In the ever-evolving world of biotechnology, Arrowhead Pharmaceuticals stands out as a beacon of innovation and growth. This article delves into the reasons why Arrowhead Pharmaceuticals is a key player in the US biotech stock market, offering insights into its unique approach to drug development and its impressive portfolio of clinical trials.

Innovative RNAi Therapies

One of the primary reasons Arrowhead Pharmaceuticals has gained significant traction in the biotech sector is its focus on RNA interference (RNAi) therapies. This groundbreaking technology targets specific messenger RNA (mRNA) molecules, effectively silencing the genes responsible for disease. RNAi has shown promising results in treating various genetic disorders, and Arrowhead is at the forefront of this revolutionary approach.

Expanding Pipeline of Clinical Trials

Arrowhead's pipeline is a testament to its commitment to innovation. The company has a robust portfolio of clinical trials, with several drugs showing promising results. One of the most notable is ARC-520, a drug designed to treat hepatitis B virus (HBV). The drug has successfully completed Phase 2 trials, showing significant reductions in HBV DNA levels. This success has positioned Arrowhead as a leader in the fight against HBV.

Collaborations and Partnerships

Arrowhead's growth can also be attributed to its strategic collaborations and partnerships with leading pharmaceutical companies. These alliances have not only provided the company with additional funding but have also expanded its reach in the biotech industry. For example, the company has partnered with Amgen to develop novel RNAi therapies for the treatment of hemophilia and other genetic disorders.

Strong Financial Performance

Another factor contributing to Arrowhead's success is its strong financial performance. The company has consistently reported positive revenue growth, driven by the increasing demand for its RNAi therapies. Arrowhead's financial stability has made it an attractive investment for both institutional and retail investors.

Case Study: ARC-960 for NASH

A prime example of Arrowhead's commitment to innovation is its drug ARC-960, which is currently in Phase 2 trials for the treatment of non-alcoholic steatohepatitis (NASH). NASH is a chronic liver disease that affects millions of people worldwide. ARC-960 targets the genes responsible for the progression of NASH, offering hope for those suffering from this devastating condition.

Conclusion

In conclusion, Arrowhead Pharmaceuticals is a leader in the US biotech stock market, driven by its innovative RNAi therapies, expanding pipeline of clinical trials, strategic collaborations, and strong financial performance. As the biotech industry continues to grow, Arrowhead's role as a pioneer in RNAi therapy development will undoubtedly become even more significant. Investors looking to capitalize on the potential of the biotech sector should consider adding Arrowhead Pharmaceuticals to their portfolios.

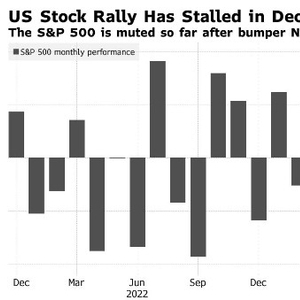

US Stock Fall: How It Impacts the Indian St? can foreigners buy us stocks