In recent months, the stock market has experienced a significant dive, sending shockwaves through the financial community. This article aims to explore the underlying causes of this market plunge and the implications it holds for investors and the broader economy.

What Triggered the Stock Market Dive?

Several factors have contributed to the stock market dive. Economic uncertainties and geopolitical tensions played a major role. For instance, rising tensions between the US and China have caused investors to worry about global trade and economic stability. Rising inflation and concerns over central bank policies also contributed to the downturn. As the Federal Reserve increased interest rates to combat inflation, investors grew concerned about the potential for a recession.

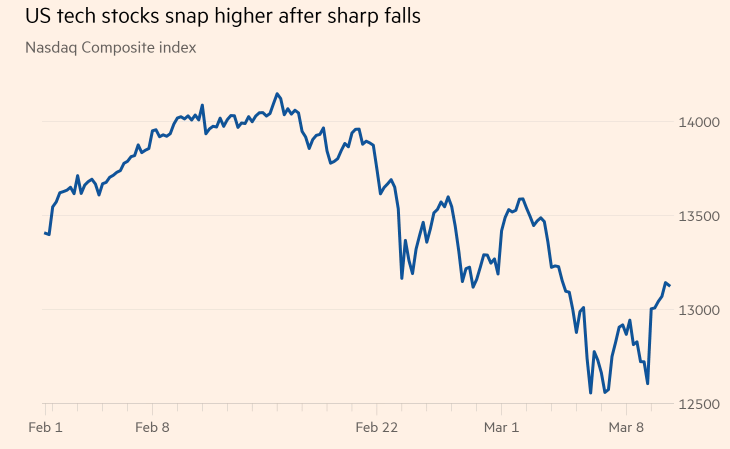

The Role of Technology Stocks

One particular sector that has been hit hard is technology stocks. High-flying tech giants such as Apple, Microsoft, and Amazon have seen their shares plummet. Many investors are questioning whether these stocks have lost their momentum and if they will be able to recover.

Case Study: The Dot-com Bubble Burst

A good case study of a market dive is the dot-com bubble burst of 2000. This event saw the tech sector crash, with many tech stocks losing 90% or more of their value. This was a result of investors becoming overzealous about the potential of tech companies, leading to irrational valuations. As the market realized that these companies were not profitable, shares plummeted.

Impact on Investors and the Economy

The stock market dive has had a significant impact on investors. Retirement portfolios have taken a hit, and many investors are now re-evaluating their investment strategies. Additionally, the broader economy has also been affected. As stock prices fall, consumer confidence tends to decline, leading to reduced spending.

The Importance of Risk Management

In light of the recent stock market dive, the importance of risk management cannot be overstated. Investors should be diversifying their portfolios to minimize exposure to market volatility. This means investing in a mix of assets, including stocks, bonds, and real estate.

The Future Outlook

As for the future, it remains uncertain. While there are concerns about a potential recession, there are also opportunities for investors. As the market adjusts to the new economic realities, some stocks may present buying opportunities.

In conclusion, the stock market dive of recent months has been caused by a combination of economic uncertainties, geopolitical tensions, and investor sentiment. While the market may continue to experience volatility, investors can protect themselves by focusing on risk management and maintaining a diversified portfolio.

US-Made Folding Stock for Norinco: The Perf? can foreigners buy us stocks