In the ever-evolving landscape of the stock market, large cap value stocks have always been a cornerstone for investors seeking stability and growth. These stocks represent some of the most significant and established companies in the United States, offering a blend of stability, profitability, and potential for long-term gains. In this article, we delve into the current prices of these large cap value stocks and provide valuable insights for investors looking to capitalize on these opportunities.

Understanding Large Cap Value Stocks

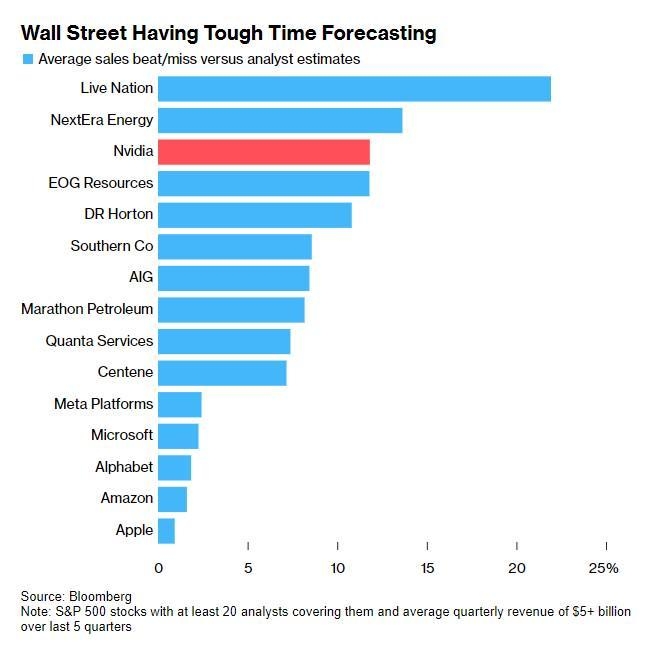

Large cap value stocks are characterized by their market capitalization, which typically exceeds $10 billion. These companies are often well-established, with a long history of profitability and stability. They are known for their strong fundamentals, including robust earnings, dividends, and low price-to-earnings (P/E) ratios. Some of the most notable large cap value stocks in the U.S. include Apple, Microsoft, Johnson & Johnson, and Procter & Gamble.

Current Prices of Large Cap Value Stocks

As of the latest market data, the current prices of these large cap value stocks have been fluctuating due to various factors, including economic conditions, market sentiment, and company-specific news. Here's a snapshot of some of the key players:

- Apple (AAPL): Trading at around

150 per share, Apple remains one of the most valuable companies in the world, with a market capitalization of over 2 trillion. - Microsoft (MSFT): Currently valued at approximately $300 per share, Microsoft continues to be a dominant force in the technology industry.

- Johnson & Johnson (JNJ): With a current price of around $150 per share, Johnson & Johnson is known for its diverse portfolio of healthcare products and services.

- Procter & Gamble (PG): Trading at approximately $150 per share, Procter & Gamble is a leader in the consumer goods industry.

Investment Insights

Investing in large cap value stocks can be a prudent strategy for long-term investors. These stocks offer several advantages:

- Stability: Large cap value stocks tend to be less volatile compared to smaller companies, making them a safer bet during market downturns.

- Dividends: Many of these companies pay regular dividends, providing investors with a steady income stream.

- Growth Potential: Despite their size, these companies often have the resources and expertise to innovate and expand their businesses, offering potential for long-term growth.

Case Study: Apple (AAPL)

Apple is a prime example of a large cap value stock that has delivered significant returns over the years. Since its initial public offering in 1980, Apple has grown to become one of the most valuable companies in the world. Despite facing challenges and competition, Apple has managed to innovate and maintain its dominance in the technology industry. Its current market capitalization of over $2 trillion is a testament to its success.

In conclusion, large cap value stocks continue to be a valuable investment option for investors seeking stability and growth. By understanding the current prices and investment insights of these stocks, investors can make informed decisions and potentially benefit from their long-term potential.

Momentum Stocks: US Market Top Performers L? can foreigners buy us stocks