The stock market is a dynamic and complex entity, always shifting and adapting to new information and global events. Keeping up with the latest market trends is crucial for investors looking to make informed decisions. So, what's the markets doing today? Let's dive into the current state of the markets and identify key trends that could impact your investment strategy.

Stock Market Overview

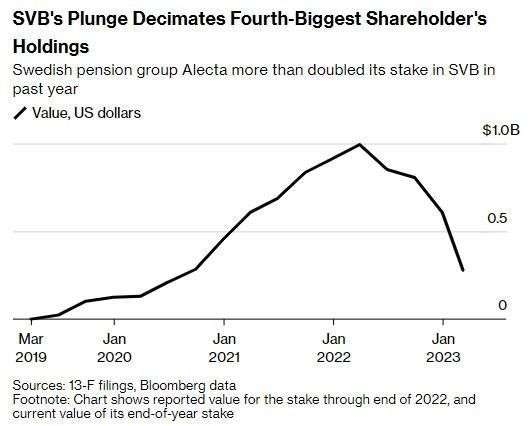

As of the latest market update, the S&P 500 index has been experiencing a mixed bag of results. Some sectors, such as technology and healthcare, have been performing well, while others, such as energy and financials, have been struggling. This indicates a diversified market, with both opportunities and risks for investors.

Key Trends to Watch

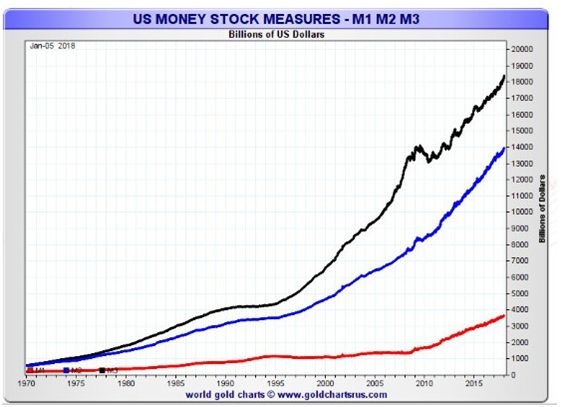

Inflation Concerns: Inflation remains a significant concern for investors, with the Consumer Price Index (CPI) showing a steady increase. This has led to higher interest rates and concerns about the potential for a recession. Investors should be cautious when investing in sectors that are sensitive to inflation, such as consumer discretionary and energy.

Global Events: The ongoing geopolitical tensions, particularly between the United States and China, have been causing volatility in the markets. Investors should pay close attention to any news regarding trade negotiations and geopolitical developments, as these can have a significant impact on market performance.

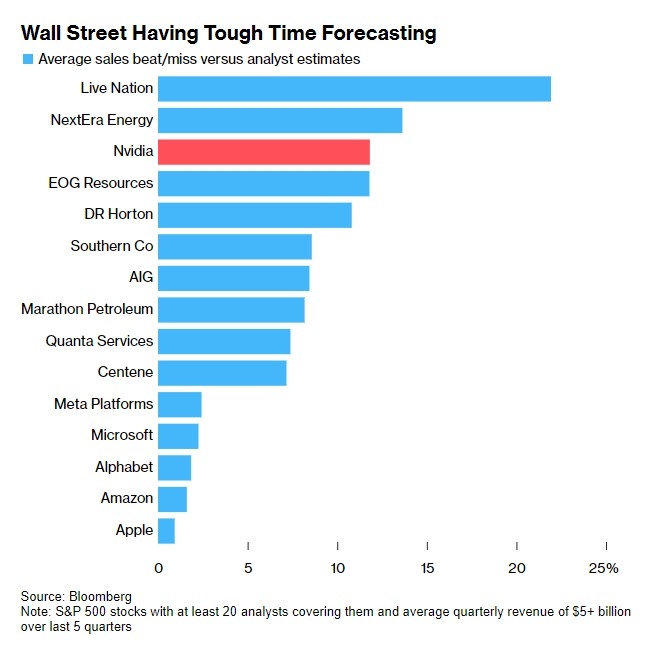

Corporate Earnings: As the fourth quarter of 2022 approaches, corporate earnings reports will be a crucial indicator of market trends. Positive earnings reports can boost investor confidence and lead to increased stock prices, while negative reports can cause market volatility.

Sector Analysis

Technology: The technology sector has been a strong performer, driven by companies like Apple, Microsoft, and Amazon. However, investors should be cautious, as valuations have become stretched and the sector is sensitive to regulatory changes.

Healthcare: The healthcare sector has been experiencing growth due to the aging population and increased demand for healthcare services. Companies like Johnson & Johnson and Pfizer have been performing well, but investors should be mindful of rising healthcare costs and potential drug pricing regulations.

Energy: The energy sector has been struggling due to lower oil prices and increased regulatory scrutiny. However, some companies, such as ExxonMobil and Chevron, have been able to maintain strong performance despite the challenges.

Case Studies

Apple: Apple's strong performance in the technology sector has been driven by its innovative products and robust demand. However, investors should be aware of the company's increasing valuation and potential regulatory challenges.

Johnson & Johnson: Johnson & Johnson has been a solid performer in the healthcare sector, with a diverse portfolio of products and a strong focus on innovation. However, investors should be cautious of rising healthcare costs and potential drug pricing regulations.

In conclusion, the markets are currently experiencing a mix of opportunities and risks. Investors should stay informed about the latest market trends and be prepared to adjust their investment strategies accordingly. By monitoring key indicators, such as inflation, global events, and corporate earnings, investors can make more informed decisions and potentially achieve better returns.

Can the Stock Market Survive Without the U.? can foreigners buy us stocks