The stock market has always been a volatile place, and the recent downturn has left many investors questioning how much has the US stock market lost. In this article, we'll delve into the specifics of the losses and analyze the factors that have contributed to this decline.

Understanding the Scale of Losses

As of the latest data, the US stock market has experienced significant losses. The S&P 500, a widely followed index that tracks the performance of 500 large companies, has seen its value plummet by approximately 20% since the start of the year. This represents a loss of over $5 trillion in market capitalization.

Factors Contributing to the Decline

Several factors have contributed to the recent downturn in the US stock market. Here are some of the key reasons:

- COVID-19 Pandemic: The ongoing COVID-19 pandemic has had a profound impact on the global economy, leading to widespread job losses, business closures, and a general sense of uncertainty. This has resulted in a decrease in consumer spending and corporate earnings, which in turn has affected stock prices.

- Economic Uncertainty: The economic outlook remains uncertain, with concerns about the pace of economic recovery and the potential for a second wave of the pandemic. This uncertainty has made investors cautious and led to a sell-off in the stock market.

- Political Factors: The ongoing political tensions in the US have also contributed to the market's volatility. Issues such as the impeachment trial of former President Trump and the upcoming presidential election have created a climate of uncertainty and risk.

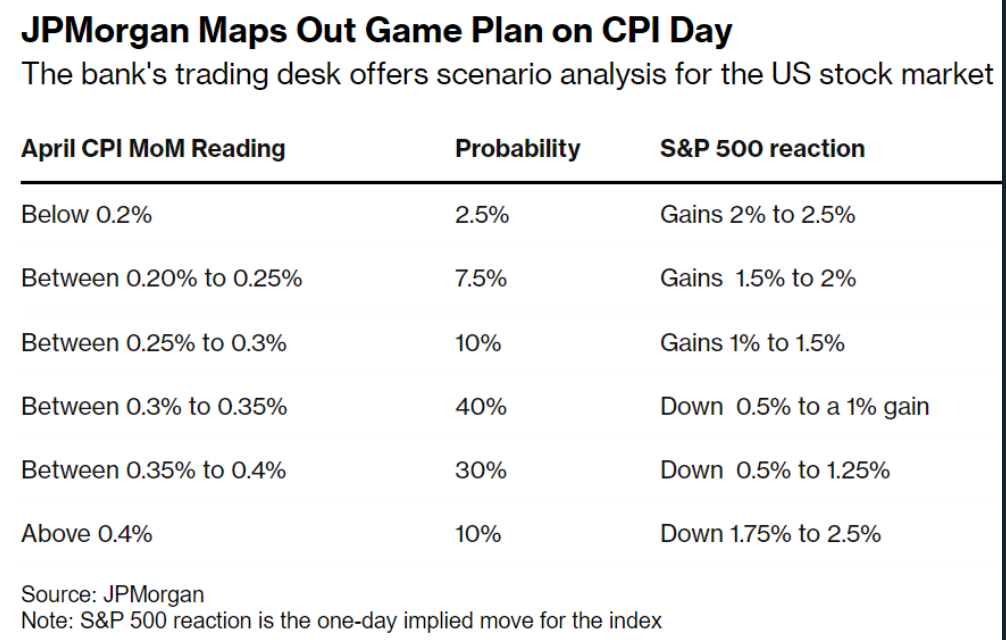

- Interest Rate Hikes: The Federal Reserve has been raising interest rates in an effort to control inflation. While this is a positive sign for the economy, it can also have a negative impact on stock prices, as higher interest rates can make borrowing more expensive and reduce the value of fixed-income investments.

Case Studies

To better understand the impact of the recent downturn, let's look at a few case studies:

- Tesla: The electric vehicle manufacturer saw its stock price fall by over 30% in the first few months of the year. This was largely due to concerns about the company's ability to meet production targets and the overall economic outlook.

- Amazon: The online retail giant saw its stock price fall by nearly 20% in the same period. This was partly due to the company's decision to reduce its workforce and partly due to concerns about the impact of the pandemic on consumer spending.

- Facebook: The social media giant saw its stock price fall by over 15% in the first few months of the year. This was largely due to concerns about the company's data privacy practices and the potential for regulatory action.

Conclusion

The US stock market has experienced significant losses in recent months, with the S&P 500 falling by approximately 20%. This decline has been driven by a combination of factors, including the COVID-19 pandemic, economic uncertainty, political tensions, and interest rate hikes. While the market is expected to recover in the long term, investors should remain cautious and be prepared for continued volatility.

Kuvera Invest in US Stocks: A Strategic App? us stock market today live cha