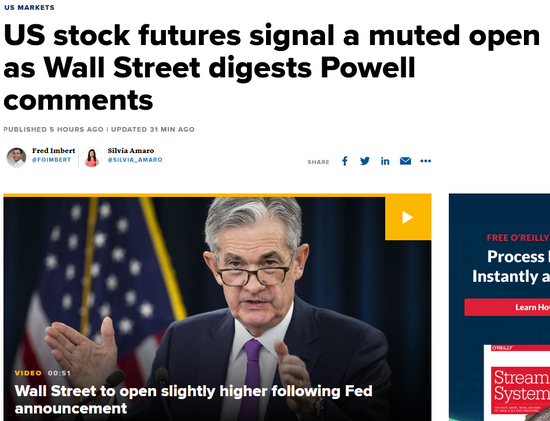

In recent times, investors have been closely monitoring the fluctuations in the US stock market, especially considering the significant impact these changes can have on their investments. The question on many minds is: "How much is the US stock market down?" This article delves into this question, providing an overview of the current market situation and discussing the factors contributing to the downward trend.

Understanding the Current Market Situation

As of the latest data, the US stock market has experienced a decline of approximately 10-15% from its all-time high. This decline has been driven by a combination of economic uncertainties, geopolitical tensions, and investor sentiment.

Economic Uncertainties

One of the primary factors contributing to the downward trend in the US stock market is economic uncertainties. The global economy has been facing challenges such as slowing growth, rising inflation, and trade tensions. These factors have led to concerns about the future performance of companies and the overall health of the economy.

Geopolitical Tensions

Geopolitical tensions have also played a significant role in the downward trend of the US stock market. Tensions between major economies, such as the US and China, have raised concerns about trade wars and their potential impact on global markets.

Investor Sentiment

Investor sentiment has also been a major factor in the current market situation. Many investors have become more cautious due to the economic and geopolitical uncertainties, leading to a sell-off in stocks.

Impact on Investors

The downward trend in the US stock market has had a significant impact on investors. Those who invested heavily in stocks may have seen their portfolios decline, leading to concerns about their financial future.

Factors to Consider

It is important for investors to consider several factors when evaluating the impact of the downward trend in the US stock market. These factors include:

- Diversification: Diversifying your investment portfolio can help mitigate the impact of market downturns.

- Long-term Perspective: Investing with a long-term perspective can help you weather short-term market volatility.

- Risk Tolerance: Understanding your risk tolerance can help you make informed investment decisions.

Case Studies

Several case studies have highlighted the impact of the downward trend in the US stock market. For instance, a study by CNN Money found that the S&P 500 index has experienced five major corrections since 1980, with the average correction lasting approximately 5 months.

Another study by the Wall Street Journal found that the stock market has historically recovered from corrections within a year. This suggests that while the downward trend can be concerning, it is not necessarily a cause for panic.

Conclusion

In conclusion, the US stock market has experienced a decline of approximately 10-15% from its all-time high. This decline has been driven by a combination of economic uncertainties, geopolitical tensions, and investor sentiment. While this downward trend can be concerning, it is important for investors to remain focused on their long-term investment strategies and consider factors such as diversification and risk tolerance.

Is the US Stock Market Open? Understanding ? us stock market live