As the world watches closely, the ongoing China-US trade talks have become a pivotal topic for investors. The talks, which have seen their share of ups and downs, have left many investors questioning where to put their money. This article aims to guide you through the potential stocks to buy amidst the ongoing China-US trade negotiations.

Understanding the China-US Trade Talks

The trade negotiations between China and the United States have been a topic of great concern for global markets. These talks, which began in 2018, have been characterized by tensions and uncertainty. Despite the setbacks, there is still hope for a resolution that could significantly impact the global economy.

Identifying Potential Stocks to Buy

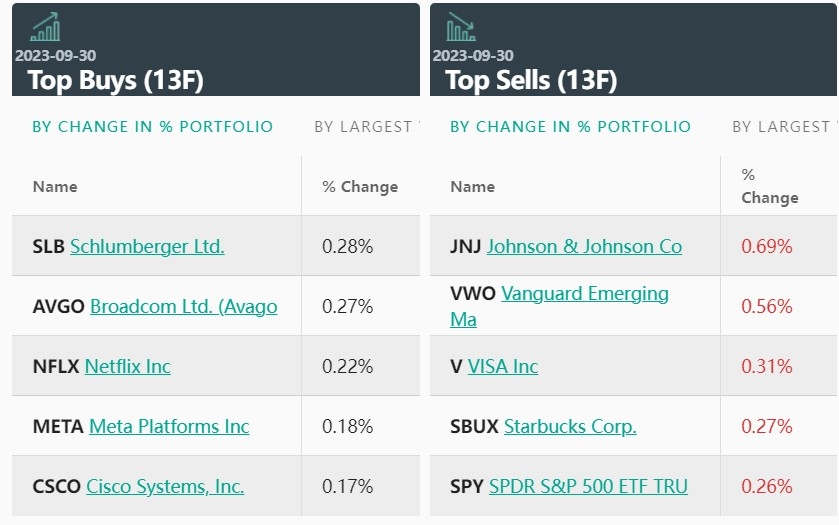

Given the volatile nature of the China-US trade talks, it is crucial to identify stocks that can withstand potential market fluctuations. Here are some potential picks:

1. Technology Stocks

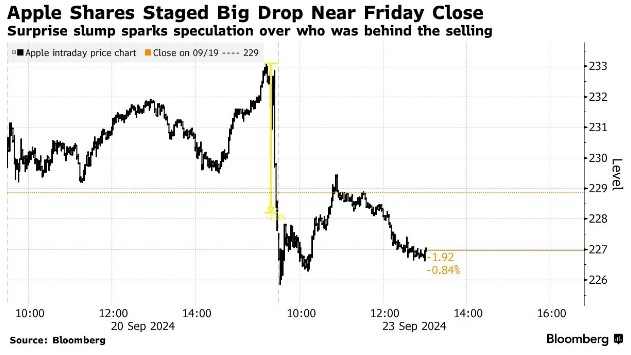

Technology stocks have emerged as a safe bet amidst the trade tensions. Companies like Apple Inc. (AAPL) and Microsoft Corporation (MSFT) have a significant presence in both the Chinese and US markets. Despite the trade tensions, these companies have shown resilience and continue to grow their market share.

2. Consumer Goods Companies

Consumer goods companies like Procter & Gamble Co. (PG) and Coca-Cola Co. (KO) have a strong presence in both China and the US. These companies have demonstrated the ability to adapt to changing market conditions and maintain their profitability.

3. Agricultural Stocks

Agricultural stocks could benefit from any potential trade deal between China and the US. Companies like Monsanto Company (MON) and Deere & Company (DE) have a significant stake in the agricultural sector and could see a boost if trade barriers are lifted.

4. Financial Stocks

Financial stocks, such as Bank of America Corporation (BAC) and JPMorgan Chase & Co. (JPM), have a strong presence in both the Chinese and US markets. These companies could benefit from increased trade activity and a potential easing of trade tensions.

Case Studies

Apple Inc. (AAPL): Despite the trade tensions, Apple has managed to maintain its market share in China. The company has also been diversifying its supply chain, reducing its reliance on Chinese manufacturers.

Coca-Cola Co. (KO): Coca-Cola has a strong presence in China, with over 40 bottling partners across the country. The company has been successful in adapting its product offerings to cater to the preferences of Chinese consumers.

Conclusion

The China-US trade talks have created a volatile environment for investors. However, by identifying potential stocks that can withstand market fluctuations, investors can navigate this uncertain landscape. As the talks continue, it is crucial to stay informed and adapt your investment strategy accordingly.

Trading Stocks Outside the US: A Comprehens? us stock market today