As the holiday season approaches, investors are often on the lookout for signs of market stability and growth. This year, the major US stock indexes have delivered a strong finish ahead of Christmas, signaling optimism for the upcoming year. In this article, we'll delve into the factors contributing to this positive trend and analyze the potential implications for investors.

Market Performance

The S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite all closed higher in the final trading sessions before Christmas. The S&P 500, which is a broad measure of the US stock market, saw a gain of 2.5% over the past month. The Dow Jones Industrial Average, which tracks the performance of 30 large companies, rose by 2.8%. The NASDAQ Composite, which includes technology stocks, saw a 3.1% increase.

Factors Contributing to the Rise

Several factors have contributed to the upward trend in the stock market. One of the primary drivers has been strong corporate earnings reports. Many companies have reported higher profits and revenue, which has boosted investor confidence. Additionally, the Federal Reserve's decision to keep interest rates unchanged has provided a supportive environment for stocks.

Economic Outlook

The positive economic outlook has also played a significant role in the stock market's performance. The US economy has shown signs of strength, with low unemployment rates and steady economic growth. This has led to increased consumer spending and business investment, which has positively impacted corporate earnings.

Sector Performance

Different sectors within the stock market have performed differently. Technology stocks, particularly those in the semiconductor and software industries, have seen significant gains. This can be attributed to the strong demand for technology products and services, as well as the ongoing digital transformation across various industries.

On the other hand, energy stocks have faced challenges due to the decline in oil prices. This has been a concern for investors, as energy companies often face lower profits when oil prices are low.

Case Studies

To illustrate the impact of the stock market's performance, let's consider two case studies:

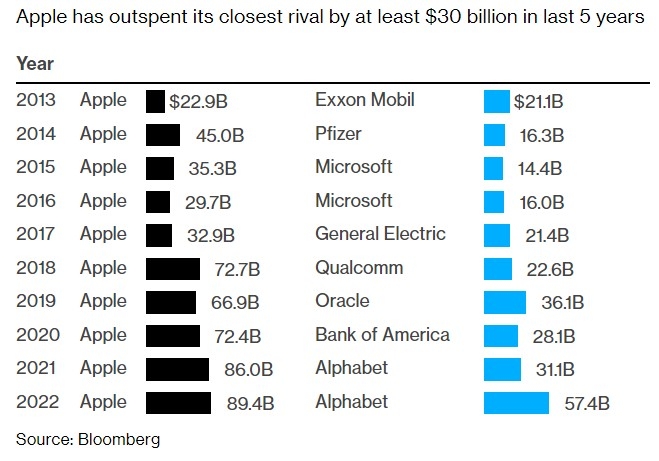

Apple Inc.: Apple, one of the largest companies in the world, has seen its stock price rise significantly over the past year. This can be attributed to strong sales of its iPhone and other products, as well as the company's expansion into new markets and services.

Tesla Inc.: Tesla, a leader in the electric vehicle market, has seen its stock price soar in recent months. This can be attributed to the company's strong sales and the growing demand for electric vehicles.

Conclusion

The strong performance of the major US stock indexes ahead of Christmas is a positive sign for investors. With strong corporate earnings, a positive economic outlook, and a supportive Federal Reserve, the stock market appears poised for continued growth in the coming year. However, it's important for investors to remain cautious and stay informed about market trends and economic indicators.

2025 US Stock Market Outlook Forecast: What? can foreigners buy us stocks