Are you contemplating whether to invest in US oil stocks? With the ever-evolving energy sector, making the right decision can be challenging. In this article, we'll explore the factors you should consider before making your decision. So, let's dive in and find out if buying US oil stock is the right move for you.

Understanding the US Oil Market

The US oil market is one of the most significant in the world, with a vast array of companies operating in the industry. These companies range from large, established players like ExxonMobil and Chevron to smaller, niche companies specializing in specific aspects of the oil industry.

Factors to Consider Before Investing in US Oil Stocks

Economic Stability: The stability of the global economy plays a crucial role in the oil market. When the economy is strong, demand for oil tends to increase, driving up prices. Conversely, during economic downturns, oil demand may decrease, leading to lower prices. It's essential to assess the current economic climate and its potential impact on the oil market.

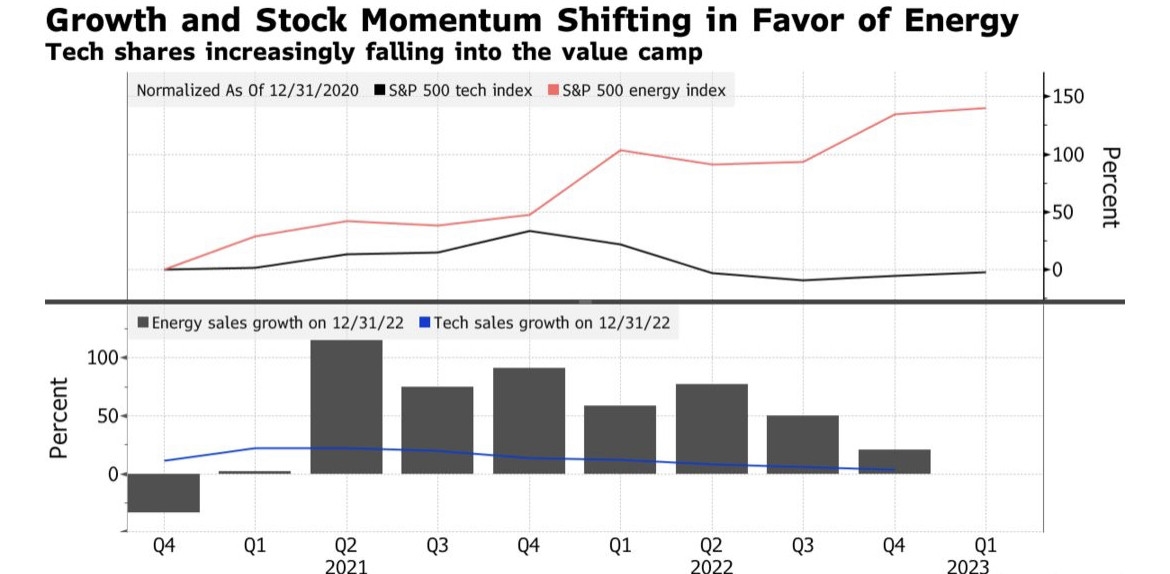

Supply and Demand: The balance between oil supply and demand is a critical factor in determining stock prices. If supply exceeds demand, prices may plummet, affecting the profitability of oil companies. Conversely, if demand outpaces supply, prices can soar, benefiting oil stocks. Keep an eye on global oil production and consumption trends.

Technological Advancements: The oil industry is constantly evolving, with new technologies emerging that can improve efficiency and reduce costs. Companies that invest in these technologies may enjoy a competitive edge and better financial performance. Stay informed about the latest advancements in the industry.

Regulatory Environment: The regulatory landscape can significantly impact the oil industry. Stricter environmental regulations or geopolitical tensions can lead to higher costs and reduced profitability for oil companies. It's essential to understand the regulatory environment and its potential impact on your investment.

Company Financials: Before investing in a particular oil stock, analyze the company's financials, including revenue, profit margins, and debt levels. Look for companies with strong financials and a solid track record of performance.

Dividends: Some oil companies offer dividends, providing investors with a steady income stream. Consider whether dividends are an important factor in your investment strategy.

Case Studies

To illustrate the potential of investing in US oil stocks, let's look at two case studies:

ExxonMobil: As one of the largest oil companies in the world, ExxonMobil has a long history of strong financial performance. Despite facing challenges from geopolitical tensions and environmental concerns, the company has consistently generated significant revenue and dividends for its shareholders.

EOG Resources: EOG Resources is a smaller, niche oil company specializing in unconventional resources like shale oil and gas. By focusing on these high-growth areas, EOG has achieved impressive financial results, making it an attractive investment for those looking to capitalize on the potential of the oil industry.

Conclusion

Investing in US oil stocks can be a lucrative opportunity, but it's essential to conduct thorough research and consider various factors before making your decision. By understanding the market dynamics, assessing company financials, and staying informed about the latest industry trends, you can make a more informed investment choice. Remember, investing in the oil industry comes with its risks, so proceed with caution and consult with a financial advisor if needed.

US Market Stock Recommendations: Top Picks ? us stock market today