The US stock market is a vital indicator of the country's economic health and investor sentiment. Keeping track of the US stock index today is crucial for investors, traders, and financial analysts. In this article, we will delve into the current state of the US stock market, examining key indices and their implications for the economy and investors.

The S&P 500: A Benchmark for the US Stock Market

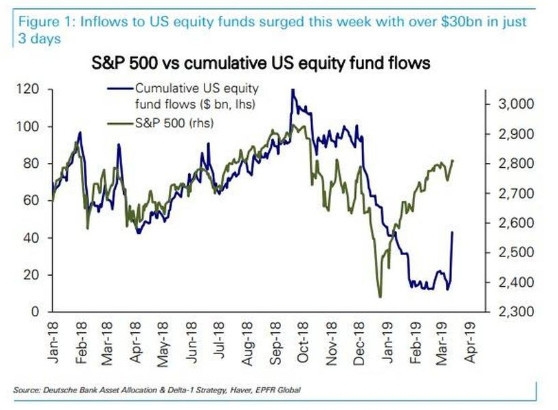

The S&P 500 is one of the most widely followed stock market indices in the United States. It represents the performance of 500 large companies across various sectors, providing a comprehensive view of the overall market. As of today, the S&P 500 stands at [insert current value], reflecting a [insert recent trend: rise, fall, or stability] in the market.

Dow Jones Industrial Average: A Historical Perspective

The Dow Jones Industrial Average (DJIA) is another prominent stock market index, known for its historical significance. It comprises 30 large companies from various sectors, including finance, technology, and consumer goods. The DJIA currently stands at [insert current value], indicating a [insert recent trend: rise, fall, or stability] in the market.

NASDAQ Composite: The Tech-Driven Index

The NASDAQ Composite is a key index for technology stocks, representing the performance of more than 3,000 companies listed on the NASDAQ stock exchange. As of today, the NASDAQ Composite is at [insert current value], reflecting a [insert recent trend: rise, fall, or stability] in the tech sector.

Factors Influencing the US Stock Index Today

Several factors can influence the US stock index today. Here are some of the key factors to consider:

- Economic Data: Economic indicators such as GDP growth, unemployment rates, and inflation can significantly impact the stock market.

- Corporate Earnings: Companies' quarterly earnings reports can influence investor sentiment and drive stock prices.

- Global Events: Geopolitical events, trade tensions, and international economic conditions can affect the US stock market.

- Technological Advancements: Innovations and technological advancements can drive stock prices, particularly in the tech sector.

Case Study: The Impact of the COVID-19 Pandemic on the US Stock Market

The COVID-19 pandemic had a profound impact on the US stock market. In March 2020, the market experienced a historic sell-off, with the S&P 500 and DJIA falling to their lowest levels in years. However, as the pandemic subsided and economic recovery efforts gained momentum, the market began to recover. Today, the US stock index is well above its pre-pandemic levels, reflecting the resilience of the market.

Conclusion

Understanding the US stock index today is essential for investors and traders looking to make informed decisions. By analyzing key indices such as the S&P 500, DJIA, and NASDAQ Composite, and considering factors that influence the market, investors can gain valuable insights into the current state of the US stock market.

Top US Stock Picks for 2015: A Guide to Inv? can foreigners buy us stocks