In the vast landscape of investment opportunities, small cap value US stock mutual funds stand out as a beacon for investors seeking substantial growth potential. These funds focus on companies with a market capitalization of less than $2 billion, offering a unique blend of value and growth. This article delves into the intricacies of small cap value US stock mutual funds, highlighting their benefits, risks, and key considerations for investors.

Understanding Small Cap Value US Stock Mutual Funds

Small cap value US stock mutual funds are designed to invest in companies that are undervalued by the market. These funds typically target companies with a market capitalization of less than $2 billion, which are often overlooked by larger investors. The "value" aspect of these funds stems from their focus on companies trading at a discount to their intrinsic value.

Benefits of Investing in Small Cap Value US Stock Mutual Funds

- Potential for High Returns: Historically, small cap stocks have outperformed their larger counterparts over the long term. This is due to the higher growth potential of smaller companies as they scale up.

- Diversification: Investing in a mutual fund allows investors to gain exposure to a diversified portfolio of small cap value stocks, reducing the risk associated with investing in a single stock.

- Professional Management: Mutual funds are managed by experienced professionals who conduct thorough research and analysis to identify undervalued small cap stocks.

Risks Associated with Small Cap Value US Stock Mutual Funds

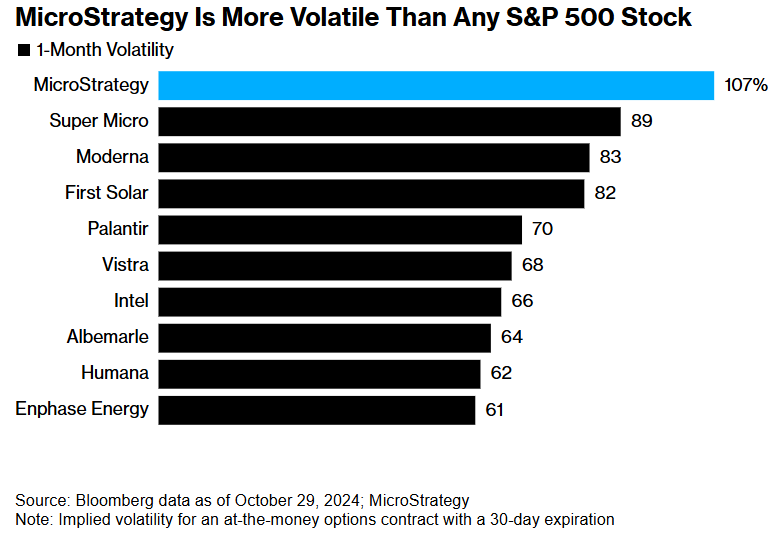

- Higher Volatility: Small cap stocks tend to be more volatile than large cap stocks, which can lead to significant price fluctuations.

- Liquidity Risk: Smaller companies may have lower liquidity, making it more difficult to buy or sell shares at desired prices.

- Higher Fees: Some small cap value US stock mutual funds may charge higher fees compared to larger funds.

Key Considerations for Investors

- Investment Strategy: Before investing, it's crucial to understand the investment strategy of the mutual fund. Ensure that it aligns with your investment goals and risk tolerance.

- Fund Performance: Evaluate the historical performance of the mutual fund, taking into account both the returns and the risk associated with the fund.

- Fund Manager: Research the experience and track record of the fund manager, as their expertise can significantly impact the fund's performance.

Case Study: Fidelity Small Cap Value Fund

Consider the Fidelity Small Cap Value Fund, which has a long-standing reputation for investing in undervalued small cap stocks. Over the past decade, the fund has delivered impressive returns, outperforming the S&P 500 index. This case study highlights the potential of small cap value US stock mutual funds in delivering substantial growth.

In conclusion, small cap value US stock mutual funds offer a compelling investment opportunity for those seeking high growth potential. By understanding the benefits, risks, and key considerations, investors can make informed decisions and potentially unlock substantial value in their portfolios.

Buy Foreign Stocks from US Brokerage: A Com? new york stock exchange