In the ever-evolving world of finance, finding the best stock to invest in can be a daunting task. With countless options available, it's crucial to conduct thorough research and stay informed about market trends. This article aims to provide you with a comprehensive guide to identify the best stock in the US to buy. By understanding key factors and utilizing effective strategies, you can make informed decisions that could potentially yield significant returns.

Understanding the Market

Before diving into specific stocks, it's essential to have a basic understanding of the market. The US stock market is one of the largest and most influential in the world, with numerous exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list thousands of companies across various industries, making it challenging to pinpoint the best stock to buy.

Key Factors to Consider

When evaluating potential investments, several key factors should be taken into account:

Financial Health: Analyze a company's financial statements, including its income statement, balance sheet, and cash flow statement. Look for consistent revenue growth, positive earnings, and a strong balance sheet.

Industry Position: Consider the company's position within its industry. Look for companies with a strong competitive advantage, such as a unique product or service, a loyal customer base, or a dominant market share.

Management Team: Assess the quality of the company's management team. Look for experienced leaders with a proven track record of success.

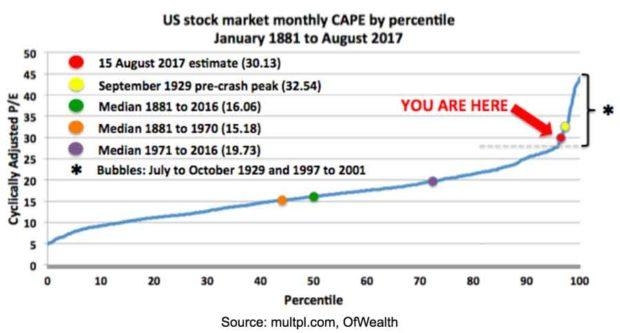

Valuation: Evaluate the company's valuation by comparing its price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and other metrics to its peers and industry averages.

Growth Prospects: Consider the company's future growth prospects, including its revenue growth rate, earnings growth rate, and potential for expansion into new markets.

Top Stocks to Consider

Based on the above factors, here are some top stocks to consider for investment:

Apple Inc. (AAPL): As the world's largest technology company, Apple has a strong financial health, a dominant market position, and a loyal customer base. Its growth prospects remain robust, with a significant presence in the smartphone, computer, and services markets.

Amazon.com Inc. (AMZN): Amazon is a leader in the e-commerce industry, with a vast product selection and a strong competitive advantage. The company has also expanded into cloud computing, streaming, and other areas, further enhancing its growth prospects.

Microsoft Corporation (MSFT): Microsoft is a dominant player in the software industry, with a diverse portfolio of products and services, including Windows, Office, and Azure. The company has a strong financial health and a loyal customer base, with significant growth prospects in cloud computing and other areas.

Tesla, Inc. (TSLA): Tesla is a leader in the electric vehicle (EV) market, with a strong brand and innovative technology. The company has a significant market share and is expanding into new markets, including battery energy storage and solar energy.

Facebook, Inc. (FB): Facebook is a leader in the social media industry, with a vast user base and a strong advertising platform. The company has a significant market share and is exploring new areas, such as virtual reality and augmented reality.

Conclusion

Investing in the stock market requires thorough research and a clear understanding of the key factors to consider. By focusing on financial health, industry position, management team, valuation, and growth prospects, you can identify the best stock in the US to buy. Remember to stay informed about market trends and adjust your portfolio accordingly. With the right approach, investing in the stock market can be a rewarding experience.

Top US Stock Losers: Understanding the Mark? can foreigners buy us stocks