In the ever-evolving world of finance, the stock market has always been a pivotal indicator of economic trends and investor sentiment. The year 2017 was no exception, as it saw significant fluctuations and pivotal moments in the stock market. This article delves into the 2017 stock market chart, providing a comprehensive analysis of its key trends, market movements, and notable events.

Introduction to the 2017 Stock Market Chart

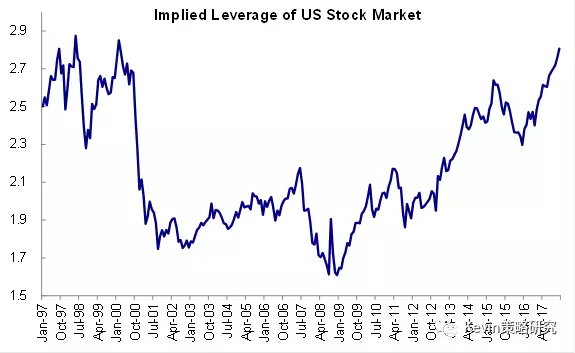

The 2017 stock market chart showcases a year marked by robust growth and optimism. The S&P 500, a widely followed index representing the top 500 companies in the United States, reached an all-time high in early 2018, reflecting a strong recovery from the 2008 financial crisis. This article will explore the various factors contributing to this growth, including economic indicators, corporate earnings, and investor sentiment.

Economic Indicators and Market Growth

In 2017, the United States experienced a period of strong economic growth, with low unemployment rates and rising consumer spending. These factors played a crucial role in driving the stock market's upward trajectory. The Federal Reserve raised interest rates three times during the year, reflecting the improving economic conditions.

Key Economic Indicators:

- GDP Growth: The U.S. GDP grew at an annualized rate of 2.3% in 2017, marking a significant increase from the previous year.

- Unemployment Rate: The unemployment rate fell to 4.1%, the lowest level since 2000.

- Consumer Spending: Consumer spending increased by 3.2%, driven by rising incomes and confidence in the economy.

These positive economic indicators provided a strong foundation for the stock market's growth in 2017.

Corporate Earnings and Stock Performance

Corporate earnings played a crucial role in the stock market's performance in 2017. Many companies reported strong earnings growth, driven by factors such as increased revenue, cost-cutting measures, and improved efficiency. This led to a surge in stock prices, particularly for companies in the technology, healthcare, and financial sectors.

Notable Stock Performances:

- Technology Sector: Companies like Apple, Microsoft, and Amazon saw significant growth in their stock prices, driven by strong earnings and innovation.

- Healthcare Sector: Biotech companies like Amgen and Gilead Sciences experienced substantial gains, thanks to their groundbreaking research and development.

- Financial Sector: Banks and financial institutions, such as JPMorgan Chase and Bank of America, saw improved earnings due to higher interest rates and increased lending activity.

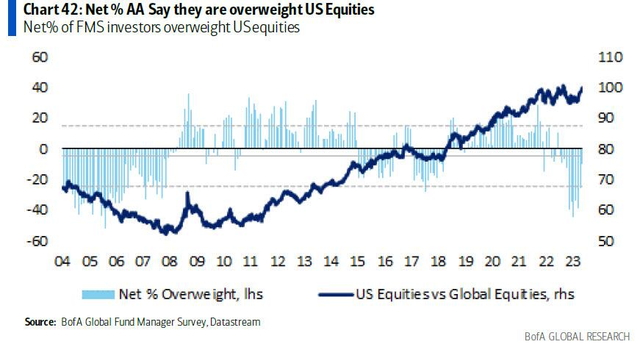

Investor Sentiment and Market Trends

Investor sentiment played a significant role in shaping the stock market's performance in 2017. The market was driven by optimism and a belief in the strength of the U.S. economy. This sentiment was further bolstered by the election of Donald Trump as President, who promised tax cuts and regulatory reforms.

Key Market Trends:

- Rally in Small-Cap Stocks: Small-cap stocks outperformed large-cap stocks in 2017, driven by investor optimism and a belief in the potential for growth.

- Rise in Volatility: While the overall market trend was upward, there were periods of increased volatility, particularly in the final months of the year.

Conclusion

The 2017 stock market chart reflects a year of robust growth and optimism. Driven by strong economic indicators, corporate earnings, and investor sentiment, the stock market experienced significant gains. While the market faced challenges, such as increased volatility, the overall trend was positive. Understanding the factors that influenced the stock market in 2017 can provide valuable insights for investors looking to navigate the markets in the years to come.

Today's US Stock Futures: Key Insights? us stock market today live cha