Are you interested in investing in Canadian bank stocks but unsure if it's possible from the United States? You're not alone. Many American investors are looking for opportunities to diversify their portfolios by investing in international markets, including Canada. In this article, we'll explore whether you can buy Canadian bank stocks in the US and what you need to know before making such an investment.

Understanding Canadian Bank Stocks

Canada is home to some of the world's largest and most stable banking institutions. These banks, such as Royal Bank of Canada (RBC), Toronto-Dominion Bank (TD), Bank of Nova Scotia (Scotiabank), and Bank of Montreal (BMO), are well-regarded for their strong financial health and robust performance.

Can You Buy Canadian Bank Stocks in the US?

Yes, you can buy Canadian bank stocks in the US. There are several ways to do so:

Stock Exchanges: Canadian bank stocks are listed on the Toronto Stock Exchange (TSX). American investors can purchase these stocks through brokerage firms that offer international trading capabilities. Many major brokerage platforms, such as TD Ameritrade, E*TRADE, and Charles Schwab, provide access to the TSX.

American Depositary Receipts (ADRs): Some Canadian bank stocks are also available as American Depositary Receipts (ADRs) on the New York Stock Exchange (NYSE) or NASDAQ. ADRs are shares of a foreign company that trade on a US exchange, representing ownership of the underlying shares in the foreign stock market. Examples of Canadian bank ADRs include RBC, TD, and BMO.

Mutual Funds and ETFs: Another way to invest in Canadian bank stocks is through mutual funds or ETFs that focus on the Canadian financial sector. These funds are available through brokerage firms and offer a diversified way to invest in Canadian banks.

Considerations Before Investing

Before you decide to buy Canadian bank stocks, here are some important factors to consider:

Exchange Rates: The value of Canadian bank stocks is denominated in Canadian dollars. Fluctuations in the exchange rate can impact the performance of your investment when converted to US dollars.

Tax Implications: When you invest in Canadian stocks, you may be subject to Canadian tax laws. It's important to consult with a tax professional to understand any potential tax implications.

Regulatory Differences: The regulatory environment for banks in Canada may differ from that in the US. It's important to research the financial health and stability of Canadian banks before investing.

Case Study: Royal Bank of Canada (RBC)

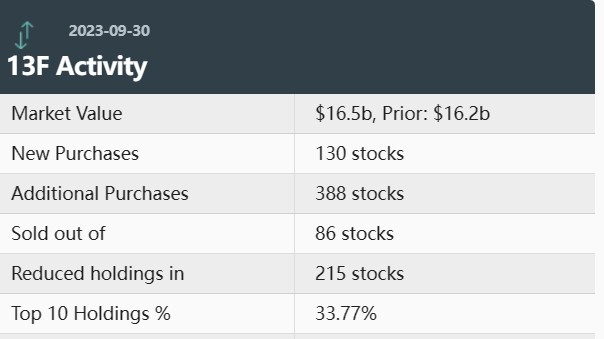

One of the largest banks in Canada, Royal Bank of Canada (RBC), has a strong presence in the US as well. RBC's ADR, listed on the NYSE under the ticker symbol "RY," offers American investors access to the bank's performance.

RBC has demonstrated resilience in various economic conditions and has a long history of strong financial performance. As of the latest financial reporting, RBC reported a net income of $6.9 billion, reflecting a robust performance across its various business segments.

Conclusion

Investing in Canadian bank stocks from the US is possible and offers opportunities for diversification and potential growth. By understanding the process, considering the factors mentioned above, and conducting thorough research, you can make informed decisions about your investments in Canadian banks.

Pattern Energy: A Game-Changer for US Solar? new york stock exchange