In the ever-evolving world of finance, staying ahead of the curve is crucial. One stock that has been generating a lot of buzz is Airr-US. This article aims to provide a comprehensive guide to understanding the potential of Airr-US stock, its market performance, and what investors should consider before making any decisions.

What is Airr-US?

Airr-US is a publicly-traded company specializing in the aerospace and defense industry. The company focuses on providing innovative solutions for the aviation industry, including aircraft maintenance, repair, and operations (MRO) services. With a strong presence in the United States and expanding globally, Airr-US has become a key player in the aerospace sector.

Market Performance

In recent years, Airr-US has seen impressive growth, with its stock price reflecting the company's success. The stock has been on a steady upward trend, attracting the attention of both retail and institutional investors. This growth can be attributed to several factors:

- Strong Earnings: Airr-US has consistently reported robust earnings, demonstrating the company's profitability and stability.

- Expansion: The company has been actively expanding its operations, both domestically and internationally, which has helped drive revenue growth.

- Innovation: Airr-US is known for its innovative approach to solving complex problems in the aerospace industry, which has given it a competitive edge.

What to Consider Before Investing

While Airr-US stock may seem like an attractive investment opportunity, there are several factors to consider:

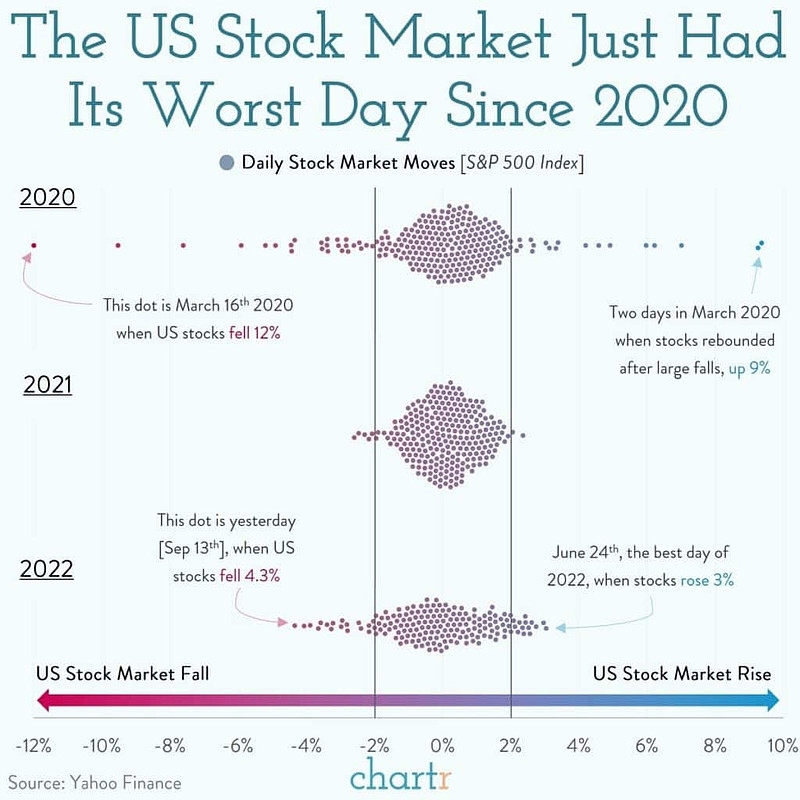

- Market Volatility: The aerospace and defense industry is subject to market volatility, which can impact the stock price.

- Regulatory Risks: The industry is heavily regulated, and changes in government policies can affect the company's operations.

- Competition: The aerospace industry is highly competitive, and Airr-US must constantly innovate to maintain its market position.

Case Studies

To better understand the potential of Airr-US stock, let's look at a few case studies:

- Expansion in Europe: Airr-US recently expanded its operations in Europe, opening a new facility in Germany. This move has helped the company tap into a growing market and has contributed to its revenue growth.

- Innovation in MRO Services: Airr-US developed a new MRO service that has significantly reduced turnaround times for aircraft maintenance. This innovation has helped the company attract new clients and improve customer satisfaction.

Conclusion

Airr-US stock presents a compelling investment opportunity for those looking to invest in the aerospace and defense industry. However, it is essential to conduct thorough research and consider the risks before making any investment decisions. With its strong market performance and potential for future growth, Airr-US could be a valuable addition to any investor's portfolio.

Et Us Stock: The Ultimate Guide to Stock Ma? can foreigners buy us stocks