Are you looking to invest in the thriving US stock market? If so, you might have come across the term "TOL US Stock." But what does it mean, and how can you capitalize on this investment opportunity? In this article, we'll delve into the world of TOL US Stock, exploring its potential, risks, and how you can make informed decisions.

Understanding TOL US Stock

Firstly, let's clarify what TOL US Stock stands for. "TOL" typically refers to a company or industry, while "US Stock" signifies that the investment is in a company listed on a US stock exchange. In this context, TOL US Stock could refer to a company operating in the transportation or logistics sector, which is a vital part of the US economy.

The Transportation and Logistics Industry

The transportation and logistics industry plays a crucial role in the global supply chain. It involves the movement of goods and services from one place to another, ensuring that products reach consumers efficiently and effectively. This industry encompasses various sectors, including shipping, warehousing, and distribution.

Why Invest in TOL US Stock?

Investing in TOL US Stock can offer several benefits:

- Stable Growth: The transportation and logistics industry is known for its stability, as it is essential for the functioning of the global economy.

- Diversification: Investing in TOL US Stock can provide diversification to your portfolio, reducing the risk associated with other sectors.

- Innovation: The industry is constantly evolving, with new technologies and methods being introduced to improve efficiency and reduce costs.

Risks to Consider

While investing in TOL US Stock can be lucrative, it's important to be aware of the risks involved:

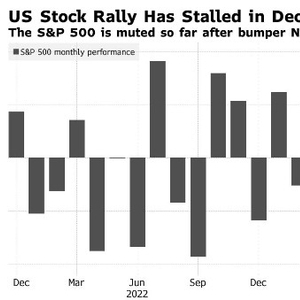

- Economic Factors: Economic downturns can impact the transportation and logistics industry, leading to lower profits and stock prices.

- Regulatory Changes: Changes in regulations can affect the operations of companies in this sector, potentially leading to increased costs or restrictions.

- Competition: The industry is highly competitive, with numerous players vying for market share.

Case Study: FedEx Corporation

One notable example of a TOL US Stock is FedEx Corporation. FedEx is a global leader in transportation, offering a wide range of services, including package delivery, freight services, and supply chain management.

In recent years, FedEx has seen significant growth, driven by its commitment to innovation and expansion into new markets. However, the company has also faced challenges, such as increased competition and economic uncertainties.

How to Invest in TOL US Stock

If you're interested in investing in TOL US Stock, here are some steps to consider:

- Research: Conduct thorough research on the company and the industry to understand its strengths, weaknesses, and potential risks.

- Diversify: Consider diversifying your investment to reduce risk.

- Stay Informed: Keep up-to-date with industry news and economic trends to make informed decisions.

- Seek Professional Advice: If you're unsure about making investment decisions, consider seeking advice from a financial advisor.

In conclusion, TOL US Stock can be a valuable addition to your investment portfolio. By understanding the industry, its risks, and opportunities, you can make informed decisions and potentially reap the rewards of investing in this dynamic sector.

Small Cap US Biotech Stocks: A Lucrative In? can foreigners buy us stocks