In today's fast-paced financial world, staying informed about recent stock prices is crucial for investors and traders. This article delves into the latest trends, factors influencing stock prices, and provides insights into how you can make informed decisions. Whether you're a seasoned investor or just starting out, understanding the dynamics of recent stock prices is essential.

Understanding Recent Stock Prices

Recent stock prices refer to the current market value of a company's shares. This value is determined by the supply and demand dynamics in the stock market. When demand for a stock increases, its price tends to rise, and vice versa. Several factors can influence recent stock prices, including economic indicators, company performance, and market sentiment.

Economic Indicators

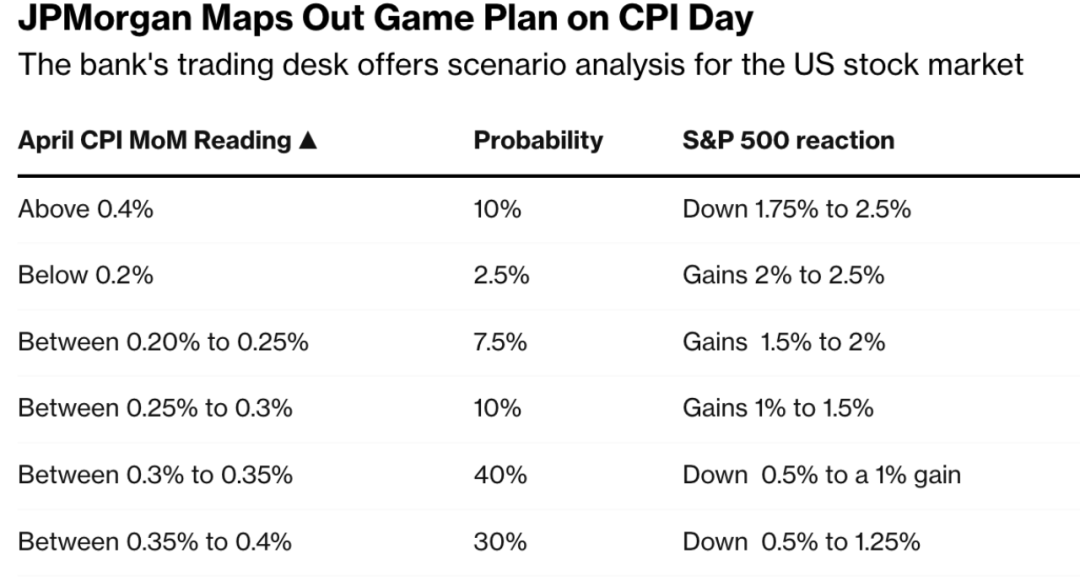

Economic indicators play a significant role in determining recent stock prices. Key indicators include:

Interest Rates: Central banks' decisions on interest rates can impact stock prices. Lower interest rates can lead to increased borrowing and spending, boosting stock prices. Conversely, higher interest rates can dampen economic activity and lead to lower stock prices.

GDP Growth: The Gross Domestic Product (GDP) measures the total value of goods and services produced in a country. Strong GDP growth can indicate a healthy economy, leading to higher stock prices. On the other hand, slow GDP growth can signal economic challenges, causing stock prices to fall.

Unemployment Rates: Lower unemployment rates suggest a robust economy, which can drive stock prices higher. Conversely, higher unemployment rates can indicate economic weakness, leading to lower stock prices.

Company Performance

Company performance is another crucial factor influencing recent stock prices. Key aspects to consider include:

Earnings Reports: Companies release earnings reports quarterly, providing insights into their financial performance. Positive earnings reports can boost stock prices, while negative reports can lead to declines.

Revenue Growth: Consistent revenue growth indicates a company's ability to generate profits and can lead to higher stock prices.

Dividends: Companies that pay dividends can attract investors seeking regular income, potentially increasing stock prices.

Market Sentiment

Market sentiment refers to the overall mood or outlook of investors in the stock market. Factors influencing market sentiment include:

News and Events: Economic news, political events, and other developments can significantly impact market sentiment and, subsequently, stock prices.

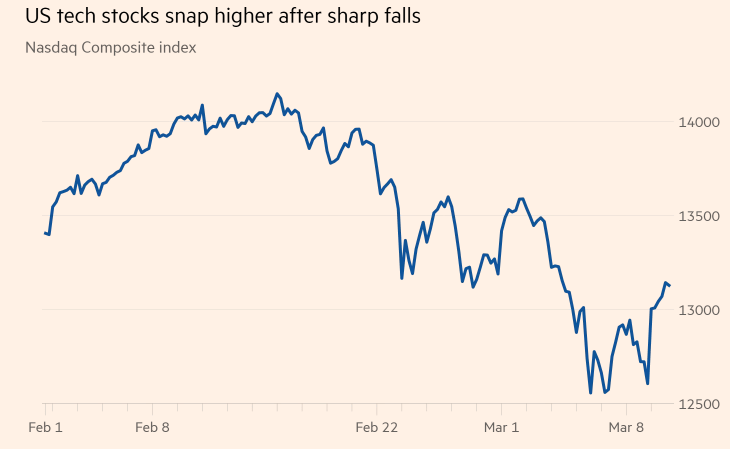

Technological Advancements: Breakthroughs in technology can drive stock prices higher, particularly for companies in the tech sector.

Investor Sentiment: The collective sentiment of investors can lead to market trends. For example, a bull market characterized by optimism can drive stock prices higher, while a bear market characterized by pessimism can lead to declines.

Case Studies

To illustrate the impact of recent stock prices, let's consider two case studies:

Tesla (TSLA): Tesla's stock price skyrocketed after the company reported strong earnings and unveiled new products. The positive sentiment surrounding the electric vehicle market and Tesla's leadership position contributed to the stock's surge.

Amazon (AMZN): Amazon's stock price has experienced significant volatility over the years, influenced by factors such as economic indicators, company performance, and market sentiment. For instance, during the COVID-19 pandemic, the stock price surged as demand for online shopping increased.

Conclusion

Understanding recent stock prices is vital for investors and traders. By analyzing economic indicators, company performance, and market sentiment, you can make informed decisions and navigate the complexities of the stock market. Stay informed and keep an eye on recent stock prices to stay ahead of the curve.

August 26, 2025: US Stock Market Performanc? can foreigners buy us stocks