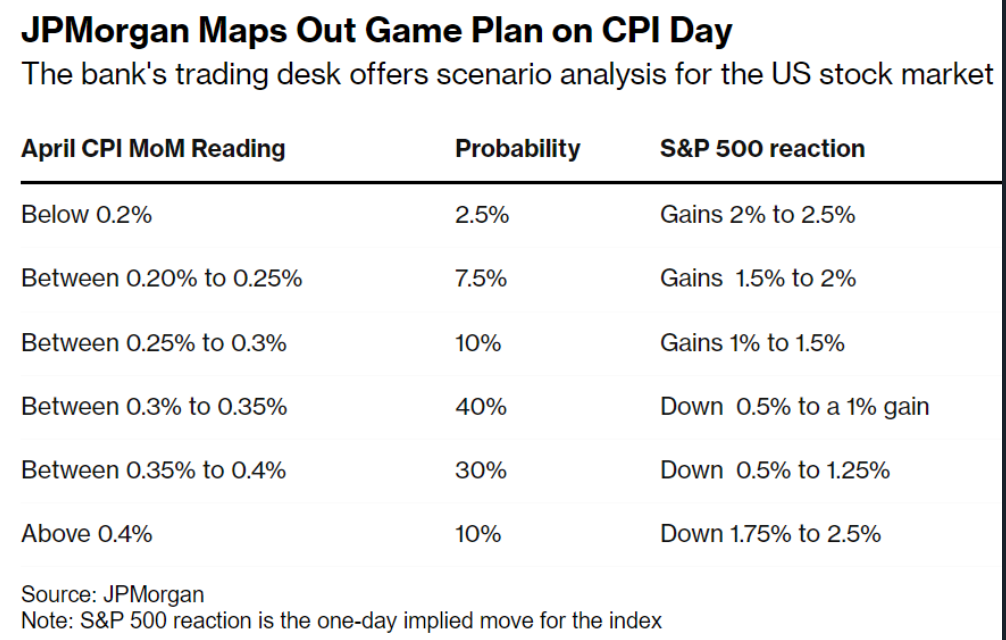

One significant factor is the rising inflation rates, which have led to interest rate hikes by major central banks. The Federal Reserve, for instance, has indicated that it may increase interest rates to curb inflation. This has raised concerns about the potential impact on corporate earnings and consumer spending.

Tech Sector Under Pressure

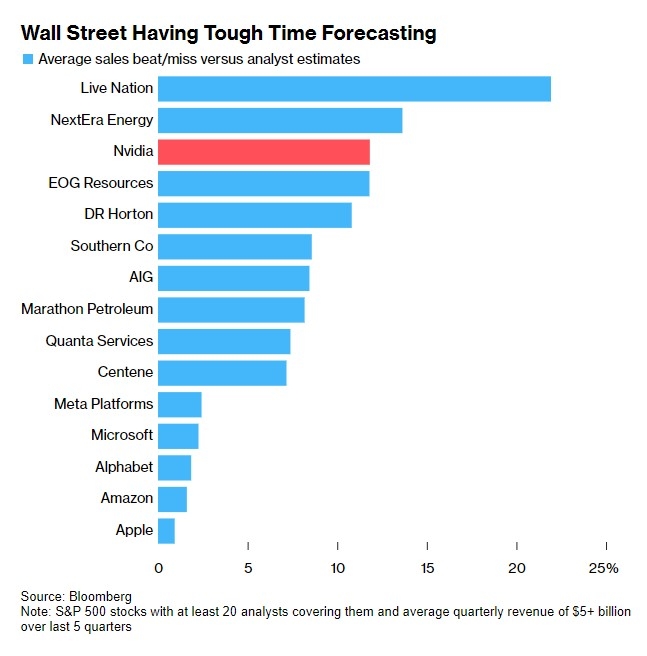

The tech sector, which has been a major driver of the stock market's growth over the past few years, has come under particular pressure. Companies like Apple, Microsoft, and Amazon have seen their futures decline, reflecting broader market concerns.

Impact on Small-Cap Stocks

In addition to the tech sector, small-cap stocks have also been hit hard. These companies are more sensitive to economic changes and have seen their futures drop significantly. This trend has raised concerns about the overall health of the stock market.

Global Economic Outlook

The global economic outlook remains a key concern. The COVID-19 pandemic has disrupted supply chains and caused economic uncertainty, leading to downward pressure on stock futures. Additionally, geopolitical tensions between major economies have added to the volatility.

Investor Sentiment and Market Volatility

Investor sentiment has been volatile, with many investors adopting a cautious approach. This sentiment has been further exacerbated by the rise in corporate earnings warnings and job losses in various sectors.

Case Study: Apple's Stock Futures

To illustrate the impact of these factors, let's take a look at Apple's stock futures. The company's futures have seen a significant decline, reflecting broader market concerns. Apple's dependence on the global supply chain and its exposure to the tech sector have made it particularly vulnerable to economic and geopolitical uncertainties.

Conclusion

In conclusion, US stock futures have started the week on a weak note, reflecting broader market concerns. The factors contributing to this trend include economic uncertainties, geopolitical tensions, and rising inflation rates. Investors should remain cautious and keep a close eye on market developments.

Understanding the Market Cap in the US Stoc? new york stock exchange