The stock market crash of 2020 has been a topic of intense debate and analysis. Many investors and market experts have been asking, "Did the stock market crash?" In this article, we delve into the factors that led to the crash, its impact on the global economy, and the lessons learned.

The 2020 Stock Market Crash: What Caused It?

The 2020 stock market crash was primarily caused by the COVID-19 pandemic. The outbreak of the virus led to a global lockdown, disrupting supply chains and causing widespread economic uncertainty. This uncertainty triggered a massive sell-off in stocks, leading to the crash.

Economic Impact of the Stock Market Crash

The crash had a significant impact on the global economy. Many companies saw their stock prices plummet, leading to massive job losses and a decrease in consumer spending. The crash also led to a decrease in investor confidence, making it difficult for businesses to raise capital.

Key Factors Contributing to the Stock Market Crash

Several key factors contributed to the 2020 stock market crash:

- COVID-19 Pandemic: The outbreak of the virus led to a global lockdown, disrupting supply chains and causing widespread economic uncertainty.

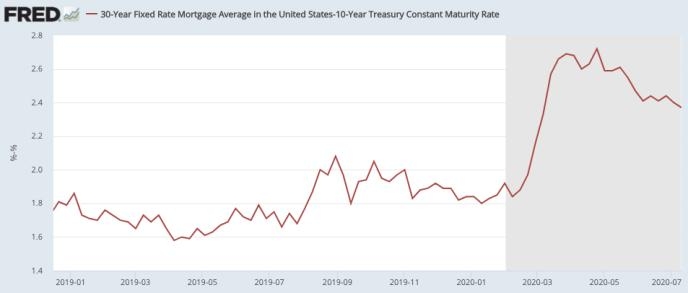

- Economic Policy: The Federal Reserve's decision to cut interest rates to near-zero and implement quantitative easing measures helped stabilize the market.

- Technological Advancements: The rise of technology played a crucial role in the stock market crash. Many investors turned to technology to trade stocks, leading to rapid trading and volatility.

Lessons Learned from the Stock Market Crash

The 2020 stock market crash taught us several important lessons:

- The Importance of Diversification: Diversifying investments can help mitigate the impact of market crashes.

- The Role of Economic Policy: Economic policies, such as interest rate cuts and quantitative easing, can help stabilize the market during times of crisis.

- The Power of Technology: Technology can play a significant role in the stock market, both positively and negatively.

Case Study: The Impact of the Stock Market Crash on Tech Giants

One of the most notable impacts of the stock market crash was on tech giants like Apple, Amazon, and Google. These companies saw their stock prices plummet during the crash. However, they were able to recover quickly due to their strong fundamentals and resilient business models.

Conclusion

The 2020 stock market crash was a wake-up call for investors and market experts. It highlighted the importance of diversification, the role of economic policy, and the power of technology. While the crash caused significant economic uncertainty, it also provided valuable lessons for the future.

Title: DeepSeek AI: Revolutionizing the US ? can foreigners buy us stocks