In the fast-paced world of the US stock market, momentum stocks have always been a key focus for investors seeking rapid growth and substantial returns. These stocks, characterized by their rapid price increases, often attract the attention of traders and investors looking to capitalize on short-term market trends. This article delves into the world of momentum stocks, highlighting the top weekly gainers in the US market and providing insights into what drives their success.

Understanding Momentum Stocks

Momentum stocks are typically companies that have seen a significant increase in their share price over a short period. This upward trend is often fueled by strong earnings reports, positive news, or market speculation. Investors who buy these stocks are betting that the upward trend will continue, allowing them to profit from the price increase.

Top Weekly Gainers

Each week, the US market sees a variety of momentum stocks rise to the top. Here are some of the recent weekly gainers:

Tesla, Inc. (TSLA): As the world's leading electric vehicle manufacturer, Tesla has consistently been a top performer in the momentum stock category. Its recent earnings report, which showed strong sales and profitability, further solidified its position as a market leader.

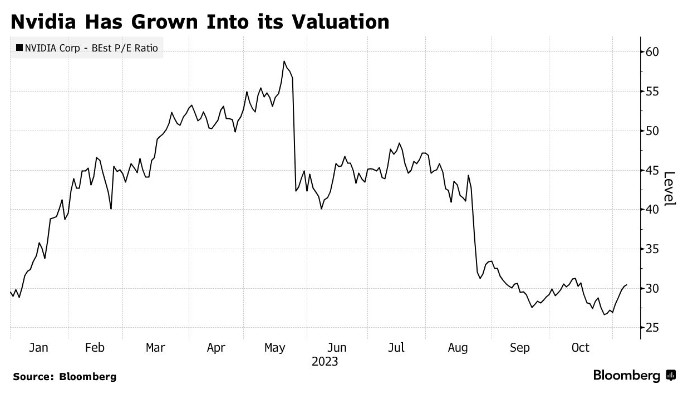

NVIDIA Corporation (NVDA): This chipmaker has seen a surge in demand for its products, particularly in the gaming and AI sectors. Its recent partnership with Google further boosted investor confidence, leading to a significant increase in its share price.

Shopify Inc. (SHOP): As an e-commerce platform, Shopify has seen a surge in demand due to the increasing popularity of online shopping. Its recent earnings report, which showed strong revenue growth, has made it a top momentum stock.

Factors Driving Momentum Stocks

Several factors contribute to the rise of momentum stocks:

Strong Earnings Reports: Companies that consistently beat earnings expectations often see their stock prices soar, attracting momentum investors.

Positive News: Positive news, such as product launches, partnerships, or regulatory approvals, can drive momentum stocks higher.

Market Speculation: Sometimes, momentum stocks are driven by speculation, with investors betting on the potential for future growth.

Case Study: Beyond Meat (BYND)

One notable example of a momentum stock is Beyond Meat, a company that produces plant-based meat alternatives. After its initial public offering (IPO) in 2019, Beyond Meat saw a significant increase in its share price, driven by strong demand for its products and positive news coverage. However, the stock's performance has been volatile, highlighting the risks associated with investing in momentum stocks.

Conclusion

Momentum stocks have always been a key focus for investors seeking rapid growth and substantial returns. By understanding the factors that drive these stocks and staying informed about market trends, investors can identify potential opportunities in the US market. However, it's important to remember that investing in momentum stocks comes with risks, and it's crucial to conduct thorough research before making any investment decisions.

Understanding the Tencent US Stock Ticker: ? us stock market today