Introduction

As we delve into the financial landscape of May 20, 2025, the US stock market presents a tapestry of opportunities and challenges. This briefing will provide a comprehensive overview of the key trends, major movements, and notable developments shaping the market at this pivotal moment.

Market Overview

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA) has been experiencing a steady rise, reflecting a robust economic outlook. Major contributors to this uptrend include tech giants like Apple and Microsoft, which have seen significant growth in their revenue and earnings reports.

S&P 500: The S&P 500 has also been on an upward trajectory, with healthcare and consumer discretionary sectors leading the charge. Companies like Johnson & Johnson and Disney have reported strong earnings, bolstering investor confidence.

NASDAQ Composite: The NASDAQ Composite has seen some volatility, with a mix of tech stocks and biotech companies driving the market. Notable performers include Tesla, which has reported impressive growth in its electric vehicle sales.

Sector Performance

Technology: The technology sector has been a major driver of market growth, with companies like Facebook (now Meta) and Google (now Alphabet) leading the pack. These companies have been investing heavily in new technologies and expanding their market presence.

Healthcare: The healthcare sector has been a bright spot, with pharmaceutical companies and medical device manufacturers reporting strong earnings. The rise in telemedicine and biotechnology has also contributed to this sector's growth.

Consumer Discretionary: The consumer discretionary sector has seen a surge in demand, driven by increased consumer spending on travel, leisure, and entertainment. Companies like Disney and Home Depot have reported significant growth in their revenue and earnings.

Market News

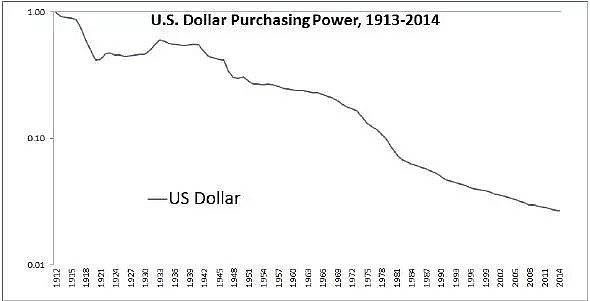

Inflation Concerns: Inflation remains a major concern for investors, with the Consumer Price Index (CPI) showing a slight increase in April. However, the Federal Reserve has indicated that it is committed to maintaining price stability.

Trade Negotiations: Trade negotiations between the US and China have been a source of uncertainty, with both sides working to resolve key issues. A positive outcome could boost market sentiment.

Earnings Reports: The earnings season has been robust, with many companies reporting strong revenue and earnings growth. This has helped to offset concerns about economic slowdown.

Case Studies

Apple: Apple has been a major force in the technology sector, with its iPhone sales and services revenue driving growth. The company's recent expansion into new markets and the introduction of new products have further solidified its position as a market leader.

Johnson & Johnson: Johnson & Johnson has been a standout in the healthcare sector, with its pharmaceutical and consumer health products driving growth. The company's commitment to innovation and its strong brand reputation have contributed to its success.

Conclusion

As we move forward, the US stock market continues to offer a range of opportunities and challenges. Investors should stay informed about key trends, sector performance, and market news to make informed decisions. With the right strategy and a keen understanding of the market dynamics, investors can navigate the complexities of the stock market and achieve their financial goals.

Do I Put All My Investments in US Stocks?? can foreigners buy us stocks