In the ever-evolving landscape of financial markets, the question of whether the US stock market is overpriced has become a hot topic among investors and financial analysts alike. With the market hitting new highs seemingly every day, it's natural to wonder if this upward trend is sustainable or if investors are overpaying for stocks. In this article, we will delve into the factors contributing to the current market conditions, analyze various valuation metrics, and provide insights into the potential risks and opportunities ahead.

Market Trends and Historical Comparisons

To determine whether the US stock market is overpriced, it's crucial to look at historical data and compare current market valuations with past performance. The Shiller P/E ratio, also known as the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, is a popular metric that measures the market's price relative to average earnings over the past 10 years. As of this writing, the CAPE ratio stands at around 32, which is above its long-term average of 16.5. This suggests that the market may be overvalued, especially considering that it has already appreciated significantly over the past few years.

Another metric to consider is the Q Ratio, which compares the total market value of stocks to the total value of all businesses. As of the latest data, the Q Ratio is above 1.0, indicating that the stock market is overvalued relative to the broader economy.

Economic Factors and Inflation Concerns

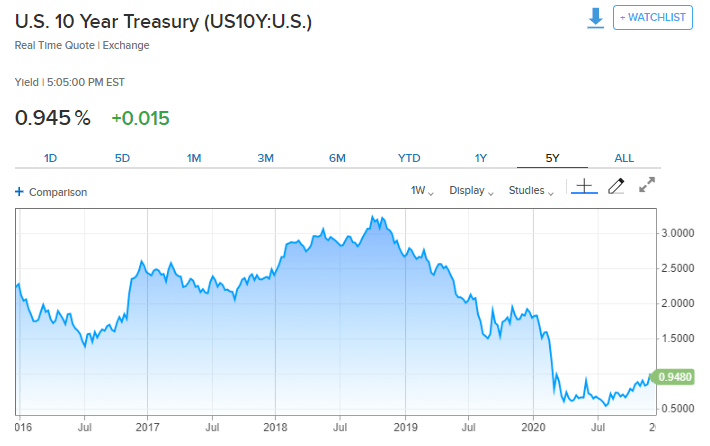

Several economic factors are contributing to the current market conditions. The Federal Reserve's monetary policy, including interest rates and quantitative easing, has played a significant role in driving stock prices higher. As the economy recovers from the COVID-19 pandemic, companies have been able to report strong earnings, fueling investor optimism.

However, some experts are concerned about the potential for inflation and the impact it could have on the stock market. As the economy heats up, there is a risk that inflation could rise faster than expected, leading to higher interest rates and potentially dampening stock prices.

Sector Analysis and Stock Picking

While the overall market may be overvalued, it's essential to remember that individual stocks can still offer attractive opportunities. In this section, we will take a closer look at several sectors and highlight some potential winners and losers.

Technology Stocks

The technology sector has been a significant driver of the stock market's rally, with companies like Apple, Microsoft, and Amazon leading the charge. However, some experts argue that these stocks are overvalued, given their current price-to-earnings ratios and market capitalizations.

Healthcare Stocks

The healthcare sector has also performed well, with companies benefiting from the ongoing shift towards telemedicine and increased spending on medical research. Johnson & Johnson, Merck, and Amgen are some of the leading healthcare stocks that investors may want to consider.

Value Stocks

On the other hand, value stocks have struggled to keep pace with growth stocks. Investors looking for undervalued opportunities may want to consider sectors like financials, consumer staples, and real estate.

Conclusion

In conclusion, while the US stock market may be overpriced at this point in time, there are still opportunities for investors to find value in individual stocks and sectors. It's essential to conduct thorough research and consider various factors, including market valuations, economic conditions, and individual company fundamentals, before making investment decisions. As always, it's crucial to consult with a financial advisor to ensure that your investment strategy aligns with your goals and risk tolerance.

Islamic Stock Market in the US: A Growing I? us stock market today live cha