In the world of finance, stocks and share prices are fundamental concepts that every investor should grasp. Whether you're a seasoned trader or just starting out, understanding how stocks and share prices work is crucial for making informed investment decisions. This article delves into the basics of stocks and share prices, providing you with a comprehensive guide to help you navigate the stock market.

What are Stocks?

Stocks represent ownership in a company. When you purchase a stock, you become a shareholder, owning a portion of that company. This ownership can come in various forms, such as common or preferred stocks. Common stocks typically offer voting rights, while preferred stocks provide fixed dividends and priority in receiving assets in case of liquidation.

Share Prices: The Key Indicator

The share price of a stock is the current market value of a single share. It is determined by the supply and demand for that stock, influenced by various factors such as the company's financial performance, industry trends, and economic conditions.

Factors Affecting Share Prices

Several factors can impact share prices, including:

- Company Performance: Strong financial results, such as high revenue and profit margins, can drive up share prices, while poor performance can lead to a decline.

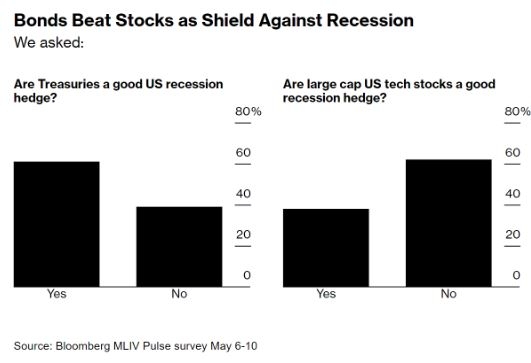

- Economic Conditions: Economic factors like inflation, interest rates, and GDP growth can influence share prices.

- Market Sentiment: The overall mood of investors can impact share prices. For example, during a bull market, investors may be optimistic, leading to higher share prices, while a bear market can result in lower prices.

- Industry Trends: Changes in the industry, such as technological advancements or regulatory changes, can affect share prices.

Understanding the Stock Market

The stock market is a complex system where shares are bought and sold. Investors can purchase stocks through a brokerage account, and the price at which they buy or sell is determined by the current market price.

Types of Stock Orders

When trading stocks, investors can place various types of orders, including:

- Market Order: This order executes at the current market price.

- Limit Order: This order allows investors to specify a maximum or minimum price at which they are willing to buy or sell a stock.

- Stop Order: This order triggers a buy or sell order when the stock reaches a certain price.

Analyzing Share Prices

To make informed investment decisions, investors should analyze share prices using various tools and techniques, such as:

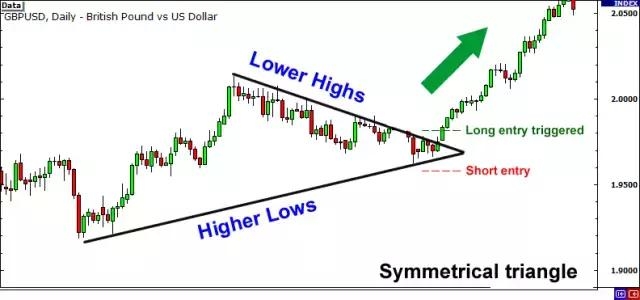

- Technical Analysis: This involves studying historical price and volume data to identify patterns and trends.

- Fundamental Analysis: This involves analyzing a company's financial statements, industry position, and management team to assess its intrinsic value.

Case Study: Apple Inc.

A prime example of how share prices can fluctuate is Apple Inc. (AAPL). In 2012, the company's share price was around

Conclusion

Understanding stocks and share prices is essential for anyone looking to invest in the stock market. By familiarizing yourself with the basics and staying informed about market trends and company performance, you can make more informed investment decisions and potentially achieve financial success.

US Bioservices Stock: A Comprehensive Analy? us stock market today live cha