Are you tired of the rollercoaster ride that is the stock market? Are you looking for a way to gain a competitive edge in the world of investing? If so, understanding stocks momentum is essential. This article will delve into what stocks momentum is, why it's important, and how you can use it to your advantage in the US market.

What is Stocks Momentum?

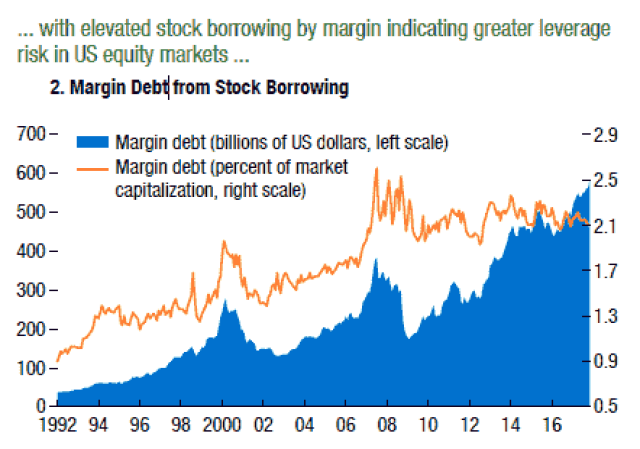

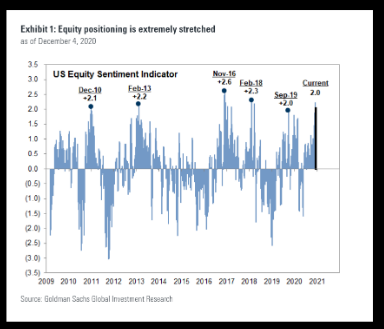

Momentum investing is a popular strategy among traders and investors. It involves buying stocks that have shown a significant increase in price and continuing to hold them as long as the upward trend persists. Conversely, momentum investing also involves selling stocks that have shown a significant decrease in price, with the hope that the downward trend will continue.

The momentum indicator is a tool used by investors to determine whether a stock is moving up or down in a strong, sustained manner. One of the most common momentum indicators is the Relative Strength Index (RSI), which measures the speed and change of price movements.

Why is Stocks Momentum Important?

Understanding stocks momentum can provide investors with several advantages:

- Risk Management: By focusing on stocks with strong momentum, investors can reduce the risk of buying a stock that is likely to fall in price.

- Performance: Historically, stocks with strong momentum have outperformed those with no momentum.

- Efficiency: Momentum investing allows investors to focus on a smaller number of stocks, which can save time and effort.

How to Use Stocks Momentum to Your Advantage

Here's how you can use stocks momentum to your advantage in the US market:

- Research Stocks: Start by researching stocks that have shown a significant increase in price over a certain period. Look for companies with a strong financial foundation and positive growth prospects.

- Analyze Momentum Indicators: Use momentum indicators, such as the RSI, to confirm whether the stock is moving up or down in a strong, sustained manner.

- Monitor the Trend: Once you've identified a stock with strong momentum, monitor the trend closely. If the upward trend continues, consider holding the stock. If the downward trend starts, consider selling or reducing your position.

- Be Patient: Don't be afraid to take your time. It's essential to be patient and wait for the right opportunities to arise.

Case Studies

Let's look at a few real-life examples of stocks with strong momentum:

- Tesla (TSLA): Tesla has been one of the most talked-about companies in recent years. Its strong momentum can be attributed to its innovative electric vehicles and strong financial performance.

- Apple (AAPL): Apple has consistently shown strong momentum over the years, driven by its strong brand and continuous innovation in technology.

- NVIDIA (NVDA): NVIDIA has been a leader in the semiconductor industry, and its stock has seen strong momentum due to its cutting-edge technology and partnerships with leading companies.

In conclusion, understanding stocks momentum is essential for profitable investing in the US market. By researching, analyzing momentum indicators, and monitoring the trend, you can identify and capitalize on stocks with strong momentum. Don't forget to be patient and stay focused on your investment strategy.

Stock Market Surge: The Impact of the US-Ch? us stock market today live cha